EVs: Too Negative, Too Fast?

The lofty heights surrounding artificial intelligence leads one to wonder whether it will eventually suffer the same fate as another sector that has had its day in the sun, electric vehicles.

In my neighborhood, you would think that the Tesla Model Y is the cheapest car you could buy. They are everywhere, in every possible color and configuration, and almost outnumber the hordes of Subarus and Ford F-150s driving around. Fun Fact: the Model Y was the best-selling vehicle in the world in 2022 and 2023, and was the best-selling car in the US last year, outselling even the Toyota Camry. From appearances, one could reasonably conclude that the EV revolution is a done deal and that gasoline-powered vehicles will soon go the way of rotary dial phones, DOS, and BlackBerries. And prior to the last six months or so, you would have been right. At peak froth, EVs were selling well over sticker and buyers were waiting months for delivery without complaint.

Then something changed. Potential EV buyers started focusing more on their drawbacks: limited range, relatively high sticker prices, charging issues, and shocking repair and insurance costs. Early adopters (the same people that are now using Apple or Meta headsets), had already bought their EVs. At the same time, and in a fit of bad timing, previous demand and unwavering conviction caused the car manufacturers, and investors, to go all in. Supply and new models flooded in, and prices dropped precipitously. Finding new customers suddenly became paramount.

As I’ve noted in previous posts, introducing a brand new vehicle, much less one with new technology, is one of the most capital intensive high wire acts in manufacturing. For Rivian, Lucid, and others, that initially meant getting enough production on line before running out of cash, and eventually reaching positive cash flow. Now it means getting customers to buy cars (and in the case of Rivian, those are $88,000 cars). Whatever you think of Elon Musk, starting a major new car company from scratch is something that very few have successfully achieved since the early 20th century. For every Henry Ford and Alfred P. Sloane, there were hundreds of failures.

Perhaps most tellingly, EV press coverage turned negative and started focusing on the slower increase in sales rather than the absolute size of the increase itself, as well as the prospect of cheap imports from China. This tended to obscure the prognosis for future EV sales, but the market focused on it, perhaps overly so.

Given that background, it’s not surprising that pure EV manufacturers (i.e., those that don’t manufacture gasoline powered vehicles) have been some of the biggest losers this year. At the time of this writing, Tesla, despite its membership in the Magnificent Seven, is down over 27% YTD. Similarly, Rivian (RIVN) and Lucid (LCID) are down a whopping 36.2% and 64%, respectively, from a year ago.

Has the market overreacted? Is it too bearish? After all, although the rate of increase of EV sales has decreased, by any standard year over year sales increases are still very high. For 2023, EV sales were 46% higher than in 2022, and their share of the total US market grew to 7.6%, up from 5.9%. Most would consider these increases to be pretty good, especially for a relatively new technology that still has some practical problems.

