It’s Hot!

One of the most underappreciated and mundane inventions of the 21st century is air conditioning. Although it rarely makes it to anyone’s Top 10 Inventions list, A/C was essential to the development of skyscrapers (upper floors would be uninhabitable — warm air rises), migration to Sun Belt states (think Phoenix, Las Vegas, etc.), and the development of cities like Dubai and Singapore. It was a boon to the fledgling entertainment industry, as people flocked to the air conditioned movies to escape their sweltering apartments. It also drastically reduced heat-related mortality, by some estimates as much as 80%. By any measure or analysis, air conditioning drastically changed the way we live.

Interesting, but what does this have to do with investing and options strategies? As it turns out, quite a lot. Air conditioning, although now essential to modern life and economic development, is one of the major contributors to growing global electricity demand, and by extension, fossil fuel consumption. With global electricity demand due to air conditioning expected to triple by 2050, the race is now on to develop a more environmentally friendly air conditioner.

I won’t bore you with what the new technologies are exactly, but suffice it to say that several startups are working on them with varying degrees of success, namely Blue Frontier, Transaera, and Montana Technologies (which is scheduled to go public soon via a SPAC merger). The A/C industry is dominated by Carrier (CARR) and Trane (TT), both of which are investing in startups, albeit grudgingly. New tech A/C startups have only raised about $350 in the 2020 – 2022 period, a fraction of what’s been showered on other new environmentally friendly technologies, e.g., batteries, fusion, etc.). Think of them like EVs; development and adoption were slow at first, and the majors came kicking and screaming to the table, but eventually went all in. New A/C technologies are unavoidably necessary; it’s just a matter of when. Although investment opportunities are currently limited (watch Montana Technologies imminent IPO), this is a sub-sector worth watching.

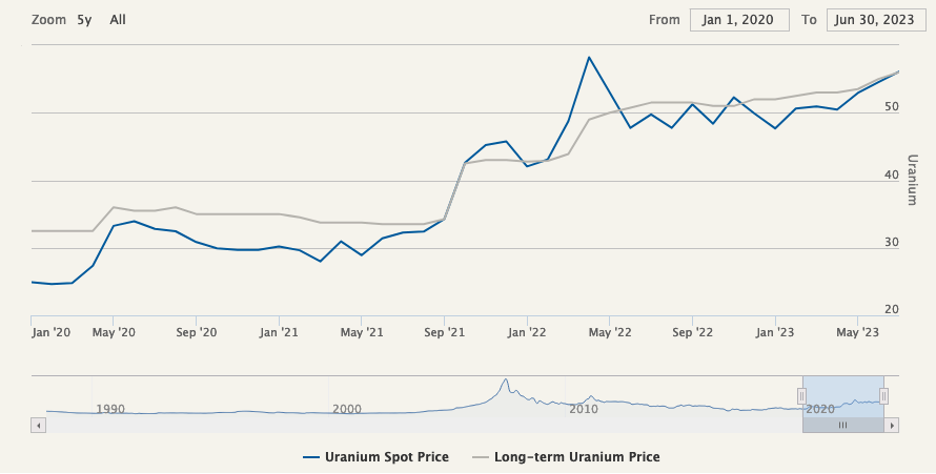

Increasing electrical demand in the face of environmental concerns leads to long term investment opportunities besides just new air conditioning technologies. Like it or not, nuclear power will figure in some shape or form in the future mix of electricity supply. Since they use uranium as fuel, extending the life of existing plants, as well as fear of sanctions against Russia supply, have led to sharply higher uranium prices (yes, uranium trades as a commodity). Spot prices have almost doubled since the beginning of 2021 (see below):

Source: Cameco

Uranium is unlike other industrial commodities in that it doesn’t respond to economic indicators or cycles. Rather, the demand for uranium is relatively stable since its only use is to fuel baseload generation (i.e., plants that are generating 24 X 7). That makes it very interesting as a so-called “uncorrelated” investment, i.e., uranium won’t move in sync with the rest of one’s portfolio, thereby acting as a diversification agent. It also won’t act a risk multiplier during periods of market turmoil, when more conventional investments tend to all move in the same direction.

