Hopes and Dreams

This week, let’s review some companies that succumbed to dreaming instead of managing. I’ve reviewed Rivian (RIVN) and Beyond Meat (BYND) before, but Salesforce (CRM) now joins the club. Although BYND and CRM are in very different businesses, they have more in common than you would think.

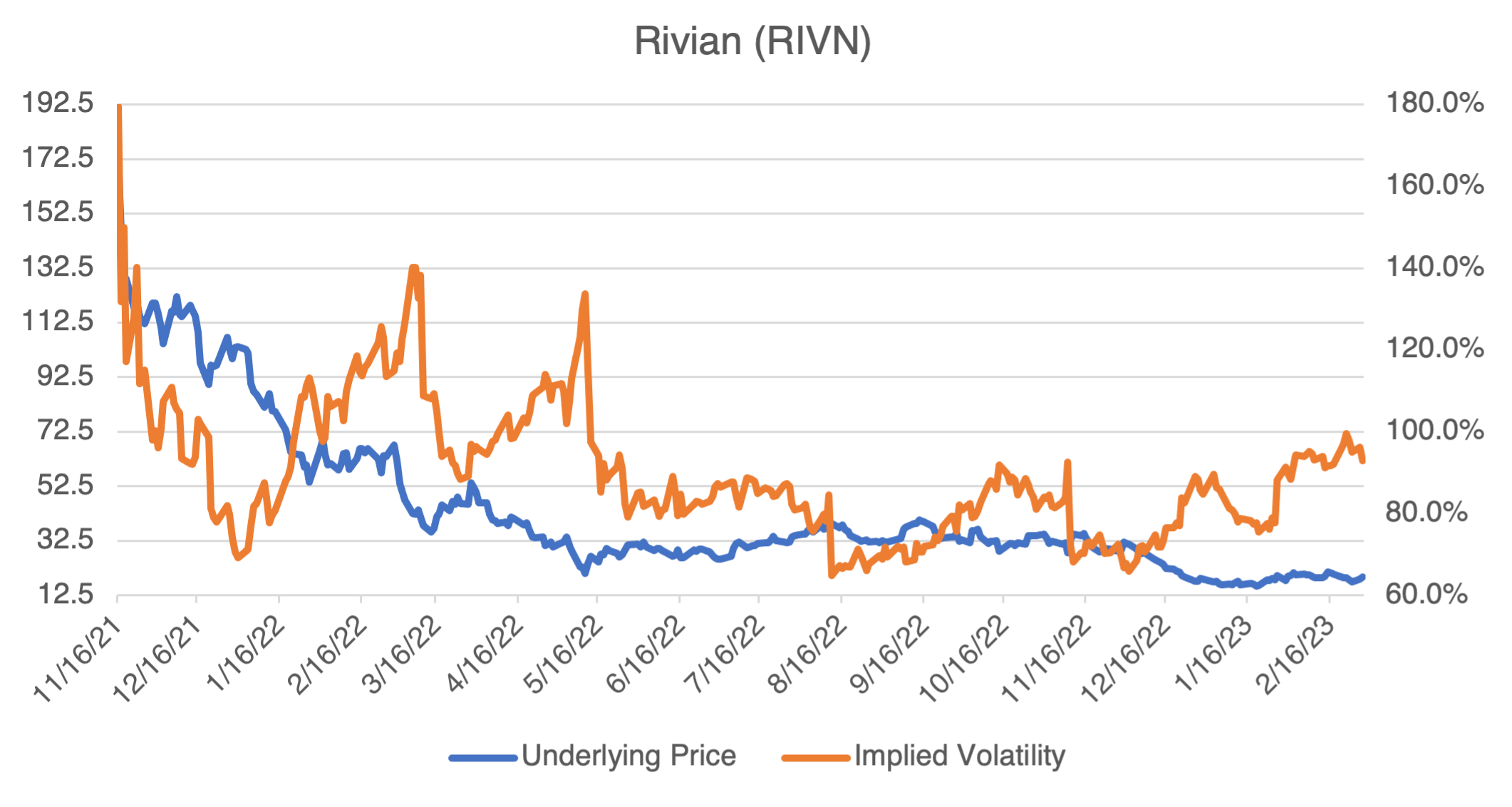

First up is Rivian (RIVN). It popped back on my radar recently because I’m seeing more of them driving around town and in my local Costco parking lot. I reviewed RIVN last November in *More Teslas?* At the time, I wrote “Like its rivals, Rivian has had production problems that have limited the roll out of their pickup and SUV. However, with over $15 billion in cash as of the end of last June, they can afford delays.”

