Black Swan

I would be remiss if I didn’t comment on the latest event roiling financial markets, the sudden death of Silicon Valley Bank, the near death of Credit Suisse, and the derisking affecting markets worldwide. I’m not a bank guy, but I’ve lived through more than my fair share of major and minor financial panics. A few comments:

- For those of you who are considering bottom fishing for regional US banks, here are some that were most caught up in the downdraft that started with SVB’s demise. As you can see, if you’re going to employ options, it’s important to realize that their implied volatilities are a function of uncertainty (as always). Hence, as their prices increase and it looks likes the regional banking crisis is over for the time being and we’re going back to normal, their implied volatilities will decrease. The opposite is true as well, as has been the case over the last week. In the current circumstances, and given the major shifts in implied volatilities, this is not a minor, technical consideration — it can radically and significantly affect option prices. See below:

| Wednesday, 03/08 | Wednesday, 03/15 | |||||

| Stock | TKR | Price ($) | Implied Volatility (%) | Price ($) | Implied Volatility (%) | Implied Volatility, 03/15 / 03/08 |

| First Republic | FRC | 115.00 | 36.1 | 31.16 | 261.1 | 7.2 |

| Western Alliance | WAL | 71.56 | 37.7 | 32.35 | 160.7 | 4.3 |

| PacWest Bancorp | PACW | 26.68 | 41.9 | 11.37 | 193.5 | 4.6 |

| Customers Bancorp | CUBI | 28.89 | 59.3 | 20.04 | 109.7 | 1.9 |

| Metropolitan Bank | MCB | 54.74 | 40.9 | 39.31 | 130.5 | 3.2 |

Source: OptionMetrics

To put into context, the over 7X move in FRC’s implied volatility means that its options (all other factors held constant), are worth 7 times what they were worth last Wednesday. If the crisis is deemed to have been contained, or just plays itself out, their implied volatilities should implode. Keep that in mind if you plan on going bottom fishing. (Remember, our options profit calculator can help you test out various strategies and see how they react to such changes in IV)

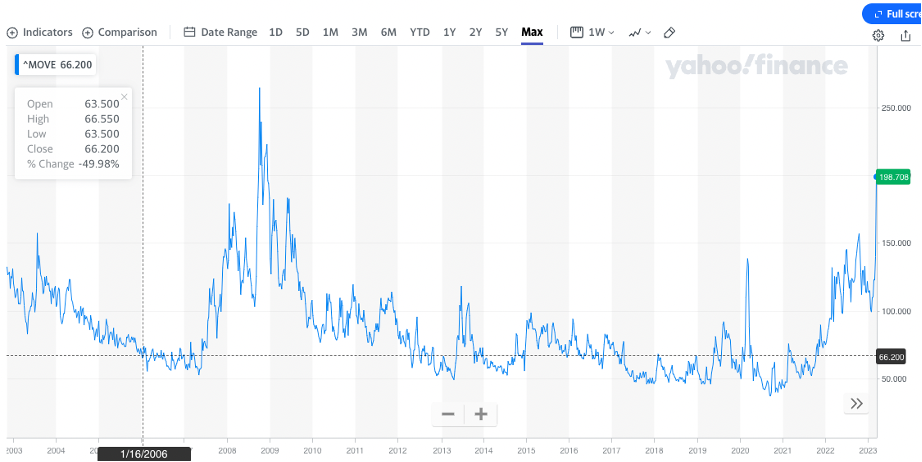

- SVB was a great example of the oversized effect that a sudden, unanticipated event can have on markets. True Black Swans (i.e., the shock is unanticipated, sudden, and out of nowhere, and the event has a disproportionate impact) are very rare and only come along once or twice a decade. Does SVB qualify as one? Maybe, but it’s too early to tell. The bond market seems to think so. Below is the ICE BofA MOVE Index, a measure of bond market volatility — it’s the highest it’s been since the financial crisis. My sense, without quantifying it, is that the frequency of such extreme events is increasing. In other words, the volatility of volatility is increasing.

Source: Yahoo Finance

- I wrote about Credit Suisse last October (Swiss Mess) so it’s no surprise to me that they are once again at the center of things. Following the well proven advice of not throwing good money after bad, it seems that their largest investor, the Saudi National Bank, has no desire to kick more money into the CS bonfire of money. Not so the Swiss National Bank, who lent them $54 billion to shore up liquidity. CS is turning out to be the Sears of investment banks — everyone knows where it’s going, eventually; it’s just a matter of time.

- From my experience, midsized bank risk management is tasked mostly with compliance and regulatory matters. Asset liability management (ALM), the true guts of what makes a bank make money and stay out of trouble, is not part of their purview. When people talk about a “failure of risk management” as a means of assigning blame, they should be pointing fingers at the finance managers in charge of ALM. The bank’s most senior executives and board should also come under scrutiny. The risk managers on the organization chart probably had nothing to do with it.