Introducing the Options Optimizer

Today we are releasing the new options optimizer tool for public testing. The options optimizer makes it easy to search through thousands of potential trades and focus on the ones that matter: the strategies with maximum return, maximum chance of profit, or some combination of the two.

To use the optimizer, simply choose:

- A sentiment (bearish, bullish, etc), or a target price

- An expiration date

- Your risk tolerance (in the form of optimizing for max return or max chance)

The tool will then do the hard work of checking thousands of potential trades to find the optimal trades for your criteria.

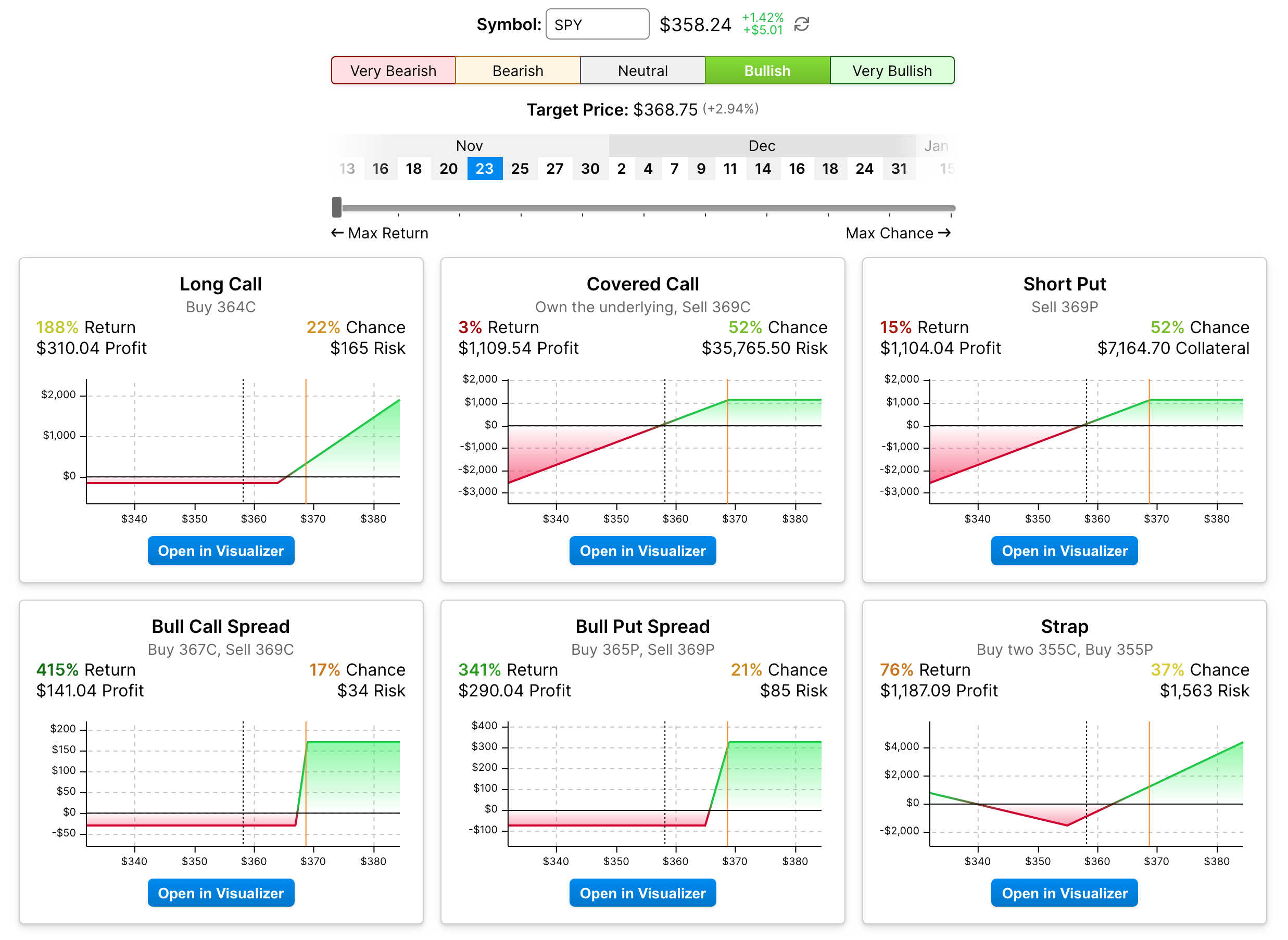

Screenshot of the new options optimizer

To get the most out of this tool, you can set your own target price by clicking the target price number and editing it. If you use the sentiment buttons, the target price will default to ± the implied move for bearish or bullish, and ±2 times the implied move for very bearish or very bullish. The implied move is calculated using the options market data.

