Buying Disaster

It’s every flyers worst nightmare: a part of the plane blows off in flight and leaves a gaping hole in the fuselage. Open, blue skies and the wind rushing through the cabin is not exactly what most passengers want to experience during a flight. But that’s exactly what occurred last Friday when a door panel blew off in flight on an Alaska Airways Boeing 737 Max 9. Luckily, no one was killed or injured. The aircraft was virtually brand new, but improper installation issues are already being alleged. All 737 Max 9s have been grounded pending the FAA’s investigation. [Unbelievably, a passengers iPhone that got sucked out was retrieved on the ground in working condition!].

Of course, the incident wasn’t exactly good news for Boeing (BA) stock and its seemingly cursed line of 737 Max aircraft. BA stock reacted by falling 8% on Monday. Tellingly, Airlines (ALK) closed down only 0.08 cents at $37.87. United Airlines, another carrier that has Max 9s in its fleet, actually closed up 2.6%. Apparently, the market does not believe that the grounding will affect them.

Although the results of the investigation are not nearly complete, it seems likely, at this point, that the Max 9s will return to service and normal flight operations will result. Short term product issues usually present buying opportunities as the market realizes that they are temporary and that normal fundamentals will soon reassert themselves. Boeing falls into this category, so far.

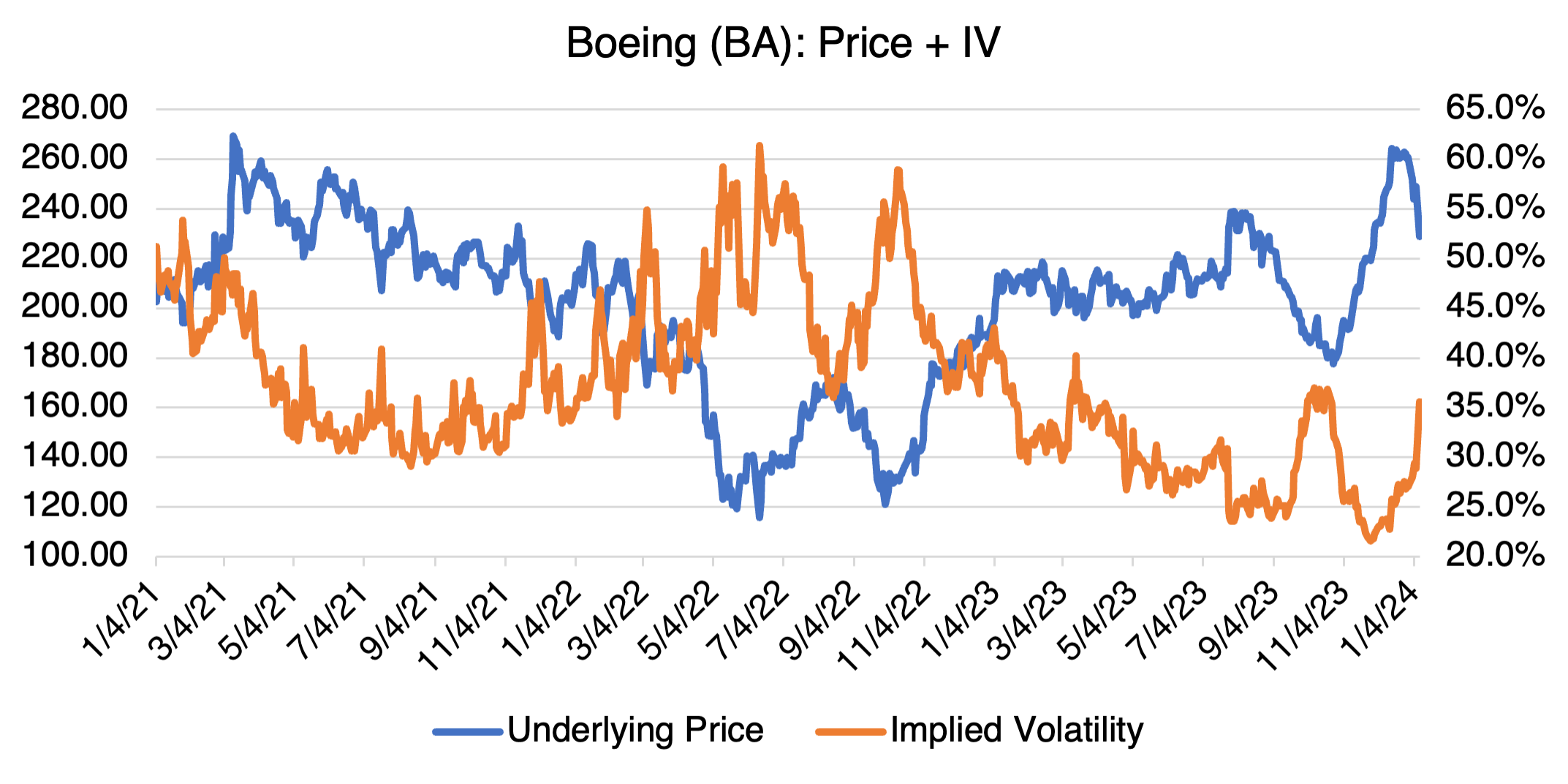

Before the accident, BA was profiting from new aircraft orders and the prospect of increased defense spending as a result of the war in the Mideast. Like many other stocks, BA’s implied volatility is inversely proportional to its price. Although its implied volatility is currently elevated as a result of the accident, it should decline as uncertainty fades and the stock recovers. Its options should then be more attractively priced.

