Game-Changing Upgrades to OptionStrat: Futures Support, Enhanced Flow, and More!

Hello Traders!

Today we are launching some significant and highly-requested upgrades to OptionStrat! We have been working hard to deliver this update based on your invaluable feedback and suggestions.

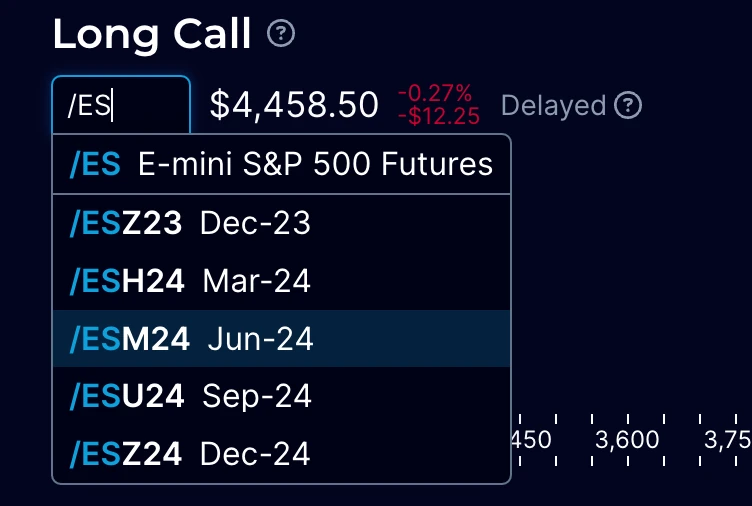

- Futures Support: You asked, we delivered! We’re excited to introduce support for futures options, our most requested feature of all time! Futures are among the most traded securities in the world, and we understand how important they are to you. Subscribers will now receive 15-min delayed futures data, enabling you to craft strategies using popularly traded futures such as /ES (S&P 500 E-Mini Futures), /NQ (Nasdaq-100 E-Mini), /GC (Gold), /BTC (Bitcoin), /6E (Euro Forex), and so much more.

Futures in our options profit calculator tool

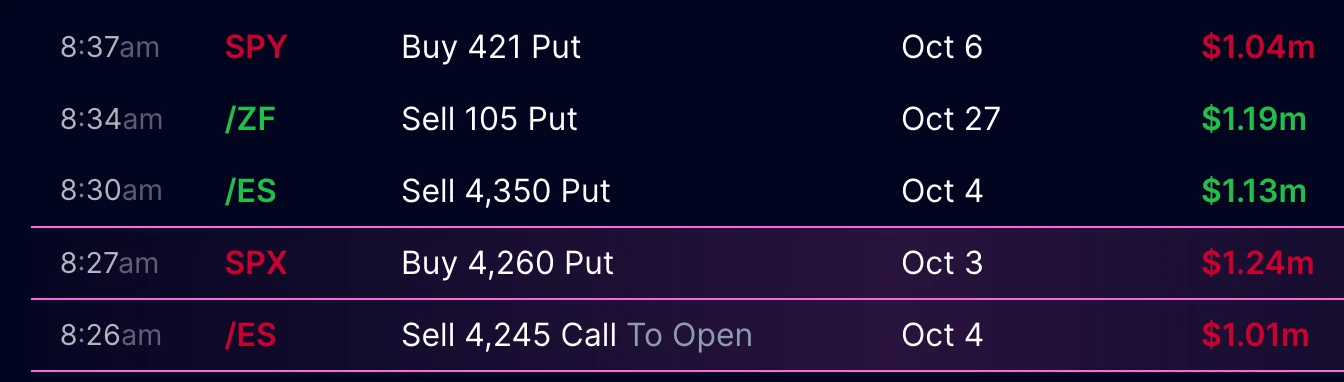

Futures in our unusual options flow tool

Subscribers to our Option Tools plan will be able to build and optimize strategies using options on futures. Flow subscribers can do the same, plus get access to large and unusual futures trades in our unusual options flow tool.

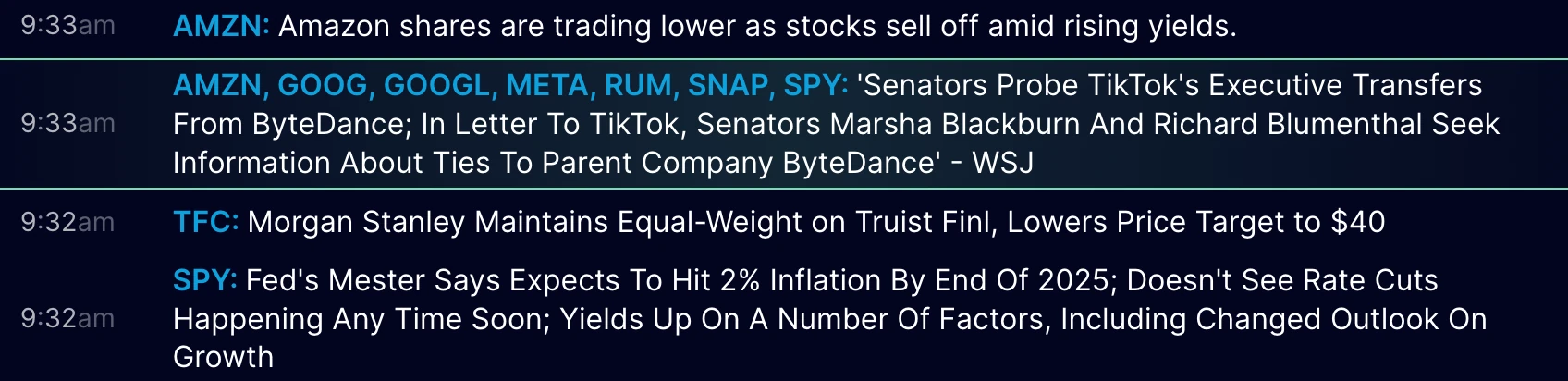

- Supercharge your Options Flow: Our options flow tool has been upgraded with three new kinds of flow: News Flow, Congress Flow, and Insider Flow.

