Options Calculator Improvements

Today we are launching a series of improvements to our options profit calculator product known as the strategy builder. These changes focus on making it easier to manage strategies throughout their lifetime. Here’s the quick rundown:

- Added ability to view and edit expired strategies

- You can now close individual legs and “roll” into new positions

- Exclude/include legs to easily see what difference they make in the strategy without having to fully remove and add them

- Compare changes before saving a strategy (it will show what the difference between the saved strategy, or the strategy loaded from a URL when you edit it)

- Add an equity position to any strategy (conversely, you can also remove all options down to an empty strategy or equity only strategy now if you want a clean slate)

- New stats shown above the chart: Unrealized gain/loss and realized gain/loss

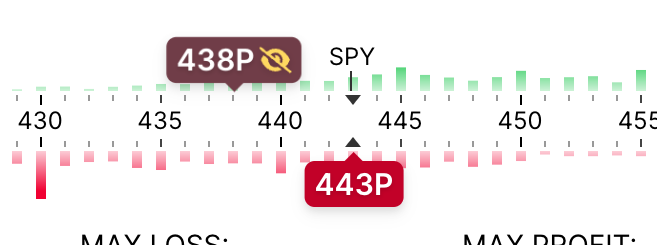

- Icons to indicate when an option has low liquidity, is excluded, is closed, or has a custom basis (this replaces the small blue dot or yellow triangle we had before)

- Performance improvements as always!

And in more detail…

Opening Expired Trades

Expired trades can now be opened and viewed, making it easy for you to see your old strategies and ensures that if you share your trade online, future viewers will always be able to see it.

Any expired options will be shown in a darker color and will have their expiration date marked in a small bubble next to the strike. Upon expiration, we will automatically close options at their expiration price, but you can go back and enter your own price if it is different. See below!

Closing Positions

We are replacing the old dialog that allowed you to close an entire strategy with a new method for closing individual positions. Now, simply open your strategy, click an option or stock position, and click “Buy to Close” or “Sell to Close”. The profit or loss reached for your closed position will be recorded as a realized gain, and will be available on the closed tab of our new positions dialog.

Rolling Positions

Once you close an option, that doesn’t mean your strategy is complete – now you can roll your options into new positions. We now show and keep track of your realized and unrealized gain separately, so you can see the profit potential of new positions while still accounting for any other gains or losses from other options in your strategy.

Excluding Positions

Ever wanted to see what your strategy would look like if you added or removed an option, without the hassle of actually removing the option and re-entering everything if you decide against it? Now you can exclude and include positions, essentially a way to toggle a position “on” or “off” to see how it affects your strategy without having to actually remove it or add it back later.

Excluded, expired, and closed options are displayed darker.

Comparing Changes

When rolling a position, it is helpful to see both the new profit potential and the previous in order to make a decision. When modifying any saved trade, we now provide a toggle button to switch between your previous trade and your new trade. The graph of the previous strategy is also shown on the chart to easily visualize the difference between your old and new strategy.

Note that to avoid cluttering the strike selection area with closed and expired positions, we will only show the expired or closed trades from the previous revision on the strike selector. For example, if you are keeping track of selling covered calls or cash secured puts (known as “the wheel” strategy), all of your closed positions will be available in the position list dialog rather than the strike selection area.