For each result, some details about the trade are shown, along with a graph of the expected profit (or loss) at various prices on the expiration date. The % Return and % Chance stats are color coded based on the maximum ROI or chance for all of the results (green being the highest ROI or chance among all results). The profit at the target price and maximum risk are also shown. For strategies such as short calls that have unlimited risk, the estimated collateral or margin required is shown. This represents how much buying power is tied up by the trade, which makes it possible to calculate the return on investment for these strategies.

To filter out illiquid trades, options that have low open interest, low volume, or are extremely cheap (5 cents and under) are not shown. After filtering out those options, every viable trade is tested to determine its ROI and chance of profit. Even though strategies like iron condors have potentially hundreds of millions of permutations, we are able to test a subset of these by excluding certain trades that couldn’t be a match. Because of this, we are able to deliver the results nearly instantly.

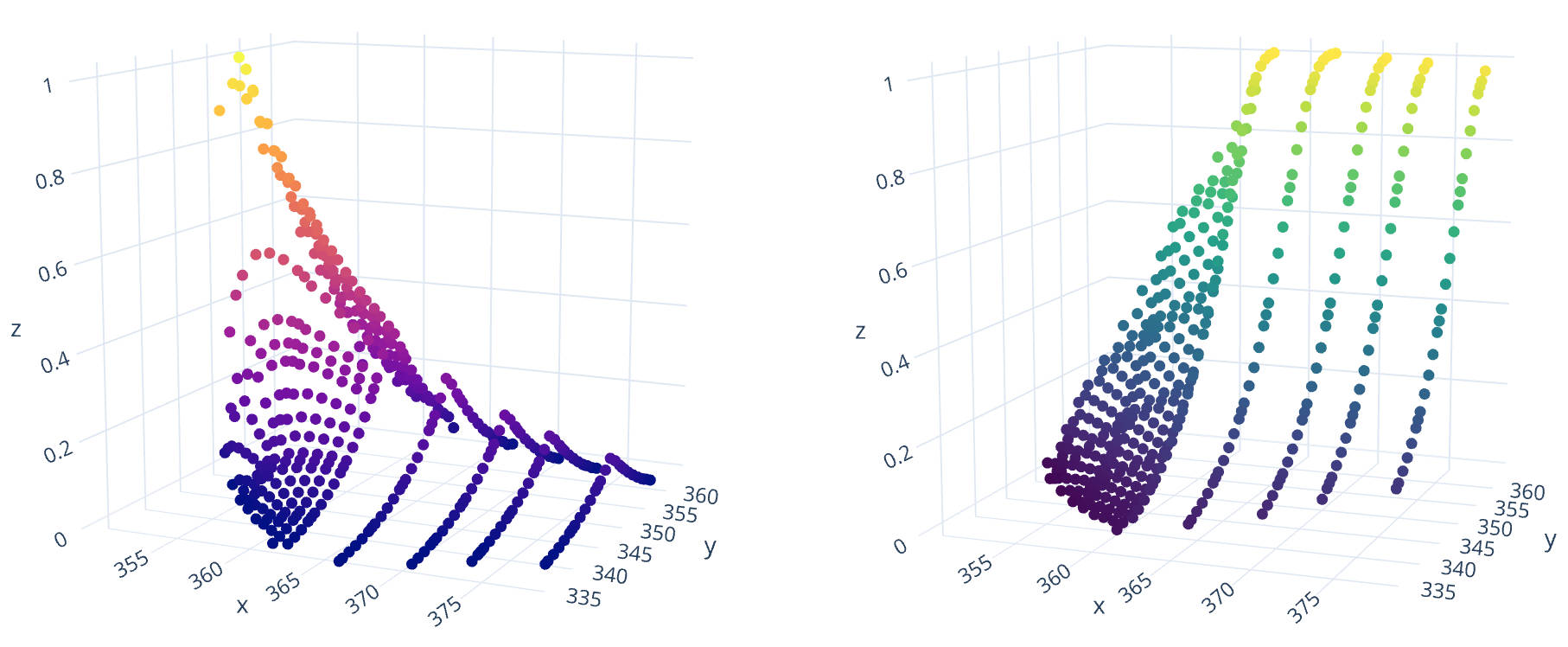

Spreads on SPY plotted by ROI (left) and chance of profit (right) – created during research and development of this tool

Note that this tool still has a few bugs and will be improved upon in the near future as we continue testing it and gathering feedback. In the future, we will add support for bi-directional sentiments (Strategies for when you think a stock could make a big move up or down), and more strategies for the existing sentiments.