Green Risk

In July, I wrote about sustainable aviation fuel, or SAF (Overpriced SAF?). It’s not the most exciting topic in the world, but it does display one possible hazard of investing in the green revolution, or any new technology for that matter. In short, and obviously, the hard truth is that investments have to make sense economically and must be feasible for them to yield long term returns, no matter how pressing the need, the politics involved, or how much market hype is present. Skepticism in investing is always warranted. That’s not to say that you can’t make money in the short term if the business model or process doesn’t make perfect sense, but that the odds will be stacked against you, eventually.

As I wrote about SAF last time, the aviation industry contributes 2-3% of annual carbon emissions. The Air Transport Association has set 2050 to achieve NetZero, and SAF accounts for 65% of their plans to achieve that goal. Faced with this daunting task, you can understand the industry’s interest in SAF, and why some ventures with doubtful and unlikely claims (to put it politely) have entered the fray. Cold fusion, anyone?

The latest example of this (possibly) is Prometheus Fuels, a startup out of California that claims to be perfecting a novel process of direct carbon capture, or pulling CO2 out of the atmosphere and then combining it with hydrogen to produce synthetic hydrocarbons (obviously, it’s a lot more complicated than just that and requires a minimum of six industrial processes). To date, the challenge has been to produce enough SAF, or electrofuels, at scale and at a price that’s competitive with existing high octane fossil fuels. Prometheus claims that it can do just that. Their slick online marketing materials trumpet their technology with catchy names and complicated sounding descriptions: “reverse combustion processes,” “Faraday reactors” (in which “molecules are broken apart and re-energized”), and “Maxwell Cores.” The whole process can take place in a relatively small container that they have dubbed the “Titan Fuel Forge.”

Apparently, this has been good enough to attract funding from some impressive investors, such as BMW and Maersk, and fuel purchasing commitments from the likes of American Airlines. With $50 million in funding, Prometheus is currently valued at $1.5 billion.

Prometheus is not public, so the market cannot weigh in on its claims via its stock price. Nor are they subject to the regulatory scrutiny that comes with a public listing. Needless to say, many researchers are extremely dubious of their claims, as showcased in an article from last April in the MIT Technology Review (“This $1.5 billion startup promised to deliver clean fuels as cheap as gas. Experts are deeply skeptical“).

Frankly, I don’t know whether Prometheus is on to something or not. Maybe they are, maybe they’re not. I’m not a chemical engineer and must therefore rely upon those that are for qualified opinions. My sense is that they have not solved the operational difficulties in bringing their product to market and are ahead of themselves (except for their marketing).

It is important to point out that I bring this up not to denigrate Prometheus or its claims, but to point out that successful investments require disciplined research, diligence, and a healthy dose of skepticism. For beginning options traders trying to master which companies to trade as well the intricacies of options themselves, this is especially true.

If you are still convinced that SAF has a future, but are wary of Prometheus, then Gevo (GEVO) is publicly listed. Just keep in mind that its options are expensive by several measures, as I detailed when I reviewed the company last July.

