Front and Center: Bitcoin & Gold?

From what’s been going on lately in Bitcoin and Gold, one would think that the world is on the edge of Armageddon. After languishing for most of 2022 and ’23, Bitcoin is up, as of this writing, almost 66% year-to-date. That puts it in the same league as everyone’s favorite high-flyer, Nvidia (up 91% year-to-date). Bitcoin’s upward drive has been relentless: it’s been up 36 out of 49 trading days so far this year, or 73%. Ever since regulators gave bitcoin ETFs the nod in early January, and the prospect of the upcoming “halfing,” it hasn’t looked back. And now that the UK regulators have come on board, many see crypto as the next big sure bet. As is their habit, breathless YouTubers are predicting stratospheric gains (“…bitcoin to $1,500,000…”).

At the same time, bitcoin’s first cousin, gold, has been quietly making new all-time highs. I wrote about gold’s bullish trend last January 31 (Only Gold!) and made the point that geopolitical tensions, plus relentless central bank purchases (lately, China and Turkey), were driving it higher.

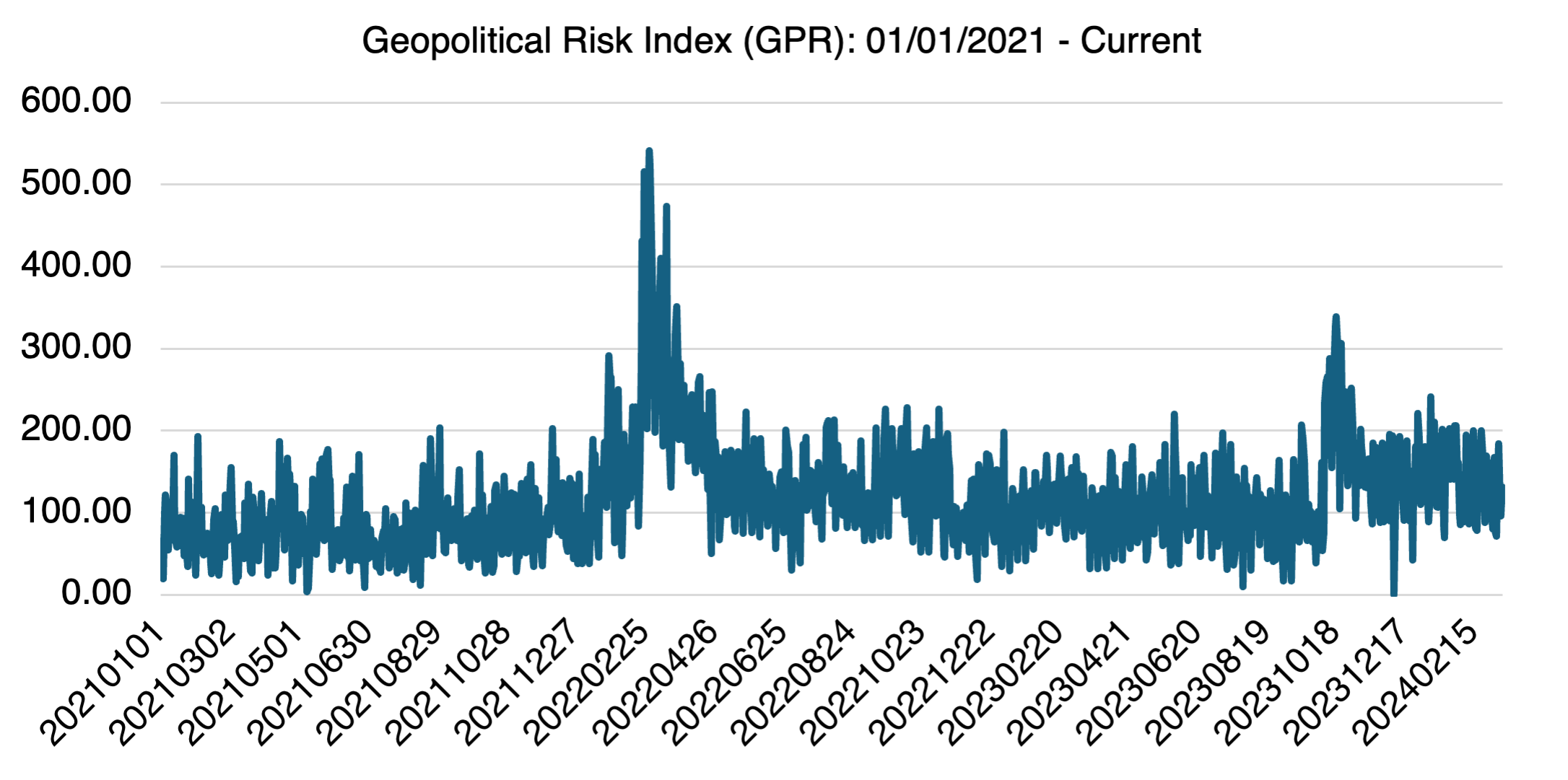

Both of those factors continue to prop up the metal and bitcoin. Although the Geopolitical Risk Index (a count of newspaper articles covering geopolitical tensions), is not at extraordinary or abnormal levels (see chart below), the number and extreme potential of concurrent geopolitical flashpoints has increased since last October. As important, the perception (and not necessarily the reality) of worldwide tension has increased.

Source: https://www.matteoiacoviello.com/gpr.htm

In addition, central bank gold purchases continue apace, as well persistent retail buying from China as fearful investors attempt to shield themselves against declining economic conditions. The prospect of lower real interest rates (i.e., interest rates adjusted for inflation) is also producing a tailwind. And of course, demand from diehard gold and crypto believers who believe that fiat currencies, such as the US dollar, have been debased over time (and will continue to do so) is always present to varying degrees.

Apart from whatever fundamentals they can lean on, many retail investors view both bitcoin and gold as momentum/FOMO plays. Bitcoin’s 2017 frenzied ascent to almost $20,000 received an inordinate amount of press and captured the attention of the general public with tales of effortless, overnight riches. The fact that few people could tell you what they were buying, exactly, was beside the point. Bitcoin was going up, other people were making easy money, and that’s all that mattered. That could still be the case — would-be investors that failed to participate the first time may feel that they now have a second chance. Only this time, the SEC, and now UK regulators, have made it easier to invest by using safer and more conventional bitcoin ETFs.

The question now is whether both gold and bitcoin, especially the latter, are forming a bubble that will inevitably pop. Others have covered this extensively, and I can only add to the conversation by referencing option valuations. Based solely on that, the answer is, I’m afraid, “maybe.”

