Bitcoin Shenanigans

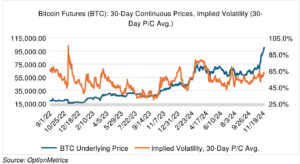

Bitcoin has been one of the clear winners of the new administration. BTC is up almost 41% since election day (see below) and looks poised to test the $100K barrier. Commentators point out that a looser regulatory environment and the departure of several administrators hostile to crypto are behind the move. I suspect it’s also a momentum play, similar to a meme stock. “Momentum trading” is Wall St. for “it’s going up, so I’m buying it.”

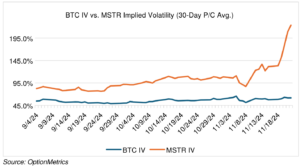

Interestingly, BTC’s implied volatility has not followed suit and has decreased by 3.9 percentage points since 11/05. Despite its recent returns, traders seem pretty comfortable with the BTC rally. I suspect BTC’s implied volatility will kick up if the rally fizzles, but then settle down once media and investor attention fades.

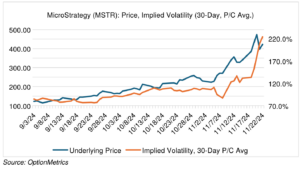

If BTC’s returns aren’t high enough for you or volatile enough, one company can provide a solution. MicroStrategy (MSTR), a business intelligence software company, has been getting a lot of attention lately, mostly due to its stratospheric 490% year-to-date return and unique business model.

What’s going on here? Simply put, in 2020, MicroStrategy turned itself into a bitcoin buying machine (it refers to itself as a “bitcoin treasury company”). The strategy is simple: issue stock or convertible debt (some with a 0% coupon!) and then use the proceeds to buy bitcoin. Currently, MSTR is sitting on 386,700 bitcoins, currently worth about $36 billion. Reportedly, their average purchase price was $56,761, which would make their cost about $22 billion.

But here’s the thing: the current market cap of MSTR is about $82 billion, $46 billion higher than the market value of its bitcoin holdings, and $60 billion higher than its average cost. So, unless the software business is going great guns (which it isn’t), something else must be generating all that value.

Michael Saylor, the company’s co-founder, Executive Chairman, and chief evangelist, has lots of reasons, all of which are readily available on social media: Some investors can’t buy bitcoin, or can’t buy it in size, or can’t get enough leverage; bitcoin ETFs don’t perform as well as bitcoin and have fees; and the most creative MSTR is like an oil company that refines crude oil into gasoline, transforming bitcoin into a tradeable asset for institutions.

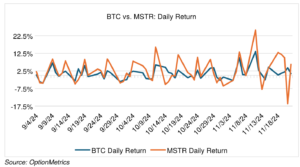

If you believe any of that, great, but keep one thing in mind: at the end of the day, MSTR is using borrowed money to buy bitcoin and is levering the company up in the process. When you buy MSTR, you are getting the leverage that cheap debt can provide. Essentially, MSTR is like an individual investor who is margined to the hilt. Everything will be fine—until bitcoin starts declining or the cheap money that keeps the machine running dries up. The merry-go-round will stop—the only question is when.

Unlike most CEOs who never cease to claim that they are risk-averse, Saylor is the exact opposite. MSTR is volatile, and he’s not bashful to point it out. During last month’s earnings call, he was quoted as saying, “When you embrace volatility, then you’re outperforming the S&P.” Well, if he wanted volatility, he got it, with MSTR implied volatility well over 200% and above that of BTC alone on an absolute and daily return basis.

News reports about MSTR contain breathless accounts from small investors (barbers, volleyball coaches, recent college grads) about how much money they’ve made and how much they are in love with the stock’s volatility. If bitcoin starts declining, let’s see how long their love lasts.

Rock Around the Clock

For those of you who just can’t get enough action during normal trading hours, don’t fret—real 24-hour trading is coming! Once the sole domain of institutions with European and Asian desks, retail investors can now trade at 2 o’clock in the morning, just like the big boys.

For options traders, this is great news, especially for those trading 0DTEs. Single stock 0DTEs (in addition to just Friday expirations) may be coming in late-2025, and 24-hour trading will make them even easier to trade and hedge.

Certain institutional investors don’t really see the need for 24-hour trading since so much activity takes place just on the opening and closing. But that’s beside the point. In an era when I can buy something in the middle of the night and have it on my doorstep by the following morning, 24-hour trading and access seem inevitable. That’s not necessarily good or bad, just a fact.

Crime Doesn’t Pay

The Archegos affair from all the way back in 2021 looks like it’s finally winding down. As is usually the case with very shady dealings on Wall St., it ended in court. But this time, someone is actually going to jail to serve real time. Bill Hwang, the founder of Archegos Capital Management and architect of a scheme to defraud banks and manipulate stock prices, was sentenced to 18 years in prison. Yes, you read that right; he’s going to the Big House.

I covered the Archegos saga multiple times when it unfolded in 2021, which you can read about here and here. As I noted, “it’s yet another tale of hedge fund and prime broker greed and incompetence, emblematic of so many ills that have long plagued Wall Street.”

Other than the amount of money that was lost (Credit Suisse alone lost $5.5 billion, forcing its sale), Archegos was interesting because it revealed a major hole in the credit risk management of many prime brokers and betrayed the extreme lack of common sense that sometimes seems to prevail on the Street. You should read more about it. Like most tales of true crime, Wall St. scandals and the sociopaths involved can be fun to read about and sometimes instructive.