Crudely Speaking

It’s been a long time since an OPEC meeting completely surprised the oil markets. There are just too many people associated with the organization, as well as too much money at stake, to keep anything under wraps for long. The usual pre-meeting pattern of rumors and leaks, carefully coordinated and timed to test how the market will react, did not hold this time. OPEC has been at the information/disinformation game for some time, and they’re good at it.

Everybody likes to throw a curve ball every now and then, and that’s exactly what OPEC did on Sunday night with their announcement that they will be cutting 1.2 MMbpd, starting in May. [Technically, it was OPEC Plus, the 13 original OPEC members, led by Saudi Arabia, plus 10 other more minor producers, led by Russia] Confirming that it was indeed a surprise, crude oil (WTI) reacted by jumping $4.75 in the May contract, or 6.3%. Higher prices then leached into other markets, shedding renewed light on the Fed’s balancing act between inflation and recession. The SVB crisis, although now fading into the sunset, left markets particularly sensitive to this. Uncertainty surrounding Russian crude supply as a result of the war added to the situation. Without all these background factors, I doubt whether the production cut would have gotten as much attention as it did. At the end of the day, the cut merely restored prices to where they were before the SVB-inspired sell off.

Clearly, OPEC is trying to get in front of over supply resulting from a possible recession later in 2023 or 2024. There are a lot of factors here. First, and as usual, the members need money for domestic programs, development projects, and in the case of Russia, warfare. Second, they all remember what happened during the early days of Covid in April 2020 when massive oversupply led to negative oil prices (it settled at -$37.63 on April 20, 2020). You could argue that that was a special case, but it highlighted in very large font what could happen when OPEC cooperation and coordination falls apart. Third, Saudi Arabia needs Russia’s cooperation to keep supply under control and consequently has been drifting away from the US and towards oil price hawks such as Russia and Iran. Finally, and adding to upward pressure, is the reopening of Chinese demand after the country was virtually shut down last Q4.

