Fool Me Once…

Yes, another article about GameStop (GME), the blogger gift that just keeps on giving.

As of Monday’s close, it seems like everyone involved with the stock has finally woken up with a wicked hangover. Friday’s much anticipated Roaring Kitty livestream (the Oracle speaks!), all 51 excruciating minutes of it, turned out to be a giant fizz to all but his most devoted followers, and a rather boring one at that. If you’re thinking of watching it to see what all the fuss was about, let me save you the trouble. In a nutshell, all the screenshotted positions are Kitty’s, he’s not working with anyone else, and he’s still a GameStop superfan (surprise). In other words, he said nothing new to keep the GME fire going. And for the first time, GME did not react to the upside. The market turned quickly, and focused instead on the company’s dismal Q1 results released Friday (before Kitty’s livestream) as well as GME’s proposed 75 million share stock sale. Posting a second screenshot of his position on Monday didn’t help much. In the real world, announcing Q1 sales that are 29% lower than the year before while at the same time losing $32.3 million, isn’t that good for the stock price.

Closing at $24.83 on Monday, GME was almost 47% lower since last Thursday’s close of $46.55. With its implied volatility trading around 300% in the near-term option expirations, no one should be too surprised. Kitty’s massive $21 call position expires on June 21. With only 10 days to go, speculation on what he’s going to do will continue to be the focus of endless speculation. Since he’s always asserted that he loves GME, I assume he’s going to stick until expiration.

I wouldn’t count out GameStop just yet. As I mentioned last week, one thing you can absolutely bet on when it comes to meme stocks is their unpredictability and the extreme fervency of their fans. They’re not just stocks, but a movement against the Wall Street status quo. Consequently, normal analysis often falls flat. Just when you think it’s over, something else happens, sending the market into yet another frenzy. If GameStop were a movie, there would be scenes from Part II in the closing credits. Its funeral is still a ways off.

It is refreshing to know that even meme stocks have to show positive revenue growth and earnings — eventually. Of course, “eventually” can be a very long time, but in the case of GameStop, everything seems to happen over just a few days, not weeks, months, or years. As is the case for all meme stocks, instant gratification is one of its main attractions and highlights the rapidly shrinking line between investing and gambling. [For those interested, one of the best explanations of the difference between the two comes from American Century Investments: “Gambling is a short-term pursuit where the individual owns nothing, with negative average returns expected over time. Investing provides ownership in an asset (for stocks) or an expected return (for bonds), over a much longer time frame.” You may disagree with that explanation, but there it is.]

Cruise Lines

Cruise lines were destroyed (to put it lightly) by the pandemic, but came roaring back when it finally faded and everyone wanted to get out of the house and go on vacation. Carnival Cruise Lines (CCL), Norwegian Cruise Lines (NCLH), and Royal Caribbean (RCL), the three major lines, all came back from the brink of demise.

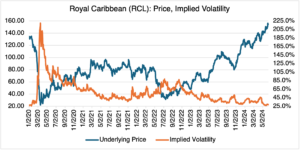

And then, in a great example of “you never can tell,” a freighter ran into the Baltimore bridge and bottled up the harbor for two and a half months. Among the ships affected were vessels from Carnival and Royal Caribbean. The financial impact was relatively minor, but the incident cast a temporary pall on the sector. Investors aren’t always rational, and that’s a good thing: it presents opportunities for those who can see beyond short term issues. Since the bridge collapse, and with the reopening of the port, CCL, NCLH, and RCL have been recovering. RCL (below) has been particularly buoyant this year and is up almost 29% YTD.

On a volatility basis, RCL options have been trading about 30% and has been declining slowly but surely since Q4 2022. As long as the rally continues, it should remain at depressed levels and shouldn’t be a factor.

Source: OptionMetrics

Source: OptionStrat