Energy

It just caught the attention of the non-energy markets and popular press that crude oil has been rallying since last June. In general, if crude has a shot at breaking $100, and its accompanied by the prospect of higher gasoline prices, it makes people notice.

The fundamentals behind the move are not difficult to figure out: both Moscow and Riyadh need money for their domestic budgets (in the case of Russia, to finance their endless war in Ukraine) and are concerned that Chinese demand will not be enough to bolster prices. Given recent data from China, that’s probably a good assumption (although, interestingly, Chinese oil demand remains relatively high). Adding to upward price pressure are hopes that the Fed will thread the needle just right and avoid a US recession (the much-debated “soft landing” scenario). Of course, sharply higher crude prices, and by extension gasoline and other energy dependent goods, are not making the Fed’s task any easier. Both fundamentals have been sufficient, along with the tightest supply situation since September 2021, to cause many traders to start thinking that an assault on the magic $100 level mightbe in the cards.

Maybe. Crude oil is a popular speculative hedge fund vehicle and that can produce short term price momentum regardless of underlying supply/demand fundamentals. Indeed, speculative net buying interest stands at nearly 10% of total open interest, its highest level since last November. Spec money is notoriously fickle and can disappear at the first sign of trouble, especially if there are perceived to be better opportunities elsewhere.