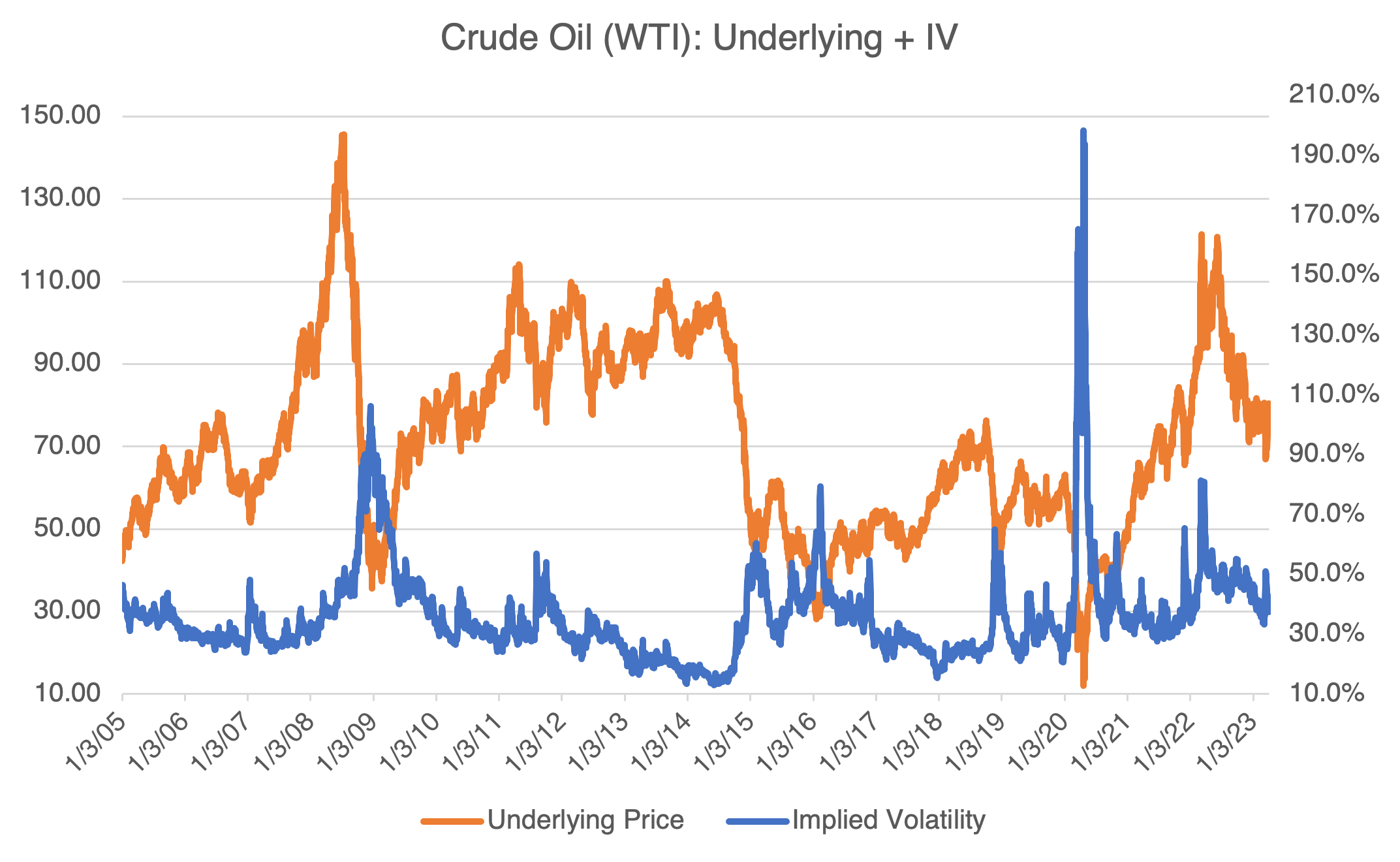

For options traders, it is important to point out that crude implied volatility displays a feature that is common to many commodities and stocks, i.e., it tends to move inversely with price, especially during price spikes or collapses. See below:

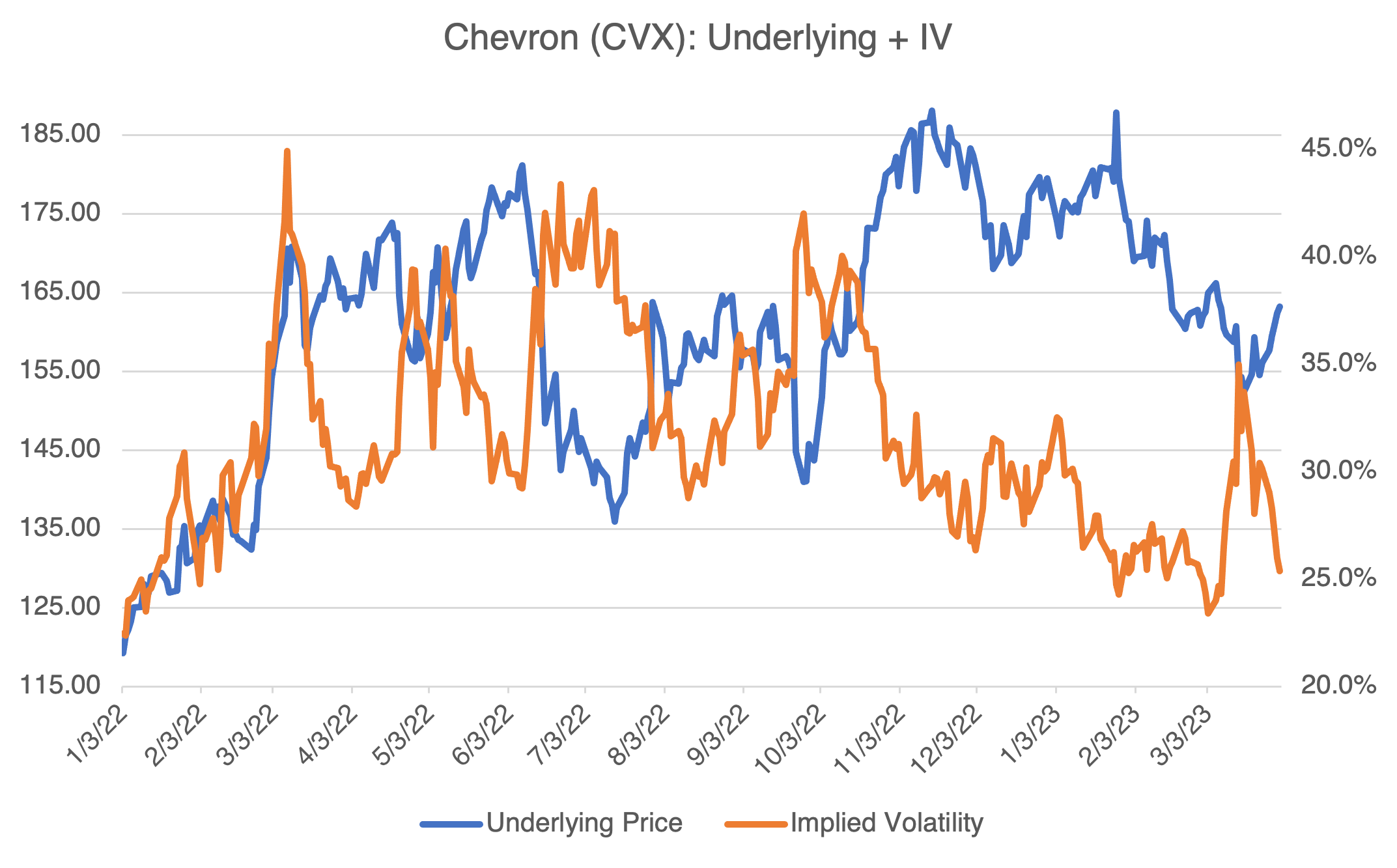

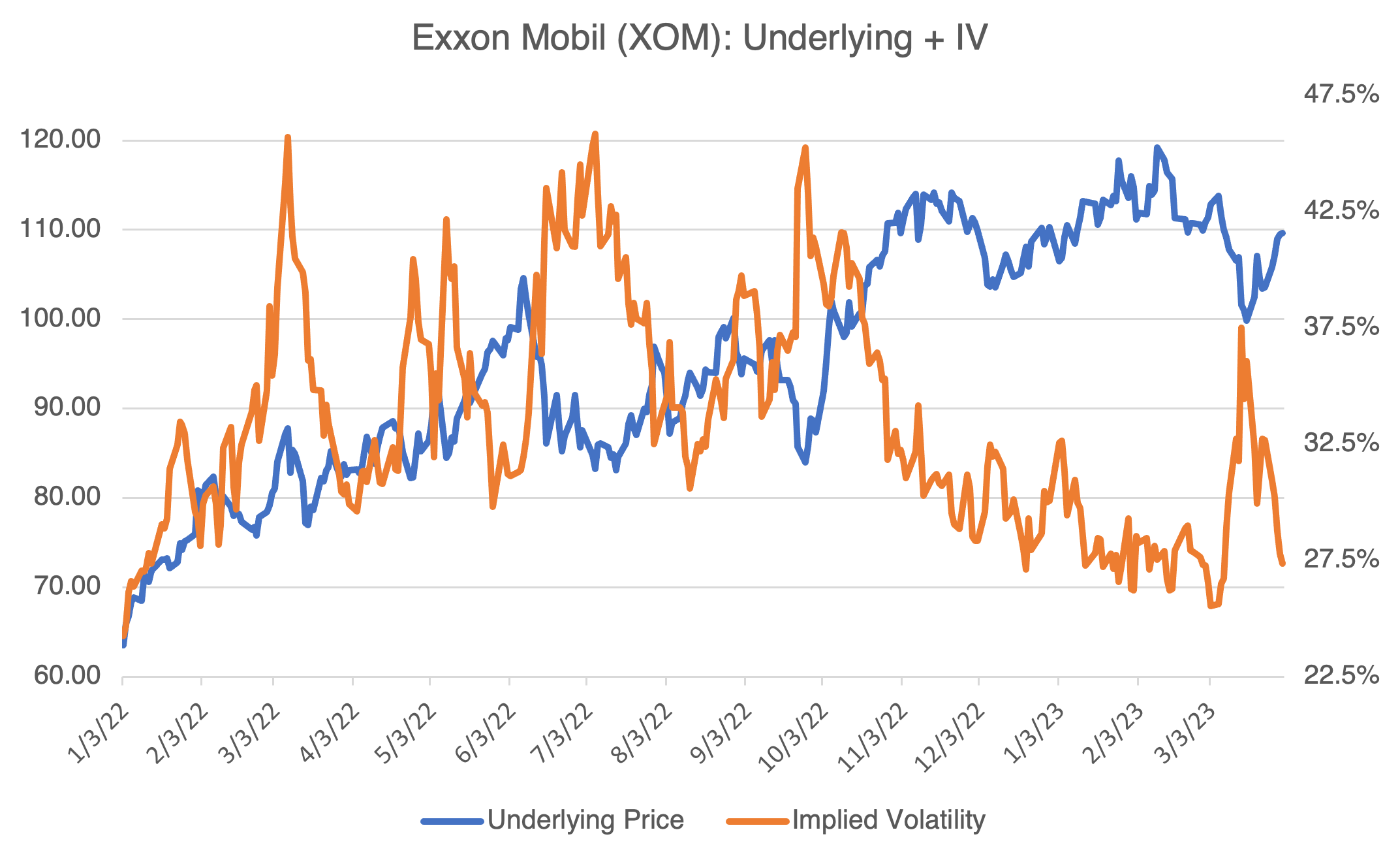

Big Oil is the most obvious way to invest since their stock prices are highly correlated to the price of crude oil and distillate (gasoline, heating oil, etc.) price margins. As you can see below for Chevron (CVX) and Exxon (XOM), both of their implied volatilities have come off sharply in March and tend to decrease as the underlying increases. Currently, they are at the low end of their range since the beginning of 2022. If you decide to trade these stocks to the upside using options, keep that in mind.

You can use the build menu at the top of our website to see various strategies sorted by expertise. Strategies highlighted in green are pre-built bullish strategies that make a good starting point if you are playing the upside. Simply click any strategy to open it in our options profit calculator tool, where you can explore the predicted profit and loss for each strategy as well as any customizations you might make.