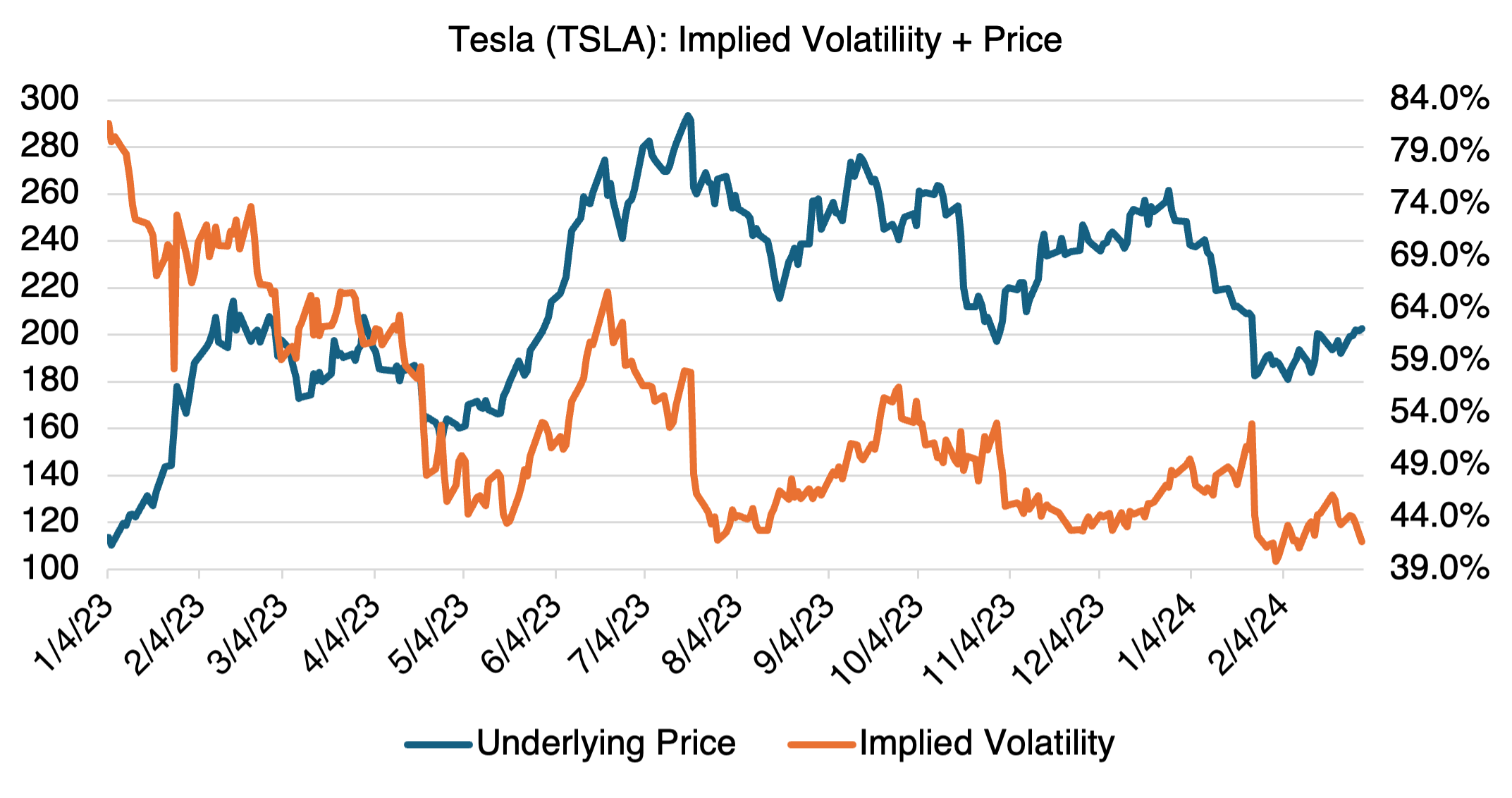

Rightly or wrongly, EVs seem to be yesterday’s news for the market, at least for the time being. The good news for those still interested in Tesla options is that the stock’s implied volatility is lower than during its heyday. Its current level of less than 42% is significantly below its life of trading average of 55%

