Presidential Elections: Don’t Trade on Them!

The Presidential election is less than two weeks away, and market pundits are busy focusing on what the results may mean for the markets. Since electing a new president is a big event, it seems to be a matter of common sense that it should have an outsized effect on the markets.

Right? Well, maybe not.

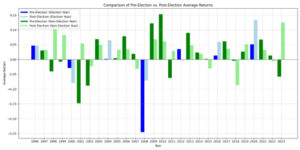

To measure the effect on the equity market, we reviewed historical S&P 500 returns (SPY) going back to 1996 for both election years and non-election years. We then compared average returns during the period before and after presidential elections (July – October and November – December) to those of non-election years. We then assessed whether the pre-election or post-election periods exhibited any significant difference in return.

The results were surprising:

Apparently, U.S. presidential elections have minimal impact on stock market performance before the election. On the other hand, in the two months after the election, the difference is more significant on an average basis. I suspect that is because the policies of the new President become clearer and more resolute after the election.

Of course, there are exceptions, but they are in years in which a significant economic event coincided with an election, such as 2008 (the financial crisis) and 2000 (dot.com bubble collapse, contested election results).

There are two caveats to the conclusion:

- The analysis above concerns only the SPY index, not individual stocks or sectors that may benefit from an election outcome. They may indeed be affected. I’m sure industry lobbyists aren’t wasting their time and money!

- In general, any analysis of the effect of election outcomes on markets suffers from small sample size. Since 1980, there have been only 11 presidential elections, and since the introduction of the Dow) in 1896, there have been just 33. The limited number of observations makes it difficult to draw firm, statistically valid conclusions, let alone to base trading strategies on the results.

This is a crucial point that often goes unmentioned, especially in relation to those who try to predict the outcome based on past election results. Keep that in mind when you hear about someone who has picked the winner the last X times. Sometimes it sounds impressive, but given the small sample size, I suspect blind luck has more to do with it than some super-secret algorithm.