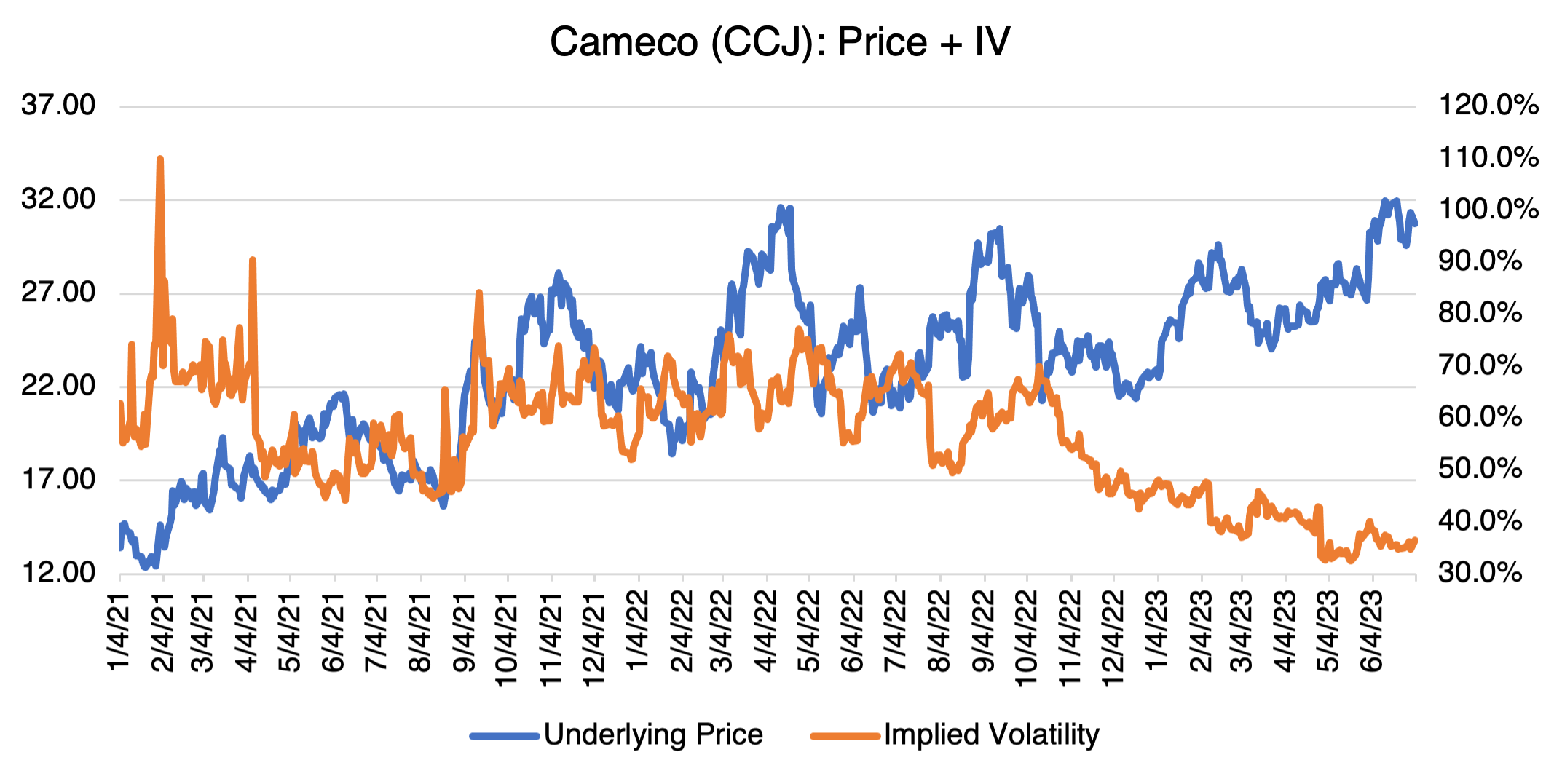

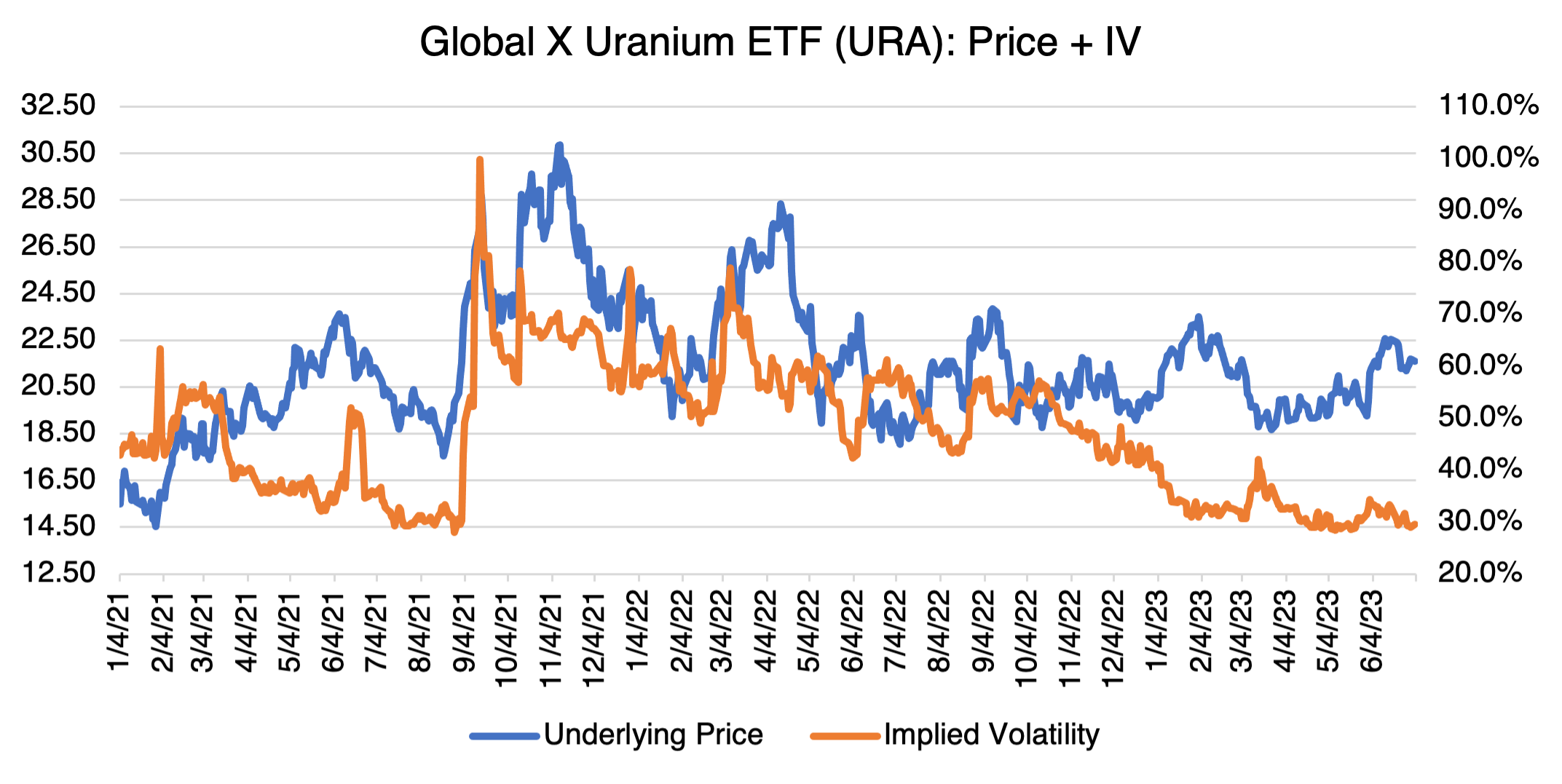

How to invest in uranium? Either through a uranium miner, Cameco (CCJ), or through the Global X Uranium ETF (URA) for a more broad exposure to physical uranium, mining companies, nuclear component manufacturers. On an implied volatility basis, options on both are relatively inexpensive and have been declining significantly YTD. That would make them an uncorrelated, low volatility investment, the Holy Grail of most hedge funds. Of course, all bets are off if news of a problem in an existing nuclear power plant arises.