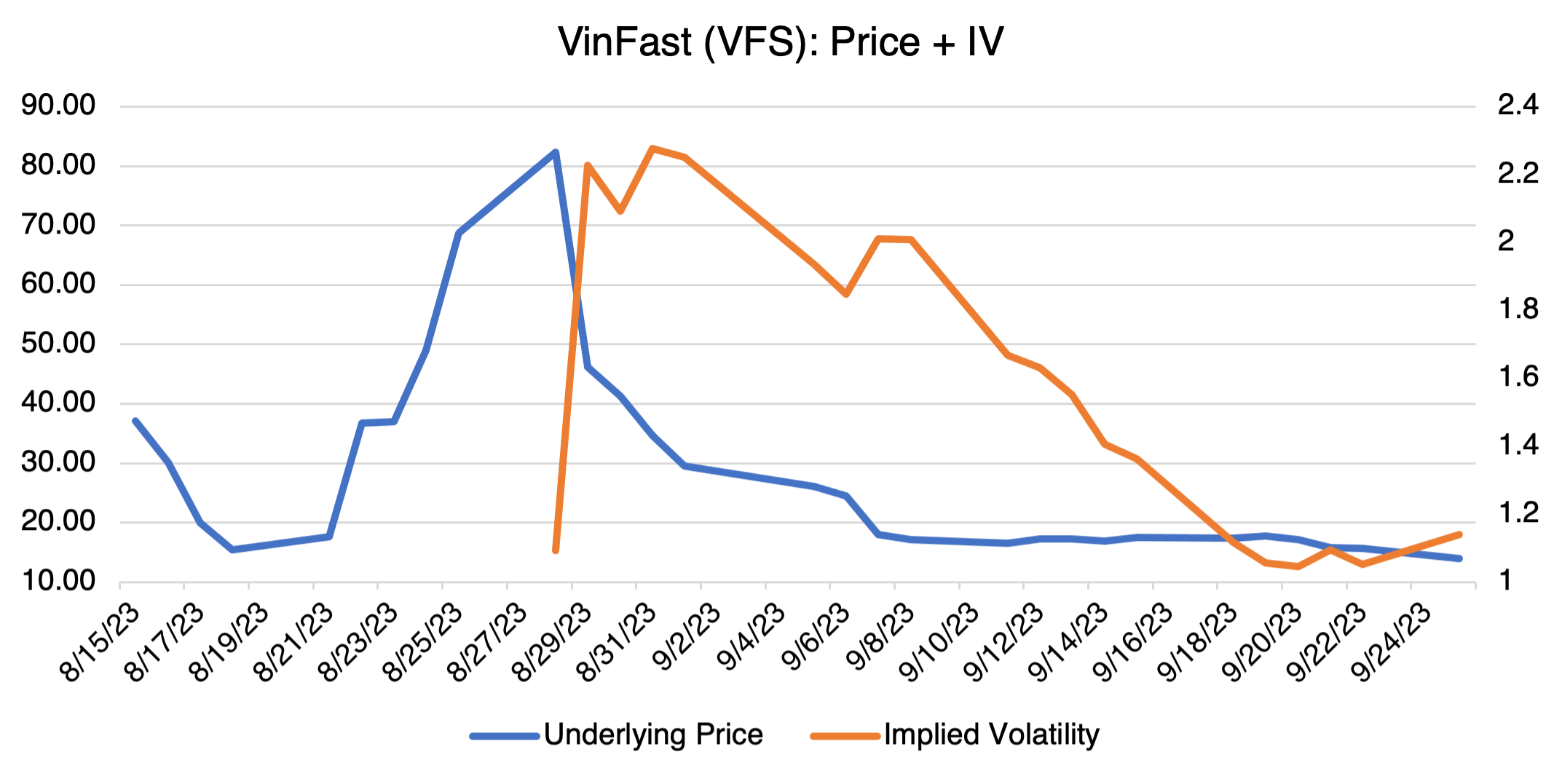

One company whose short term investment prospects leave little doubt is VinFast (VFS), the Vietnamese EV producer that went public in August via a SPAC (i.e., it merged with a shell company). An initial buying frenzy propelled the stock to over $82, briefly giving it a market cap of about $190 billion. For those into relative value, that’s over twice the value of GM and Ford combined, and this for an auto maker that only sold 24,000 vehicles globally in 2022 (Ford produces about 1000 F-150s per day). And if that wasn’t enough of a red flag, over 99% of the parent company’s shares are held by its chairman, leaving only 1% to publicly trade. It took a little over a week for investors to realize their folly and a massive repricing (read: dump) followed. VFS is currently trading in the mid-$13 region and is reminiscent of other SPAC related debacles in which retail investors are left holding the bag. Again, even the most minor due diligence on VFS (and common sense) would have revealed the fact that it was grossly overvalued and controlled by the chairman’s 99% share.