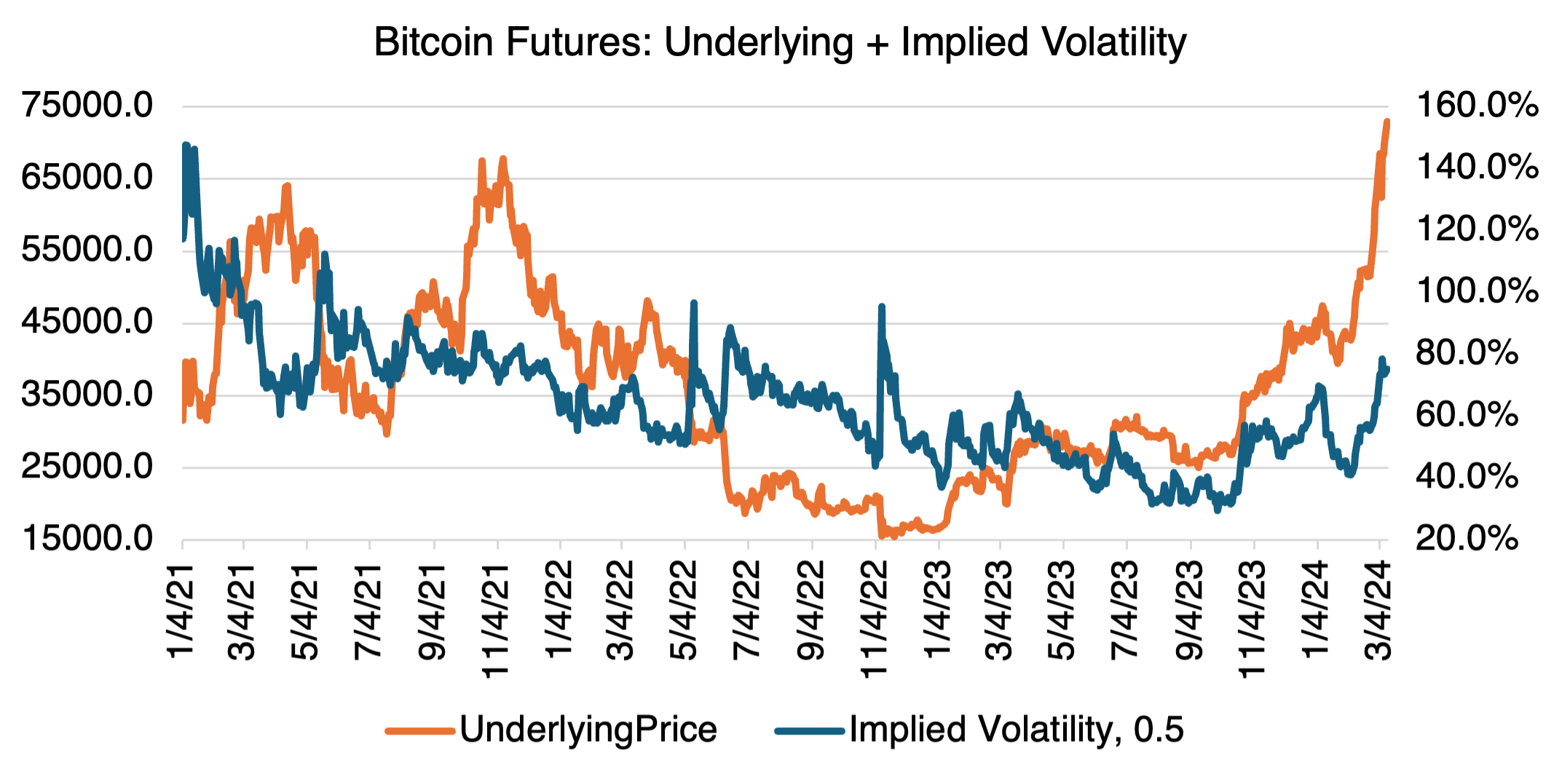

Let’s take bitcoin first. As you can see below, ever since it broke through about $40,000, bitcoin’s implied volatility has been increasing sharply. Currently, it’s approximately 75%, over 30 vol points higher than it was just about a month ago. Implied volatility tends to spike during bubbles as the price action becomes more frantic and anxiety about whether the upward trend will continue increases.

