Hedge Funds for Everyone!

Over the course of my long career on Wall Street, almost every hedge fund or trading division I’ve worked for or advised asserted that they were “risk averse.” Of course, that’s what they said, but very few were, or even wanted to be, in the first place. They came up with all sorts of euphemisms to hide the truth: trading around assets, optimizing the portfolio, arbitraging, adjusting the hedge, playing the curve, etc., etc., all just thinly veiled excuses for what was really going on. As long as the profits flowed in and new investors were signing up, all was well with the world.

Until, that is, the music stops, risk spins out of control, and returns plumet, sometimes over the course of just days or weeks. The strategies involved were usually not that obscure, just larger and more concentrated versions of pretty standard stuff. The larger trading debacles are usually well reported in the press and spun as a cautionary tale for the unwary.

Since all this is well known, and numerous studies have concluded that actively managed funds, in whatever form, consistently fail to produce excess returns, you have to wonder why investors continue to be attracted to them.

The reason has nothing to do with historical returns, diversification, or esoteric quantitative reasoning. Simply, everybody wants to sit to at the cool kids table, and investing in hedge funds or “alternative investments” is definitely a lot cooler than just buying index funds or clipping coupons. The chance to shoot for “abnormal returns,” or to be a member of an exclusive club that invests just like celebrities and the uber rich, is just too much for many to resist. Exclusivity sells, and that’s why “this fund’s strategy isn’t for everybody” or “this fund is only for investors who really know what they are doing” are two of the most effective sales pitches ever. For proof, look at the lengths that many of Bernie Madoff’s “clients” went to for the honor of giving him their money.

There is a problem, however. Most people can’t invest in hedge funds, either because they don’t meet the SEC-mandated accredited investor wealth requirements (the SEC requires that investors who want to invest in risky, loosely regulated securities meet certain net worth requirements), don’t have the funds’ minimum investment, or don’t want to lock up their funds (most hedge funds have a “lockup,” or a period of time in which you may not withdraw your investment). In other words, rich investors only.

Active mutual funds can fill the space for less well-off investors, but their fees, relative illiquidity, lack of transparency, and high fees turn many potential investors off (rightly or wrongly).

Enter one of Wall Street’s best-selling riffs on a standard product, Active ETFs. Exchange traded, transparent, daily settled, no messy accreditation requirements, more tax efficient than mutual funds, can be margined, and relatively low fees. Essentially, hedge funds for the proletariat. What’s not to like?

Active ETFs have been around for a few decades, but received a big boost in 2019 when the SEC passed the creatively named “ETF Rule,” which streamlined the Active

ETF listing process in exchange for greater transparency and disclosure requirements. Since then, they have skyrocketed to almost $10 trillion in managed assets.

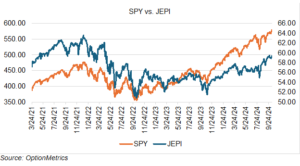

Like hedge funds, each Active ETF has a specific strategy or niche to generate excess returns (in the cases outlined below, returns above that of SPX, RUT, etc.). Options strategies proliferate, particularly those geared to generate income or limit volatility. For example, the JPMorgan Equity Premium Income ETF (JEPI) sells covered calls on its portfolio – it’s essentially a $36 billion covered call writing machine. It’s performance vs. SPY is below:

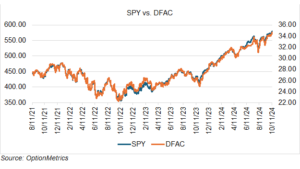

The US Core Equity 2 Active ETF (DFAC) also employs futures and options to boost its return, although it’s less clear what their exact role is. Unlike JEPI, it tracks SPY closely:

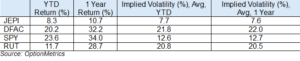

Summing up the two very popular Active ETFs vs. counterpart indexes (as of 10/14/2024):

JEPI’s covered call income producing strategy comes at a cost in lower returns; it’s best in a sideways, to slightly bullish market. DFAC is obviously more aggressive, easily outpacing JEPI. Their implied volatilities are telling, with the lowest return ETF (JEPI) having the lowest implied volatility. Notice that DFACs returns, although similar to that of SPY, come with implied volatilities that are almost twice as high. Personally, and on that basis, I would stick with the standard issue SPY.

As you would expect, Active ETFs come with higher fees than their strictly index-based and passive counterparts. For Active ETFs, fees average 0.31%; for passive ETFs, 0.07%. No wonder that the largest issuers like BlackRock, Vanguard, and State Street love these things.

Although the higher fees might not seem like much, they can eat into total return, especially when the Active ETF’s performance is similar to that of the related index. In that situation, you don’t have that much extra return to play with. Fees are a drag on performance, so you better get what you’re paying for. It seems like you don’t: according to the WSJ, over the past 15 years, Active ETFs in blue-chip stocks have returned 12.4%, vs.13.5% for passive funds and 12.6% for open ended mutual funds. Although it may be incorrect to compare different funds with different strategies and objectives, and only focus on one asset class, the results point to something that is very frustrating for investors – it’s very hard to beat the market!