Peloton: I’m back!

Peloton (PTON), the poster child for a Covid Stock Darling gone bad, might — just might — be showing signs of life. When we last looked at the stock almost a year ago (Peloton is Back: Sort Of, Kind Of, Maybe), the stock had fallen from over $167 in early 2021 to a low of about $7 bucks, with losses for FY 2022 at $2.82 billion. Rumors of impending bankruptcy swirled, the CEO was forced out, and new management instituted a series of cost-cutting and efficiency measures. After coming back to $16.36 last February, by late October PTON had declined to a new low of $4.30.

So far, not too encouraging. But then, at the end of last September, PTON struck a partnership with Lululemon (LULU) in which Peloton provides exclusive digital content and Lululemon becomes PTON’s main apparel provider. In early January, and as part of their rebranding effort to broaden their subscriber base, Peloton announced a deal with TikTok to provide short form fitness videos and other content. The stock rallied sharply on the news, shooting up from 5.38 to a high of $7.06 before settling down to close at $6.72. Since then, it’s been drifting lower and stands at $6.35 as of this writing.

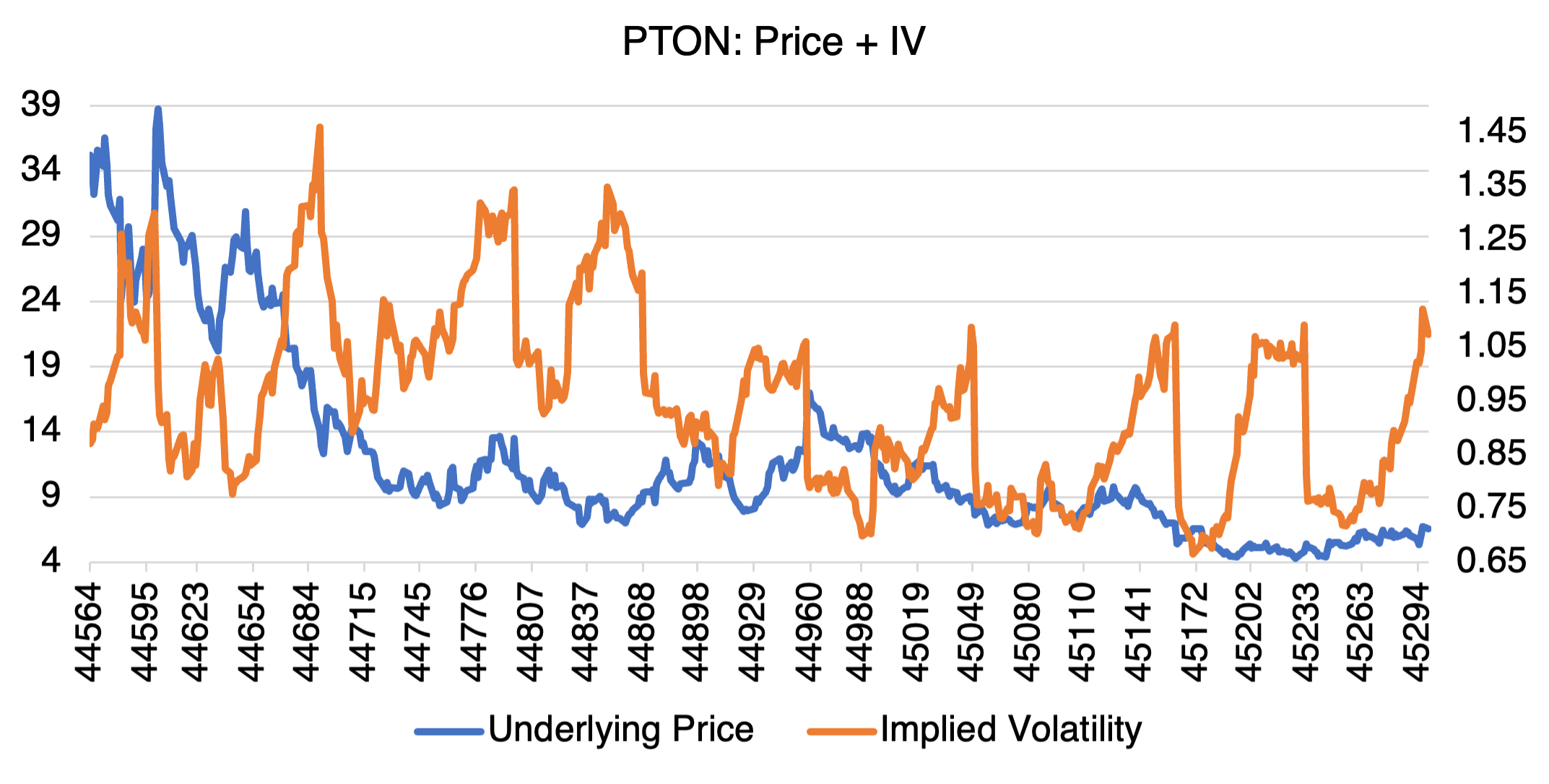

As you can see in the PTON chart above, the stock’s implied volatility jumps to the low triple digit level every time news, and related uncertainty, hits the stock. Even at its lower levels, Peloton’s IV still trades greater than 70%. As a result, PTON options are expensive and should be approached with caution.