Source: OptionMetrics

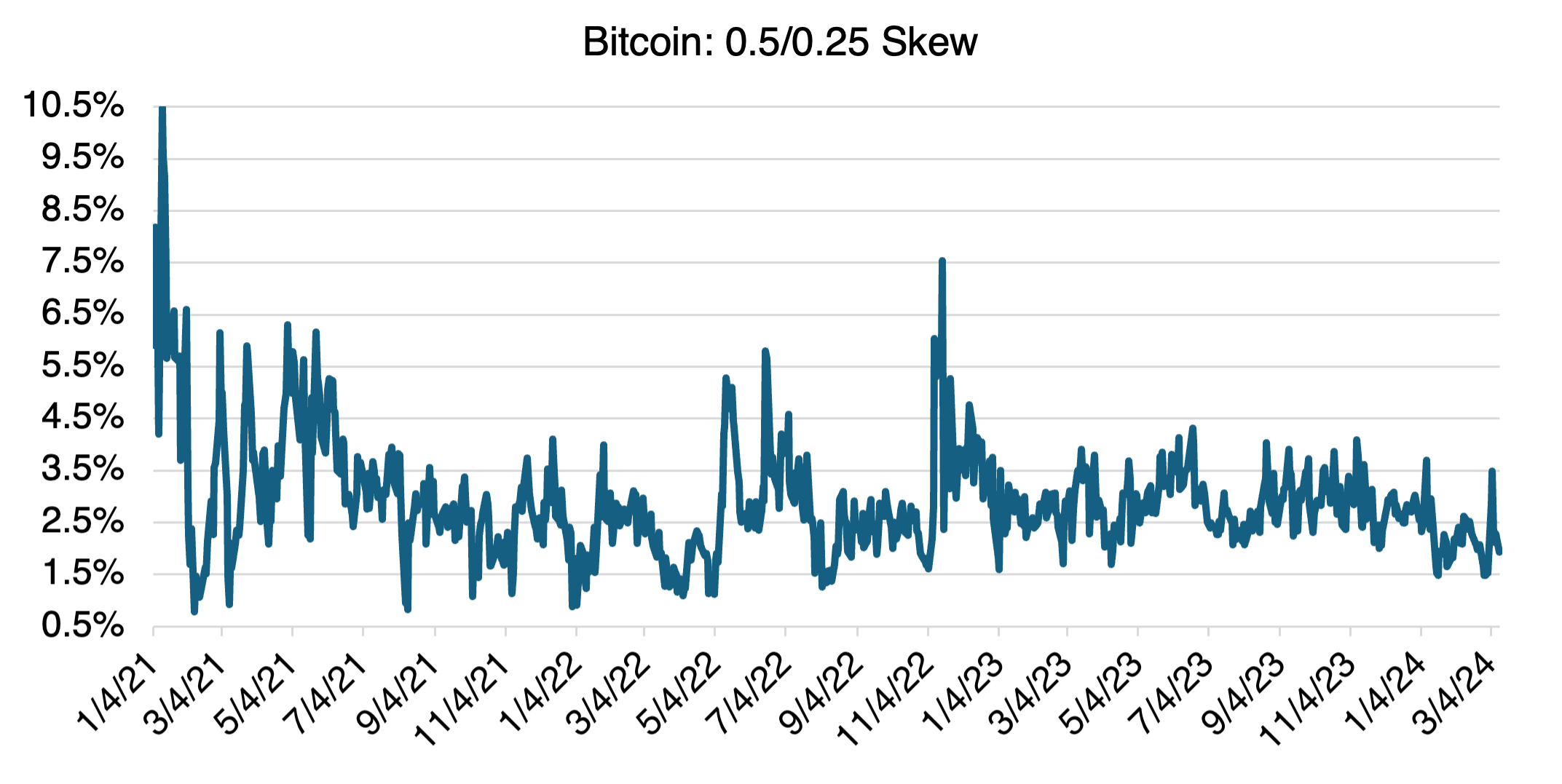

At the same time, the difference between the implied volatility of at-the-money (delta = 0.5) and out-of-the-money strikes (in this case, delta = 0.25), the “skew,” is somewhat elevated, but not at abnormal levels — for now. During a bubble, one would expect the skew to increase as investors rush to buy low priced options with the potential for outsized returns. If bitcoin continues to rally, keep an eye on its skew to see if it starts increasing to abnormal levels. That’s sometimes a sign that the rally is turning into a bubble that is getting ahead of itself.