I might have been wrong. Rivian recently revealed their losses for 2022 and Q4 and they were staggering: $6.8 billion and $1.7 billion, respectively. Their cash reserves were $11.6 billion as of the end of the year. Starting a new car company, much less one with new technologies, is one of the most cash intensive feats in the world of manufacturing. Indeed, very few have pulled it off, and there have been hundreds that have tried. Key will be whether RIVN can increase production to meet their 2023 target of 50,000 vehicles, about double of what they produced last year. Like all automotive startups, they are in a race between increasing production and decreasing cash. We shall see which will win.

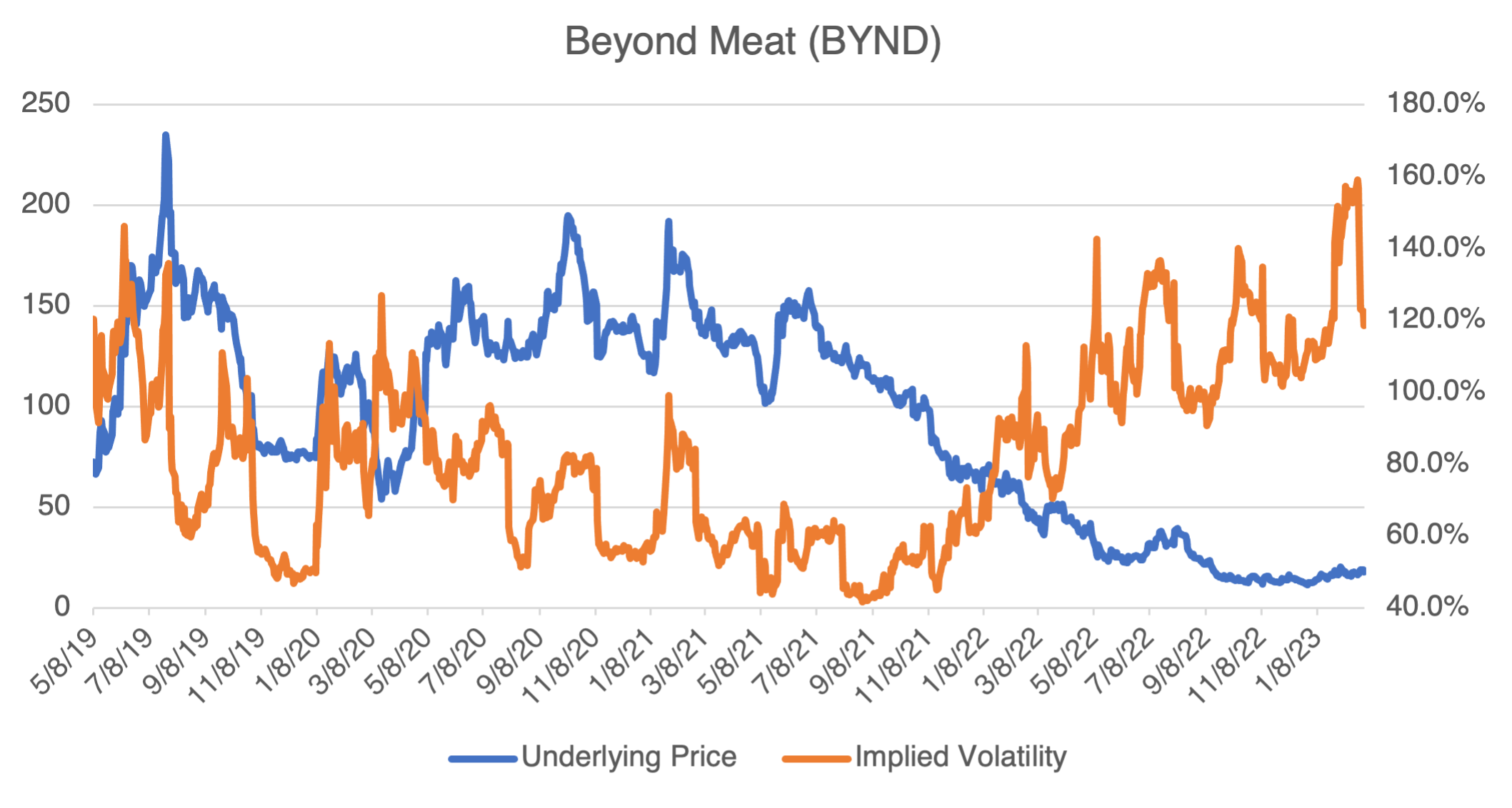

Next, Beyond Meat (BYND). I reviewed them last September 29 (Dr. Doom) when the stock closed at $14.43; it’s rallied somewhat since and closed at $17.84 at the end of February. It’s still a shade of its former IPO high of almost $235. What happened? Common to many startups with innovative products, management was entranced with growth at any cost and their “changing the world” narrative but forgot about all the boring stuff, i.e., commercialization and production. Ethan Brown, Beyond Meat’s CEO and Founder, originally took a page from a tech startup’s playbook and made growth and innovation job #1, apparently to the detriment of more mundane matters. Production problems, falling grocery store sales, and rising debt resulted. Last October, and with its share price off over 90% from its post IPO highs, Mr. Brown saw the light that Beyond Meat was really in the food supply business, cut 19% of BYND’s workforce, and announced that the company’s priority would no longer be growth at any cost but positive cash flow and sustainable growth.

Reflecting its relatively low share price and uncertainty concerning its future, BYND implied volatility is no bargain at roughly 120%. If you’re looking for its stock to rebound and buy its turnaround plan, try to pursue volatility neutral options strategies.