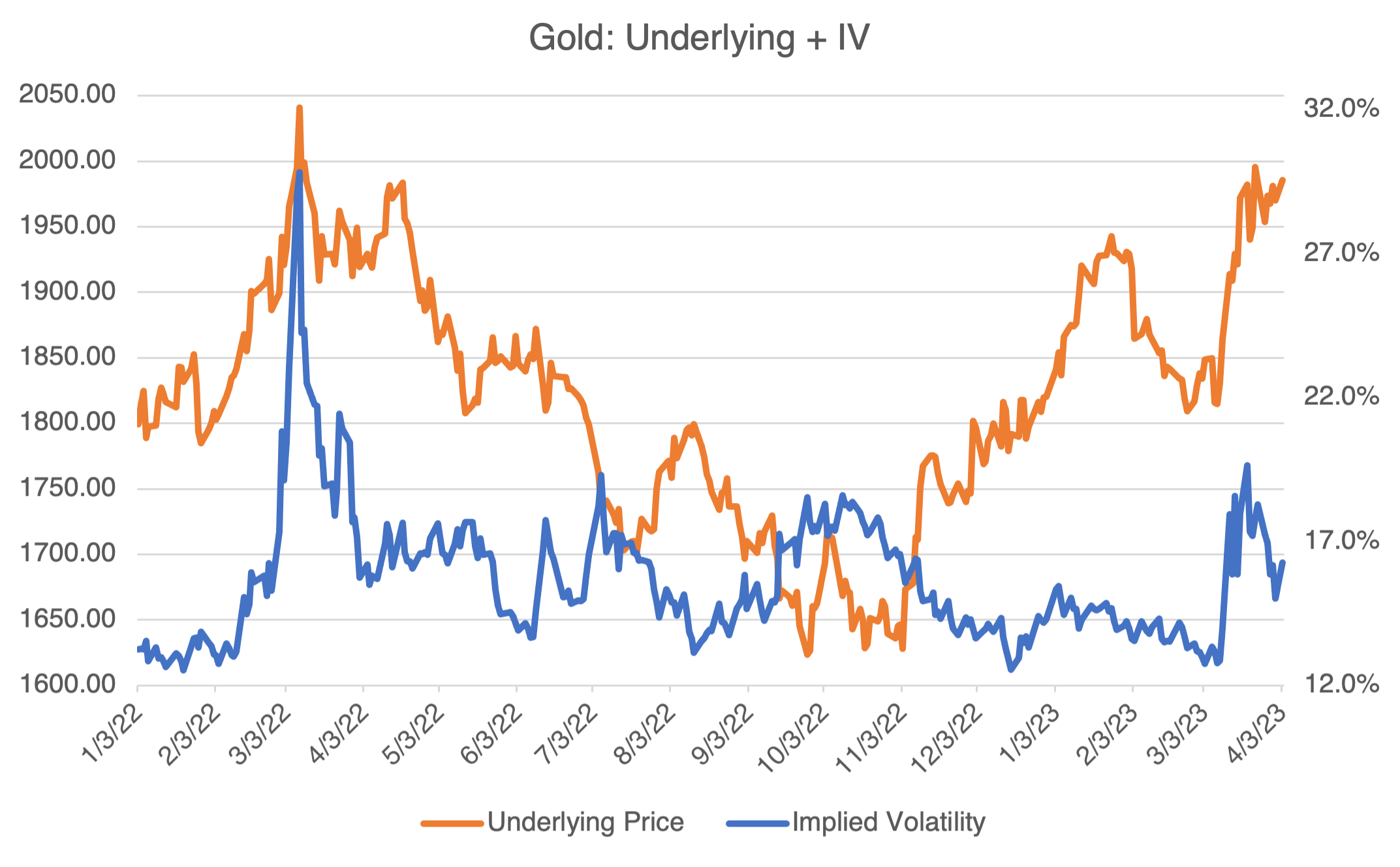

Gold, Again

Despite my skepticism expressed in my previous blog Gold Bugs and the Debt Boogeyman, gold continues to rally and is once again higher as of this writing (04/05 morning) at $2046. Yesterday, the CME June contract finally settled over the crucial $2000 barrier at $2038.20. The all-time high from August 2020 is $2074.88. Implied volatility tends to decrease as gold attempts to make new highs (increased uncertainty) and decreases as it backs off or congests (decreased uncertainty).

For whatever reason, gold’s upward trajectory since roughly last November has not gotten a lot of attention outside of precious metals circles. During the SVB crisis, investors flocked into gold and crypto as safe havens from economic uncertainty. However, the SVB crisis has faded and yet gold continues to rally. Some have postulated that those countries attempting to move away from the dollar — the BRICs — are behind it. Needless to say, there is no shortage of idle speculation about gold and financial collapse on the net.

As an investor, I usually step back when something is going on that I don’t understand or don’t have enough data to process correctly. Regardless, gold seems poised to take out its all-time high. The two stocks I focused on the last time I wrote about gold, Newmont Corp. (NEM) and Barrick Gold (GOLD), are options trade candidates if you’re so inclined.