Source: OptionMetrics

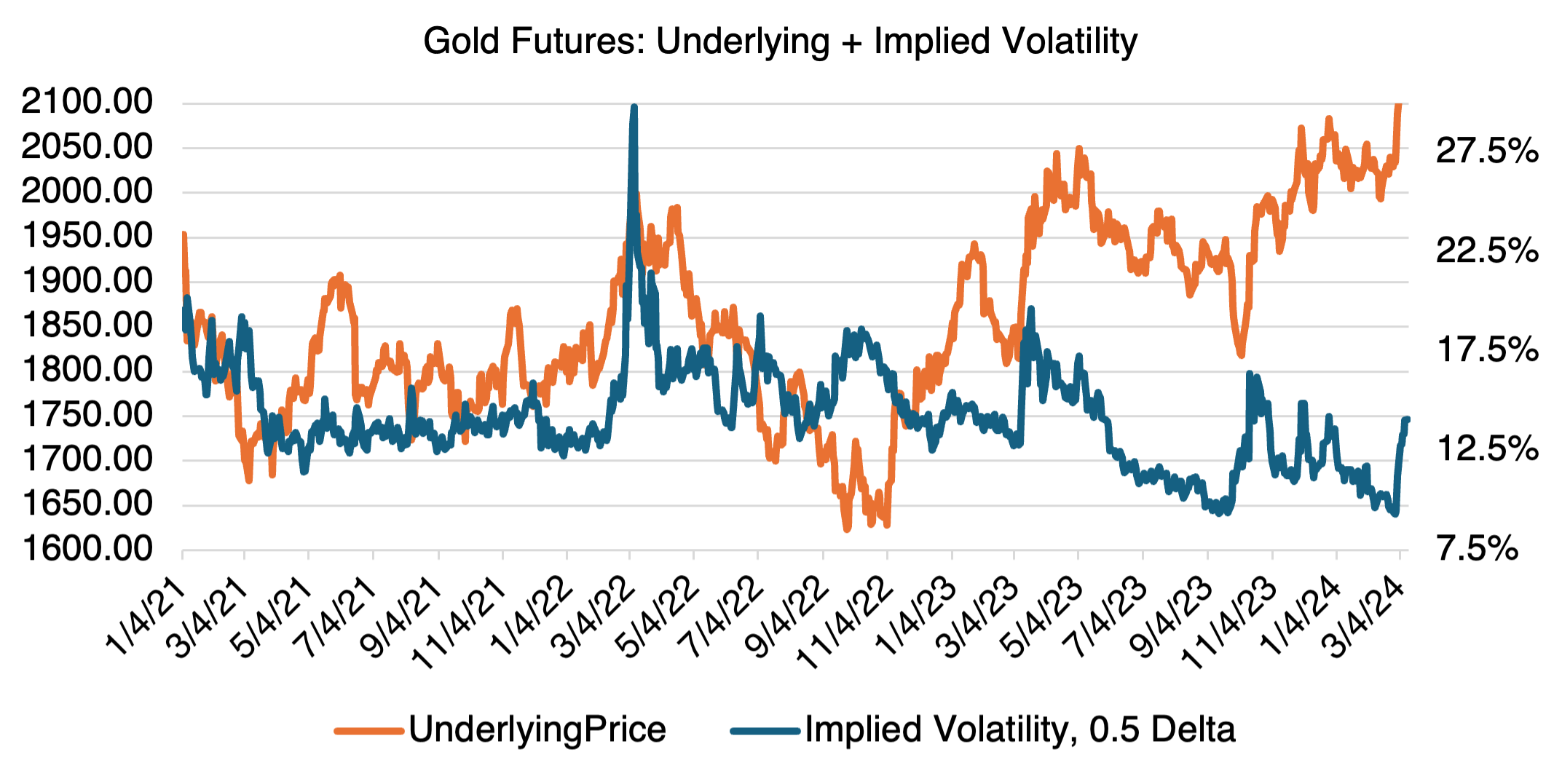

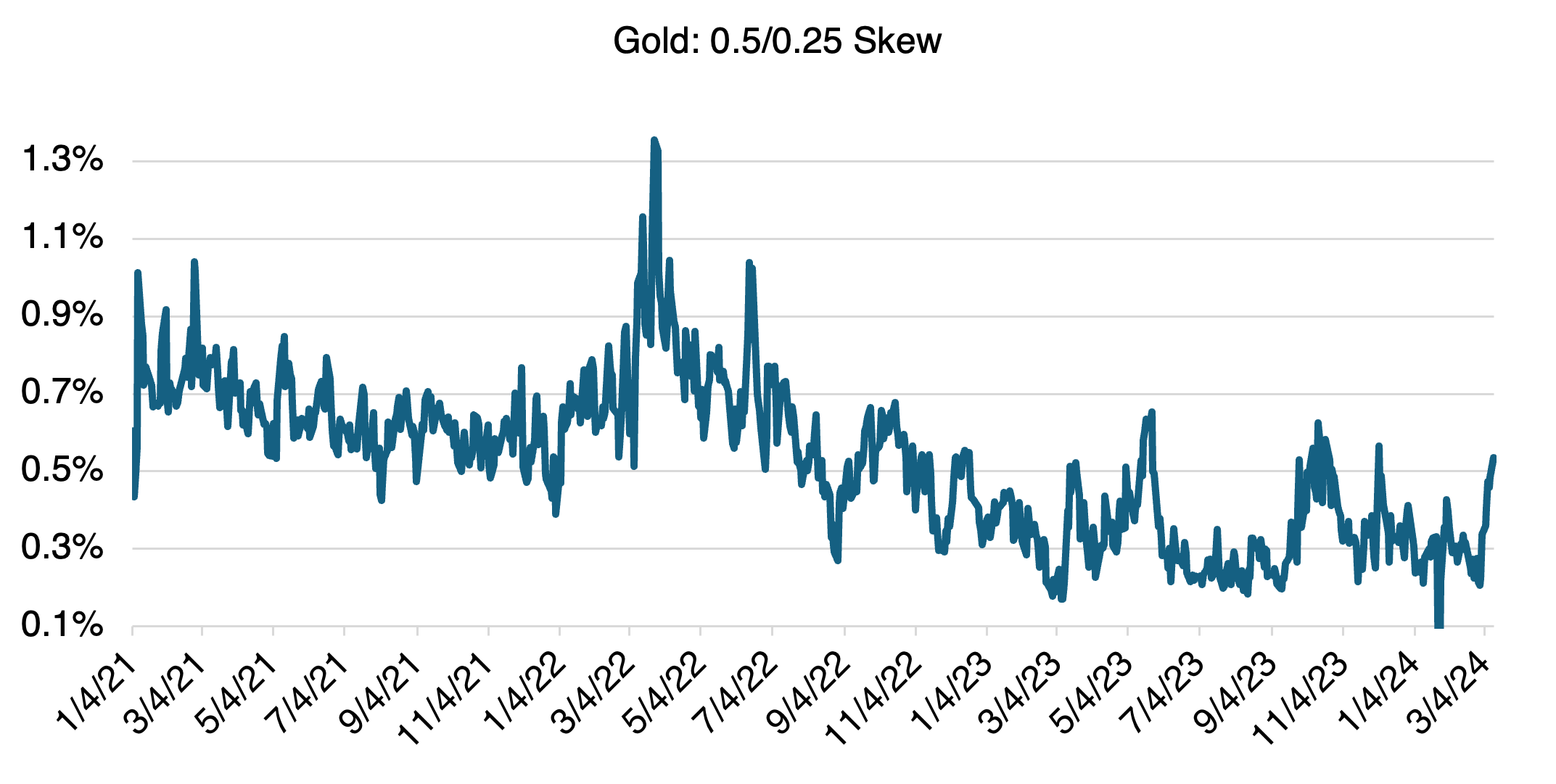

Gold’s implied volatility is showing a similar pattern to bitcoin, but its skew is much more pronounced. Note that gold trades at relatively low volatility levels, which makes its most recent volatility increase all the more impressive. Gold’s move to new all-time highs caught many by surprise. Consequently, they may be rushing in now with a severe case of FOMO. Of course, gold must maintain upward momentum or its implied volatility, and skew, will decrease back to pre-rally levels.

Source: OptionMetrics

Source: OptionMetrics