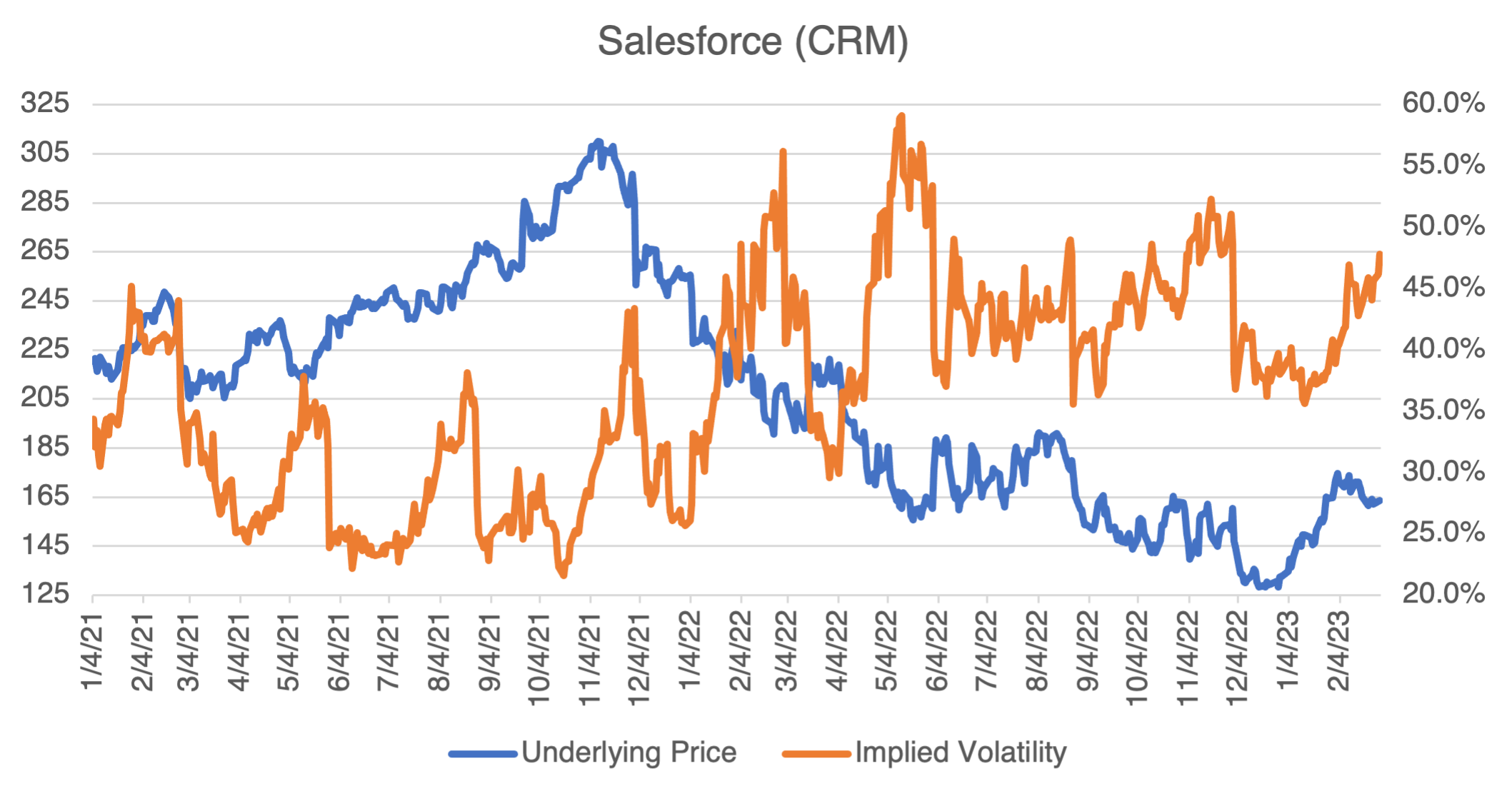

And lastly, Salesforce (CRM). The same culture and attitudes that almost took down Beyond Meat were at work here. It’s easy to dream when your stock price is rising and cash is plentiful due to super-low interest rates. Salesforce’s dream took the form of “ohana,” a Hawaiian word for “familial bonds” (where do they come up with this stuff?). In other words, “Calling all employees, management, and customers: we’re all one big happy family! Free food, fancy retreats, “well-being” days off, and celebrities — we’re here to make you happy and nothing is too good for you!”

Well, all that’s great when the stock is rallying and money is cheap. But by late December, and with the stock trading below $130 — 59% lower than its $313 peak from 2021 — activist hedge fund investors started sniffing around and it was time to discover who’s really family and who’s overhead. Sure enough, it was then time to lay off 10% of its workforce, cut expenses, and introduce employee ranking metrics. The new mantra seems to be that it’s time to run the business like a business. In other words, performance and efficiency matters.

Apparently, all this might be working. Q4 results, announced yesterday, were impressive and beat analysts’ expectations across the board. Consequently, and at the time of this writing, CRM has rallied about 12% on the day and is now at trading in the mid-$180’s.

As far as CRM’s option pricing is concerned, implied volatility has been trending up to the high 40% region due to continued uncertainty regarding the intentions of activist investors. With yesterday’s results, that fear should be abated, at least for the time being. If you’re a fan of Salesforce, its implied volatility should be coming off and its options consequently well-priced. Use our options profit calculator tool to experiment with various strategies.

What’s the moral of the story for Beyond Meat and Salesforce? It’s great to believe that your company is going to change the world or pursue a more familial workplace (“ohana”), but not at the detriment of day-to-day performance. Shockingly, results count!

The Sage Speaks

In his annual letter to Berkshire Hathaway shareholders, Warren Buffet wrote the following:

“I have been investing for 80 years—more than one-third of our country’s lifetime. Despite our citizens’ penchant—almost enthusiasm—for self-criticism and self-doubt, I have yet to see a time when it made sense to make a long-term bet against America,” Mr. Buffett wrote.

Exactly. Whether Mr. Buffett has allowed patriotism to cloud his investment judgement can be debated, but his astounding record speaks for itself. Doubt him at your peril.