It’s Over?

Since Nvidia and its AI cohorts started their seemingly unstoppable rally about a year and a half ago, there has been a steady undercurrent of those suggesting that their rally was about to end, cataclysmically wiping out all the naive and gullible bulls in the process. Needless to say, it hasn’t happened yet. Sometimes I wonder whether the commentariat just missed the whole AI thing altogether and is now rooting for a crash to be proven right. Waiting for it must be frustrating — for the 382 trading days since January 3, 2023, Nvidia has been up over 58% of the time.

Of course, the bears will be right, eventually. But that’s not the point. As any experienced trader will tell you, the object of the game is to make money, not to be right. In trading, when is a lot more important than if. Timing is everything, and daily valuation and real cash flow in or out of your account can be brutal. You can be right, in the long term, but if the market is going against you right now — rationally or irrationally, right or wrong — you just can’t afford, financially or psychologically, to hang on until it turns in your favor. No matter how smart you are (or think you are), or how brilliant your analyses, the market will have its way. As the saying goes, “they take the money anyway.” That’s a hard fact that many just can’t live with.

Back to Nvidia. The arguments for and against come out almost daily and are the basis for endless social media chatter. They all boil down to the long term prognosis for AI and whether it’s been oversold to naive investors. Spotlighting the argument is that NVDA and its AI cohorts have been dragging the markets higher, and the fear that if they stall the whole bullish artifice will come crashing down. Throw in some political turbulence and continued Fed-based uncertainty, and you see why some are anxious.

Just because I know how to trade options, doesn’t mean that I have some special knowledge about AI. Frankly, AI gives me 1990’s dot.com vibes, but that’s probably because I lived through that era and have firsthand knowledge. Other bubbles, semi-bubbles, and aggressive bull markets have been similar to the rally in AI, just less recent and less well known. Regardless, they are of limited help, other than to point out that all bull markets eventually turn into bear markets. Again, when is the question, not if.

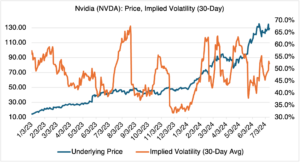

Although I don’t have a crystal ball, I can still point out a NVDA strategy that has been popular, and profitable, since the rally began in earnest in 2023, i.e., the so-called “vol crush” trade. Simply, the implied volatility of NVDA tends to increase sharply before earnings announcements and then decline sharply afterwards. Beforehand, uncertainty and implied volatility mounts as to whether NVDA will meet expectations. If it does, NVDA’s price is perceived to be justified and its business as usual; uncertainty is then reduced and implied volatility drops. As you can see from the chart below, that’s been the pattern since roughly mid-2023.

Source: OptionMetrics

A word of caution. Nvidia has gone from one spectacular earnings announcement to the next. Expectations are high, perhaps too high. If the company somehow has a bad quarter, or one that is good but not spectacular, then the market will perceive that NVDA’s price isn’t justified and sell it off. Since uncertainty will then increase, implied volatility will also increase, making the vol crush trade particularly hazardous.

Steve Ganz, a YouTube contributor to OptionStrat, will be focusing this week on various NVDA vol crush strategies and how to analyze them using OS. Steve is an experienced options educator and really knows how to make OptionStrat dance. I recommend you tune in!