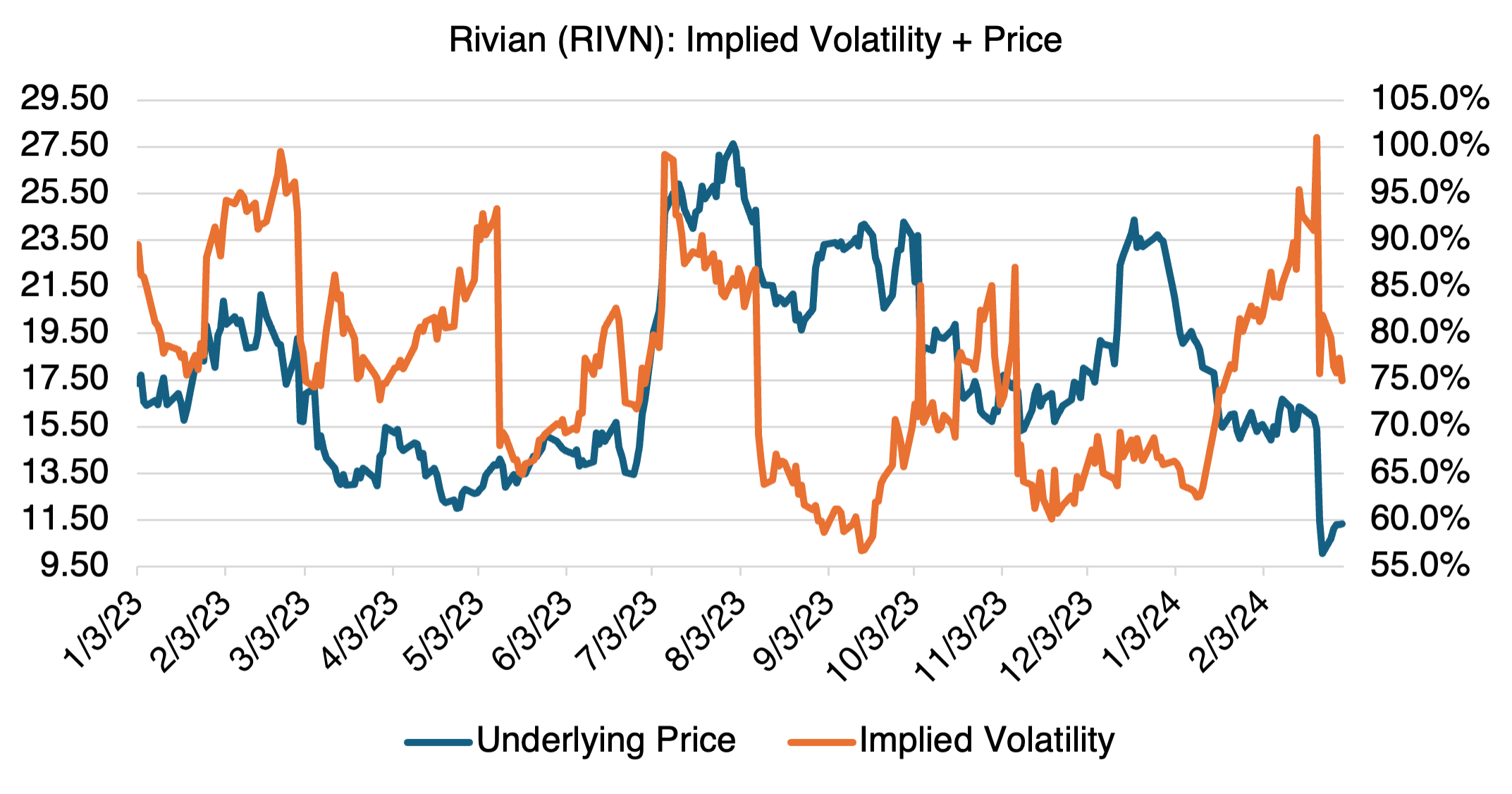

This is the less the case for Rivian. Although its implied volatility of approximately 75% is below its long term average of 83%, it is still trading at relatively high levels. This reflects the company’s increased financial risk.

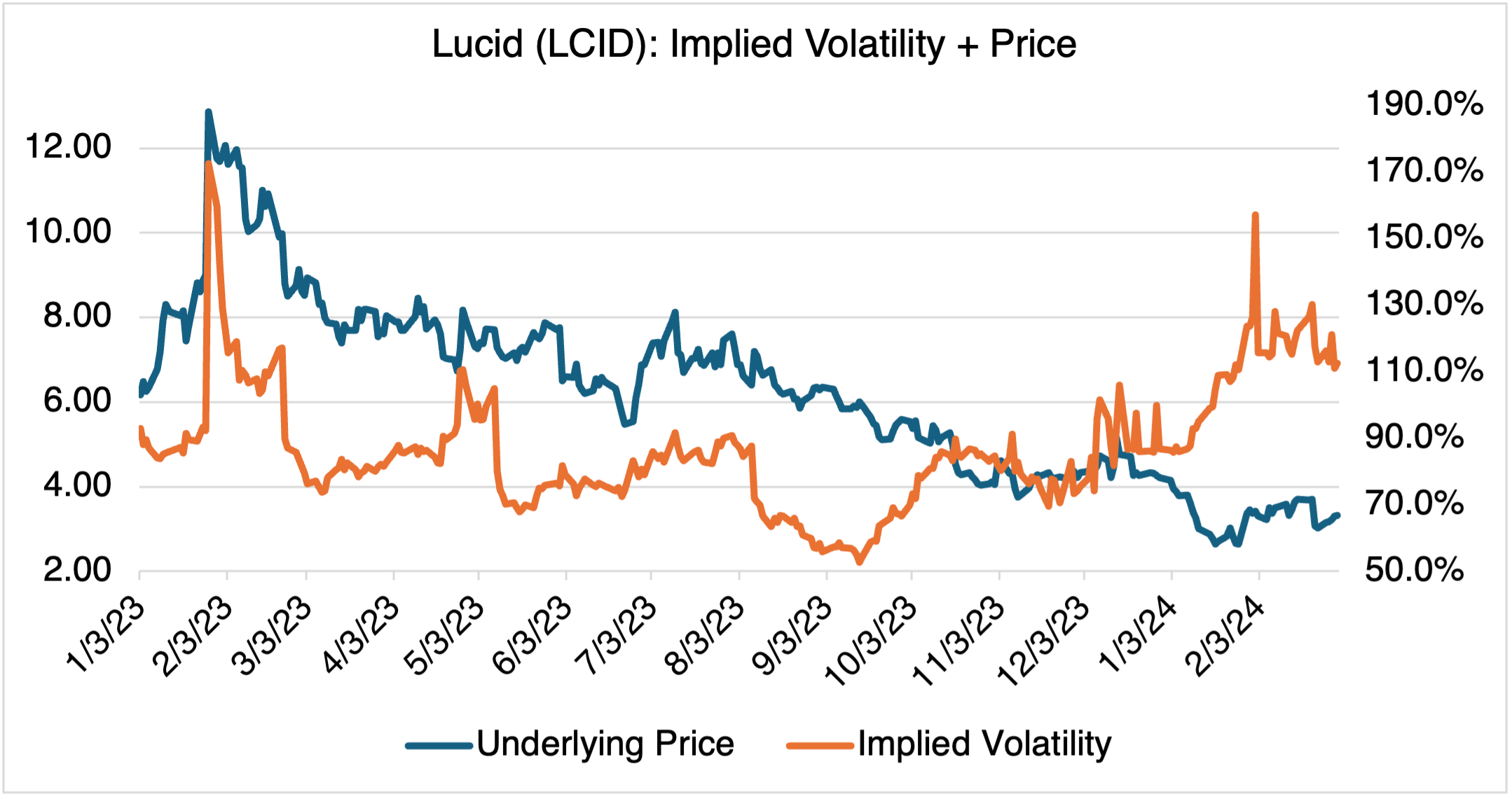

The least stable of the three, Lucid (LCID), remains at triple digit volatility and is an expensive options play from the long vol side. If the stock continues to trade roughly sideways and without new information (the next earnings call is May 13), then I expect that its implied volatility will decrease accordingly.