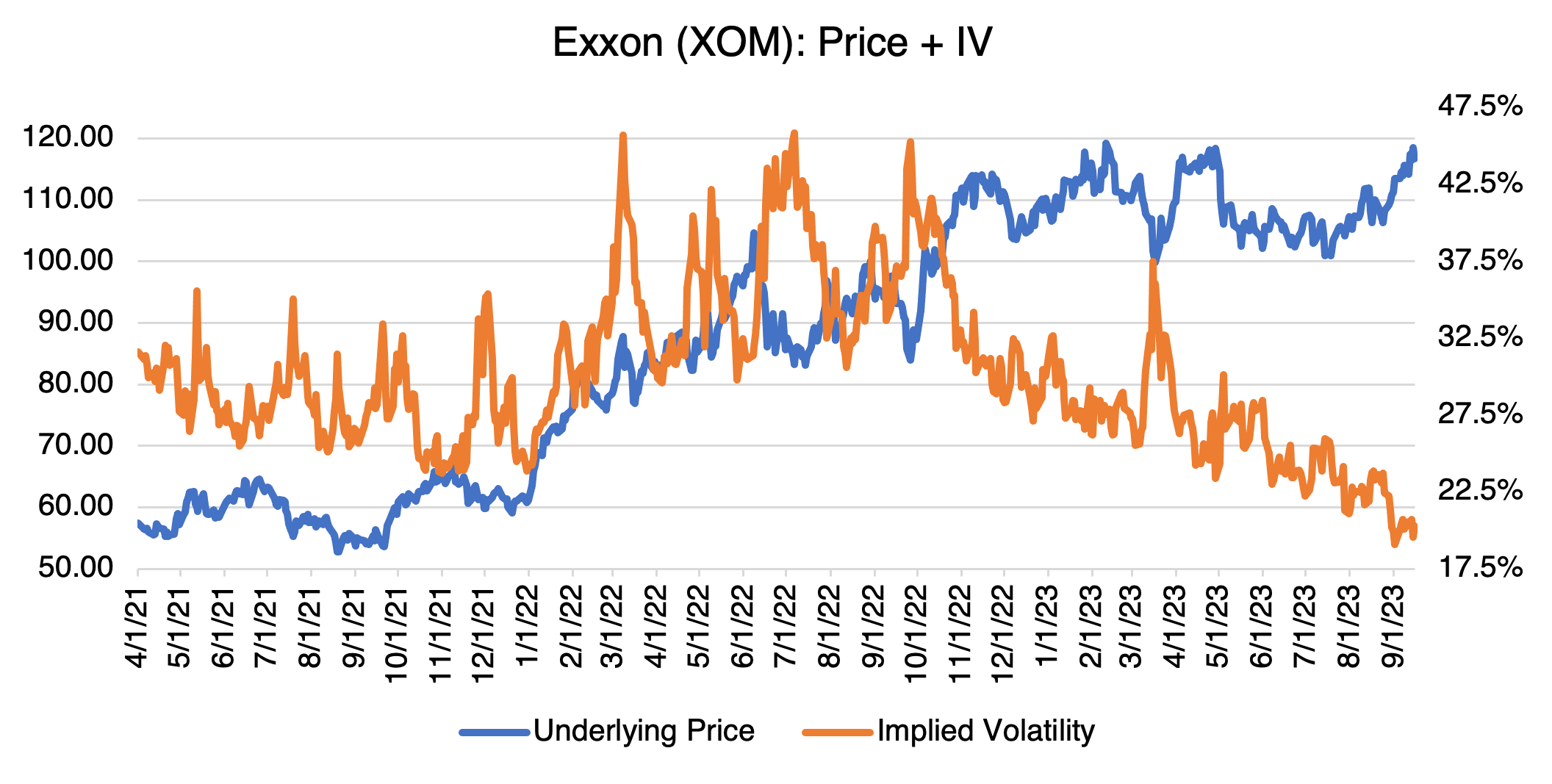

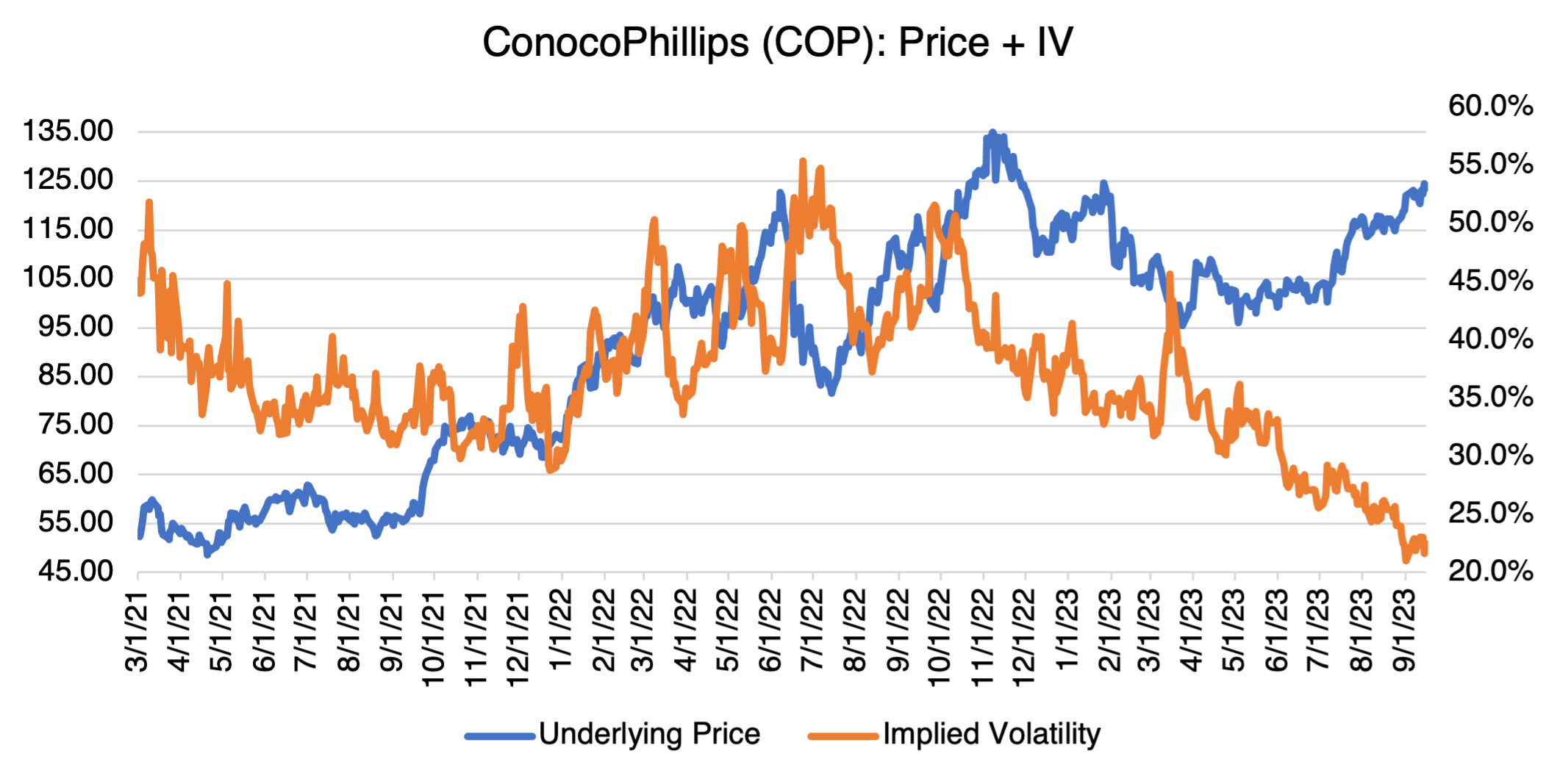

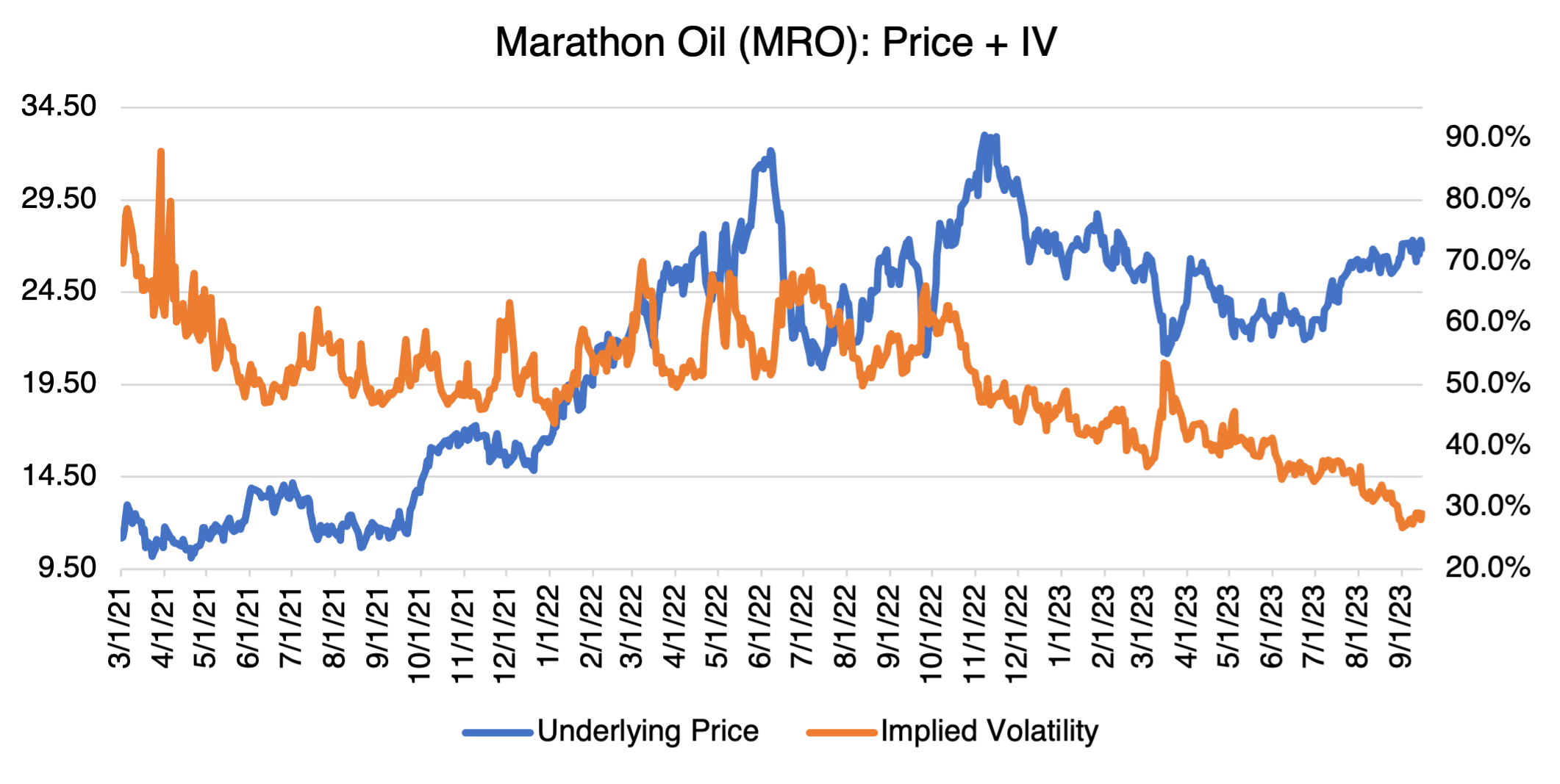

Needless to say, oil producers are the most obvious beneficiaries of higher crude prices. Below are a representative sample:

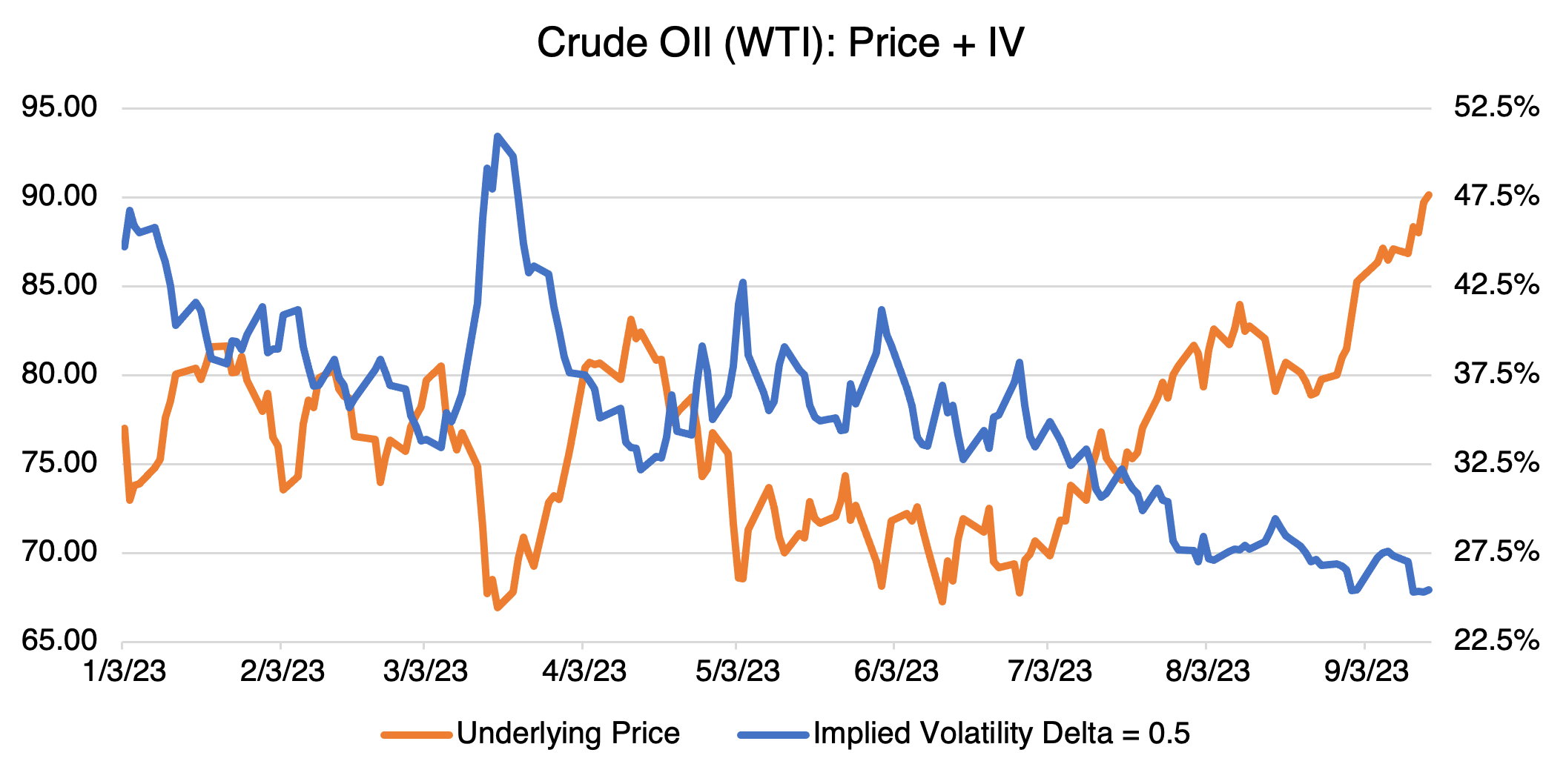

In all of the charts above, notice the extreme inverse relationship between price and implied volatility. As the crude chart demonstrates, the phenomenon is not just confined to stocks, but extends to commodities as well.

And as I’ve written numerous times before, the effect is not some technical, secondary feature of options that can be safely ignored. Look at COP above. Before the stock started rallying in earnest last Spring, its implied volatility was trading in the 32% area. Currently, it’s about 10 vol points lower, at rougly 22.5%. All things being equal, that means that there’s about a 30% off sale on COP options going on! Of course, if crude reverses course, the reverse can also be true. Something to keep in mind if you want to play higher crude using options.