Peloton is Back: Sort Of, Kind Of, Maybe

Peloton (PTON), that avatar of Things-Upper-Middle-Class-People-Did-During-Covid, is back (well, might be back). I wrote about Peloton frequently last year because it so well encapsulated the boom-and-bust cycle of many companies that thought Covid would go on forever. It didn’t, and Peloton was stuck with unsold inventory and sharply weakening demand. The stock plummeted from over $167 in early 2021 to its low last Fall of about $7 bucks, with losses for FY 2022 at $2.82 billion. Naturally, there were rumors of impending bankruptcy, or a forced sale and the old CEO and Founder was jettisoned. The new CEO instituted a series of cost cutting and production measures last year in an attempt to turn around the company. On February 1, Peloton released their Q2 2023 FY results and they offer a glimmer of hope that the measures might be starting to work. Losses narrowed, cash burn slowed, and subscriptions increased. Of course, they are not out of the woods yet, and not even close, but it was enough to rally the stock almost $3.50 to its highest level since May 2022, $16.98.

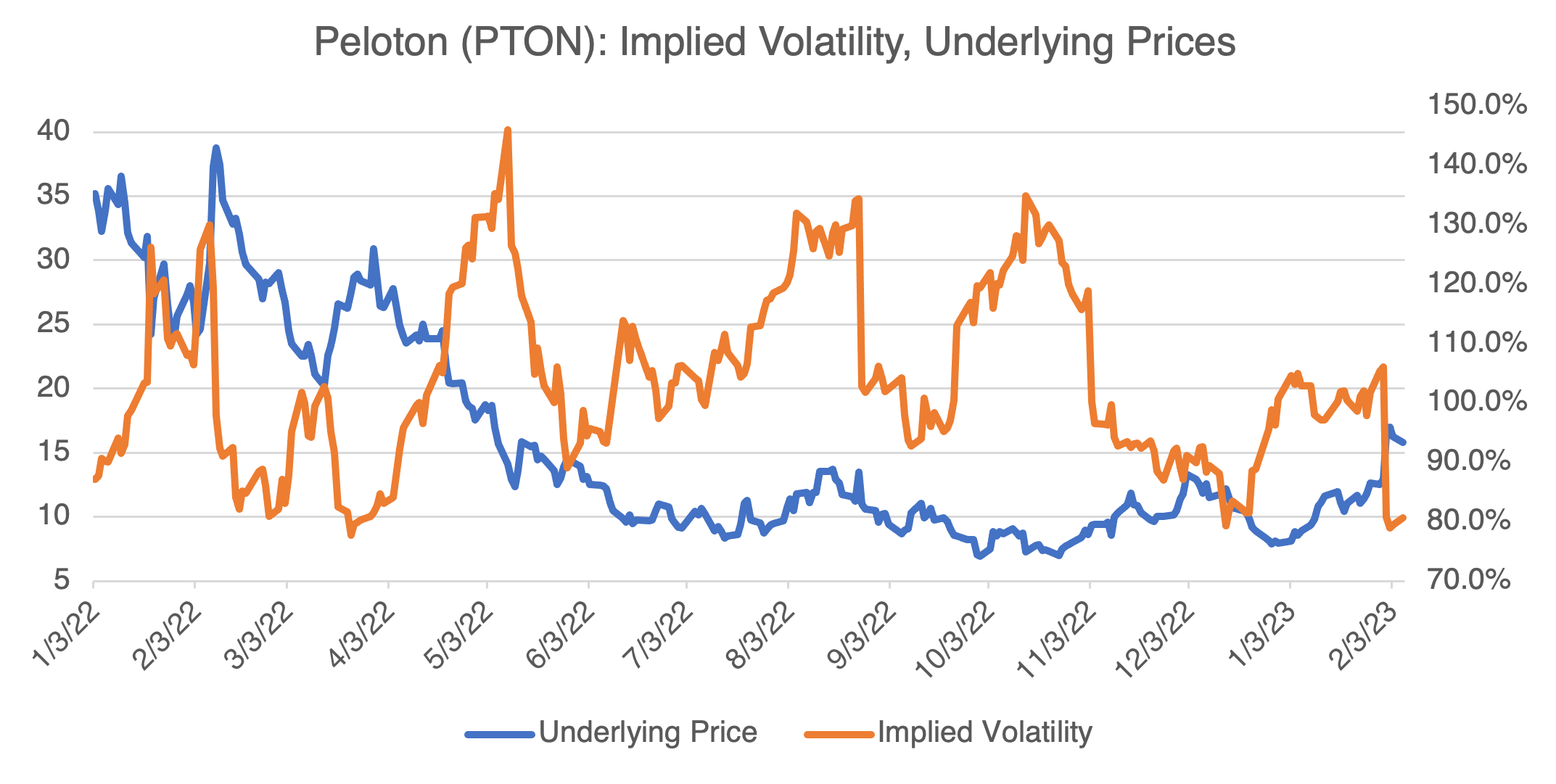

From an options standpoint, Peloton’s implied volatility reflects the classic inverse relationship we see in many other stocks. That is, it tends to increase on price declines and vice versa. It’s action since last Fall, and its greater than 25 point drop during the latest rally, clearly show this (above). As such, if you are considering playing the Peloton turnaround thesis with a simple long call strategy, volatility will most likely be working against you as PTON recovers.

Inflation, My Take

If you follow market news every day, you know that it tends to obsess on certain topics and just can’t seem to move on. Eventually, the market moves on to new playthings, but it takes a while. For the last year or so, interest rates, and their first cousin, inflation, have been The Thing. Every day brings a fresh round of predictions and analysis, most of it centered around the latest comments from the Fed. Only one thing is certain: almost all of it will be wrong.

I’m a commodity guy and tend to view inflation from that standpoint. Last July, I wrote an article for our sister company, OptionMetrics, entitled Inflation, Don’t Buy the High! My point was that steep commodity price declines since June 2022 should help to mitigate inflation. As the Bloomberg Commodity Index indicates below, that’s still true and it continues to trend lower. The effect on inflation lags, but commodity prices have been declining for about six months now. To the extent that the Fed is looking at commodity prices, this may argue for a less aggressive interest rate stance.

Bloomberg Commodity Index (BCOM)

(Source: CNBC)

0DTE, Not Just the Worst Acronym Ever

No, that is not misspelled — 0DTE stands for Zero Days to Expiration options, the latest salvo in the “casinoification” of Wall Street. Basically, they include all options with super-short maturities, some as short as one day. They have been gaining momentum for about the last year or so and are now the next new big thing. Last Thursday witnessed the heaviest call option trading ever, and 0DTEs contributed to that record.

Next week, I’ll go into what they are, exactly, and give you my take on whether they are the Devil’s Tool, as many assert, or just another kick that traders have been on for the last few months. As always, the answer isn’t that clear. For now, you can use our options profit calculator to try them out yourself.