Cruise Lines, Again

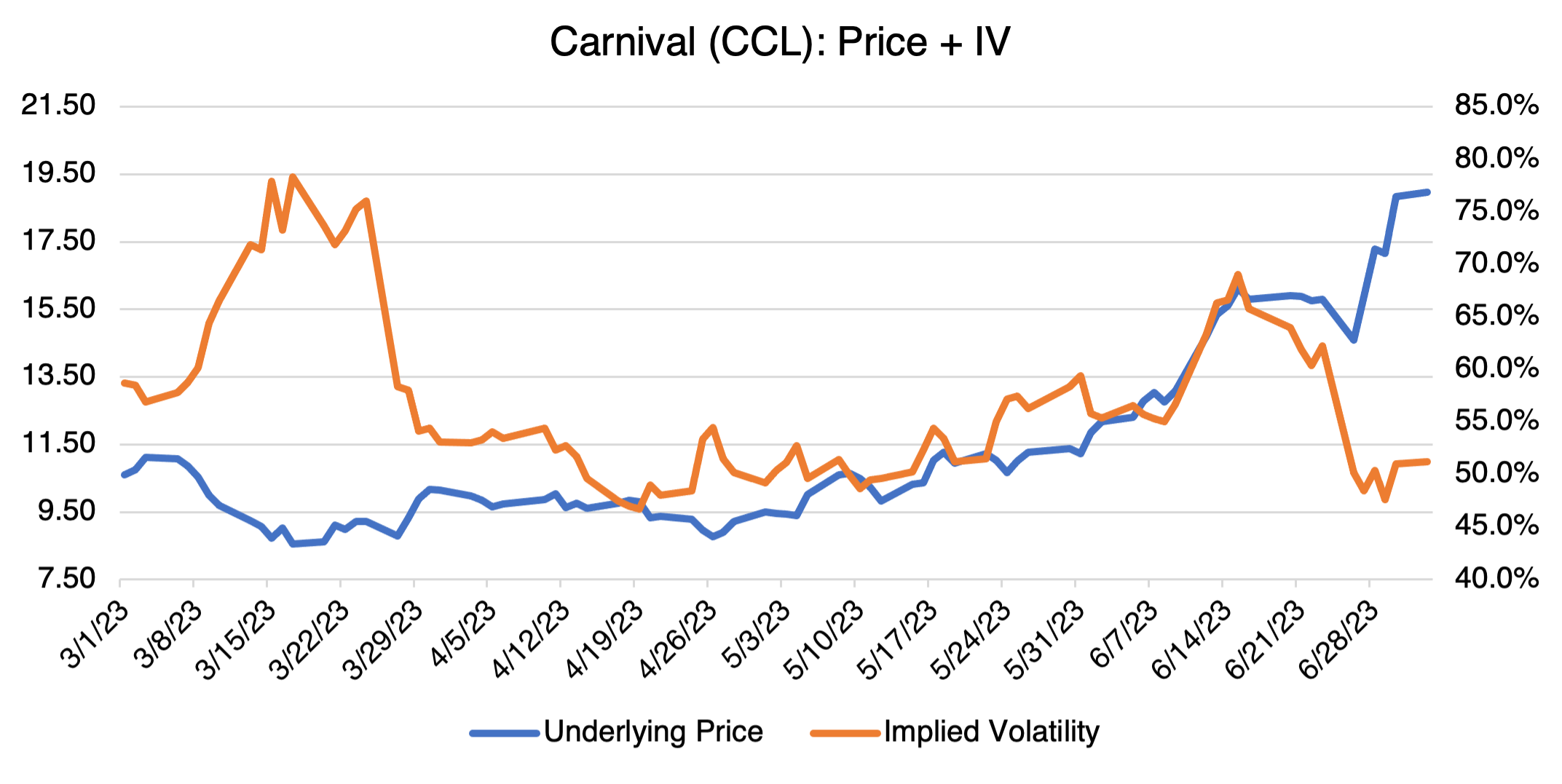

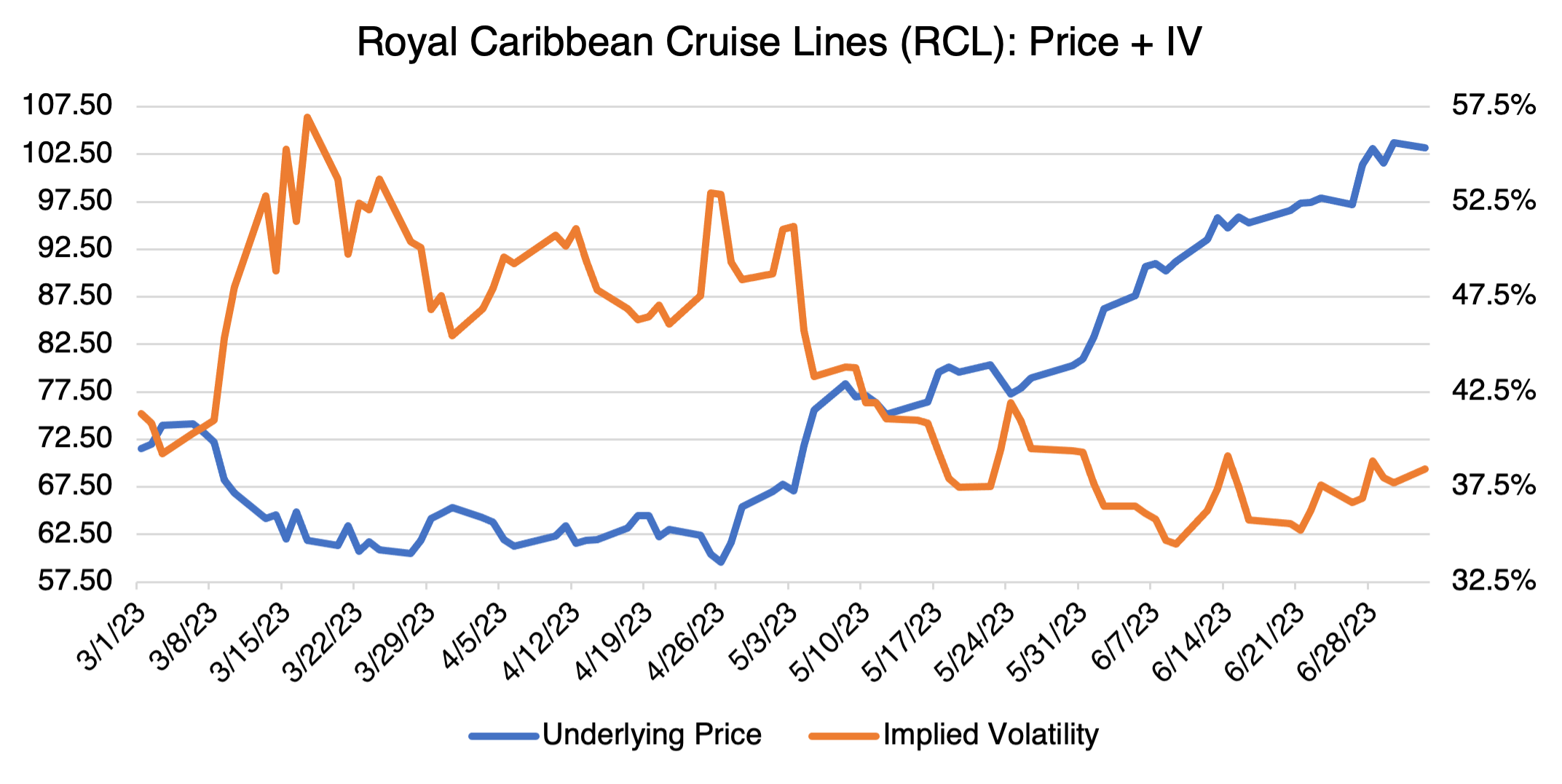

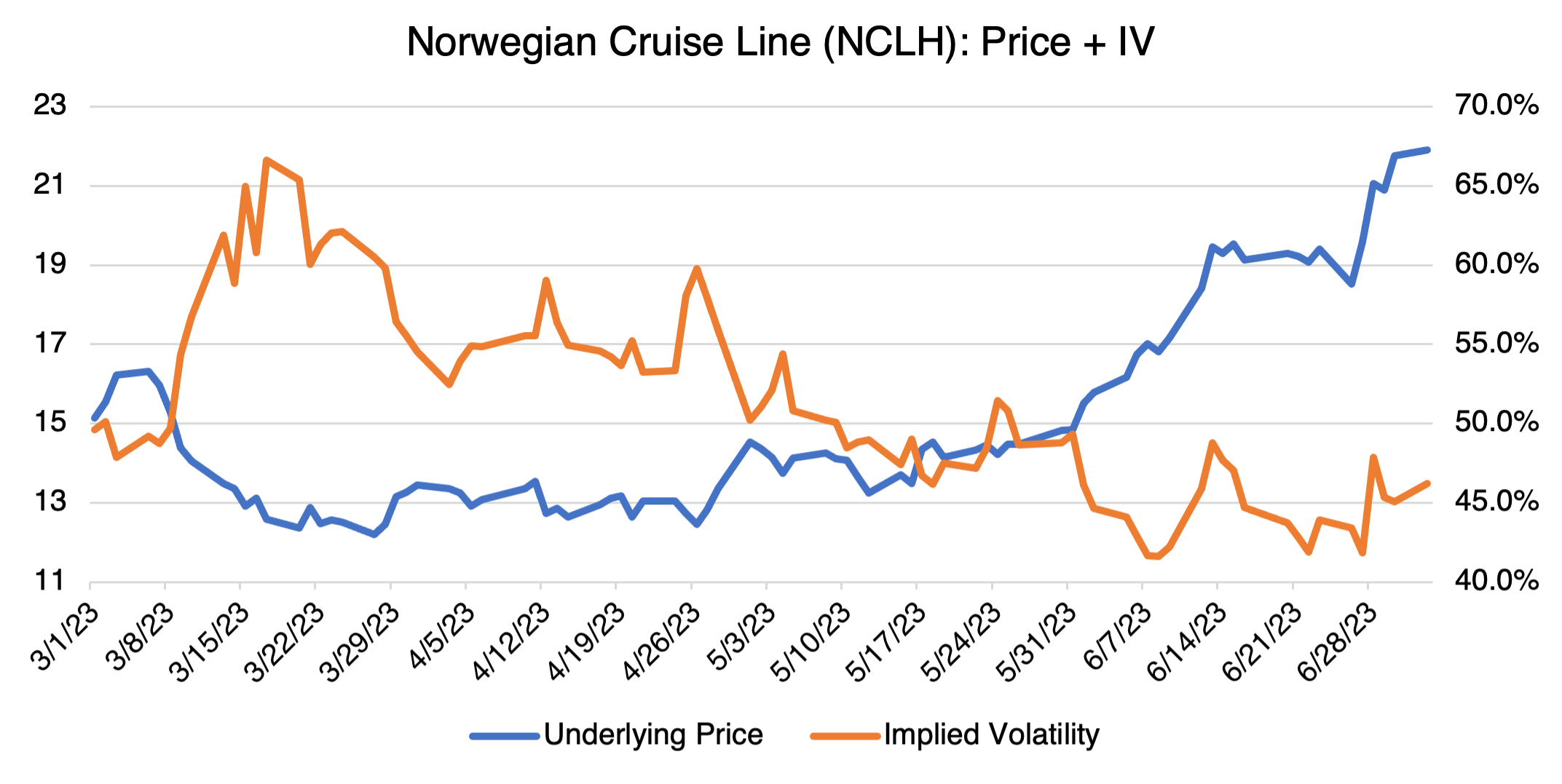

I’ve written about cruise lines a few times, most recently on June 15 (Cruisin!). I’ve been making the case that the stocks were beaten down by Covid, but a) Covid has been over for some time now, and b) travelers are now flocking to the ships in droves. Although they started to rally in early May, last week the market finally noticed in earnest, and all the cruise lines went into hyperspace. Of the Top 10 best performing stocks as of June 30, Carnival (CCL) was #3 (up 134%), Royal Caribbean (RCL) was #5 (up 110%), and Norwegian Cruise Lines was #7 (up 78%).

Implied volatility for all three has either been stable to lower or has declined significantly (CCL) since the most intense part of the rally started in late May. If you believe the cruise line rally has more life left to it, be careful: implied volatility may continue to decrease as the rally continues.