Our breaking news headlines throughout the website have been a bit hit. Now, you can take quick action as all news headlines are viewable in the News Flow tab. We’ve also included long-form news articles so you can dive deeper into those headlines.

Meanwhile, our Congress Flow lets you track U.S. Congress members’ stock trades, revealing some potentially market-beating strategies. Although these trades aren’t real-time (it can take up to 45 days to be disclosed), our timeline feature will keep you up to speed.

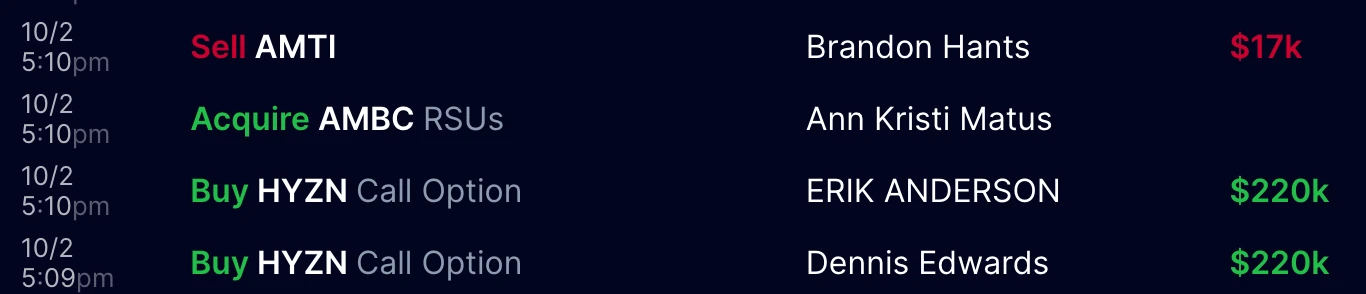

Our new Insider Flow curates public disclosures from company insiders like CEOs and executives. This could help you uncover some potential trading gems. All disclosed activity, including trades, gifts, RSUs, etc., are captured in this flow.

Just like the existing options flow, you can set up mobile alerts and filters for these new flow types.

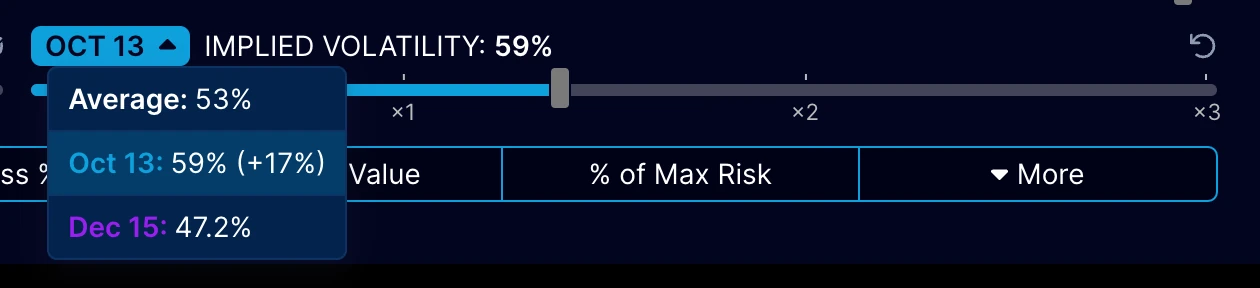

- Enhanced IV Simulation: Lastly, we’ve introduced another highly sought-after feature that allows you to adjust implied volatility (IV) per expiration. With this feature, you’ll be able to model calendar spreads better by simulating IV changes for each leg. We hope this brings your trading game to a whole new level! (Note that this feature is only available to subscribers)

We’re committed to continually enhancing your trading experience and hope these new features continue to take your trading to the next level. Remember to check out our YouTube channel where options trader Steve Ganz publishes weekly videos on how to use OptionStrat to it’s full potential.

Note: The full list of supported futures are: /6A, /6B, /6C, /6E, /6J, /6L, /6M, /6N, /6S, /6Z, /ALI, /B0, /BLK, /BTC, /BZ, /CB, /CL, /CNH, /CSC, /CU, /CZK, /DC, /DY, /EHF, /EHR, /EMD, /EPZ, /ES, /ETH, /GC, /GDK, /GF, /GNF, /HE, /HG, /HH, /HO, /HRC, /HTT, /ILS, /KE, /KRW, /LBR, /LE, /MBT, /MCL, /MES, /MET, /MGC, /MNQ, /MPX, /NG, /NIY, /NQ, /PA, /PL, /PLN, /PRK, /RB, /RF, /RP, /RTY, /RY, /SI, /SR1, /SR3, /TN, /TTF, /UB, /WTT, /YM, /ZB, /ZC, /ZF, /ZL, /ZM, /ZN, /ZO, /ZQ, /ZR, /ZS, /ZT, /ZW