It Ain’t Over Till It’s Over

I finished writing my previous blog, Apocalypse Now, just last Tuesday morning. It was about the relatively esoteric topic of VIX futures backwardation, and how it might portend continued instability and was definitely not the sign of a healthy market. Has the situation changed?

Just as the magnitude and severity of President Trump’s original tariff proposals took the market by surprise, so too did his U-turn on Wednesday. “Relief rallies” usually occur after everyone has thrown in the towel and investors are looking for any shred of good news. They were a frequent feature of the dot.com implosion, the financial crisis, and the pandemic, but ultimately signal more of a delay of sentencing than a reprieve.

Thursday’s action drove this home, as the market realized after a good night’s sleep that a full-blown trade war with China had begun. As always with the President, it’s unclear whether he’s just negotiating, and will eventually announce a surprise summit to hash things out, or really means to confront China once and for all. I suspect it’s a little bit of both (or more cynically, neither).

As I’ve written, uncertainty (some would say chaos) reigns, and the tariff reversal and Chinese trade war feeds into this narrative. The market hates surprises and inconsistency; unfortunately, it seems that the President lives on them.

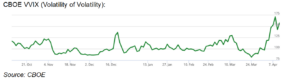

As long as that is true, the VIX will have the potential to accelerate or decelerate much faster than normal. In other words, the volatility of volatility will remain high, and difficult to predict. You can see this in the VVIX, the CBOE index that measures just that. It’s high last Tuesday was 170.9; during the height of the pandemic, it got to 190.5.

When will all this be over? As I wrote earlier in the week, keep an eye on VIX futures backwardation (see chart below). Before Wednesday’s rally, 1-month to 6-month backwardation peaked at 15.75. After retreating to 7.44 on Wednesday, it roared back on Thursday to close at 13.06. In the previous two crises, backwardation was a stubborn feature for some time. During the 2008 financial crisis, it went on for about 9 months; during the pandemic, 10 months. During that time, the SPX attempted to find a bottom (which it eventually did). Once fear, anxiety, and uncertainty become ingrained in the market, it’s difficult to get rid of them.