Revenge of the Memes

- Two meme stocks in the news, AMC and Bed, Bath, and Beyond, are trading at triple digit implied volatility levels , those usually associated with the most volatile, supply-constrained commodities. Their options are priced accordingly (i.e., super high!). As is always the case with meme stocks, caveat emptor!

- Commodity prices are still not supporting higher inflation and interest rates.

- Commodity prices that are key to supply-driven inflation — agriculturals and energy — after spiking due to the Ukrainian war, began declining in early June and bottomed out in mid-July. I wrote soon after that inflation might have peaked. Indeed, a small, 0.5% decrease was reported for July.

- With inklings of lower inflation, supported by lower gasoline prices at the pump (accurate or not, most people use gasoline as their personal inflation and consumer confidence indicator), a narrative took hold that inflation had peaked, reducing the need for further rate increases.

- Fed Chairman Powell’s recent hawkish comments on rates blew that narrative out of the water and the market promptly sold off. However, commodity prices, despite rallying somewhat since early July, are still on the defensive, especially crude oil and gasoline, and do not support his view.

AMC, BBBY

It seems like the investing thesis of meme stocks goes something like this: You better buy them, regardless of the reason, because they spike up every now and then out of the blue and you want to be there when they do. FOMO rules!

I’m not going to comment on this investment strategy (if you can call it that) or on the financial shenanigans behind the latest price action in Bed, Bath, and Beyond (BBBY) and AMC (AMC). It’s been well-covered elsewhere (but I must point out that AMC’s new preferred equity issue (APE), is the greatest stock ticker, ever).

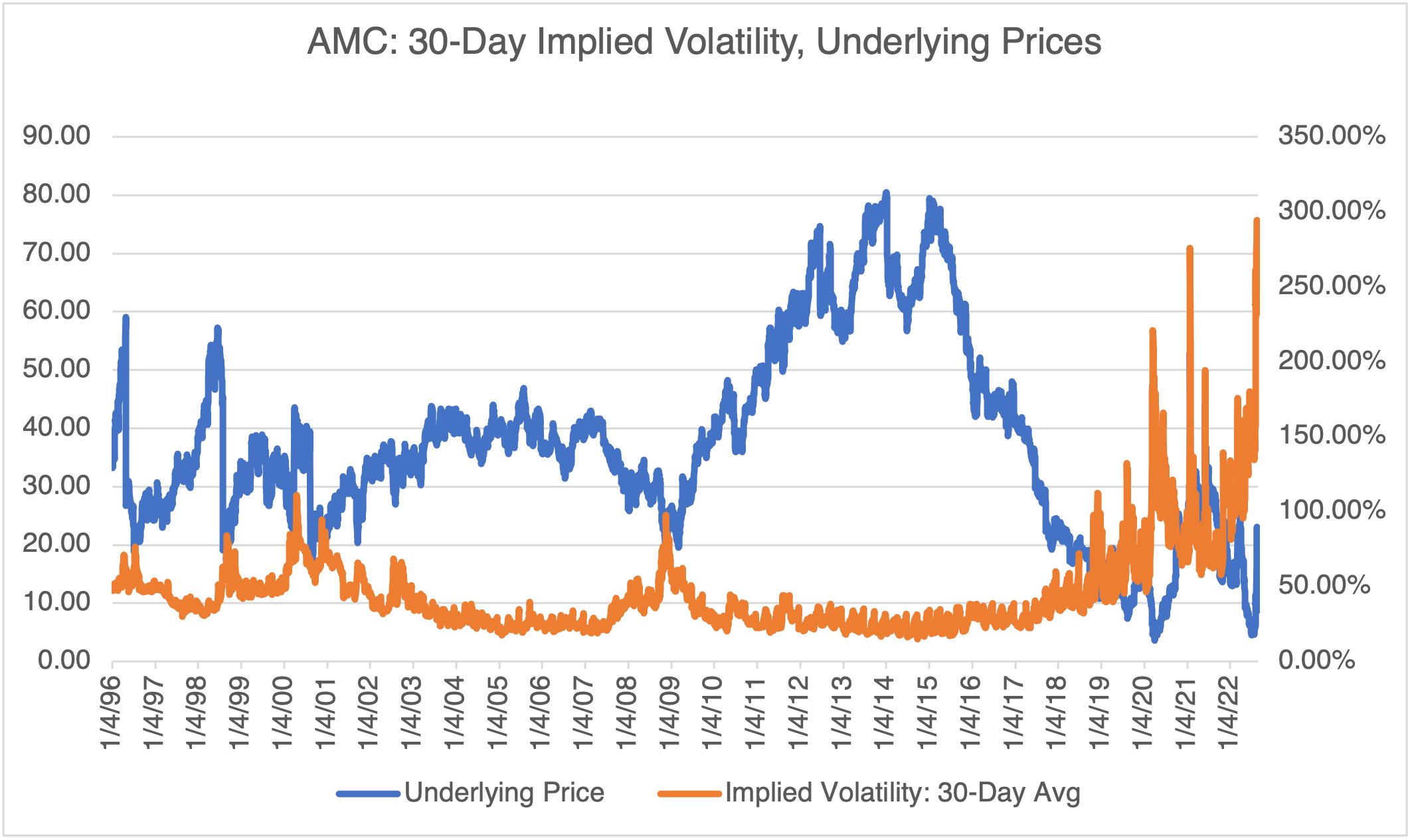

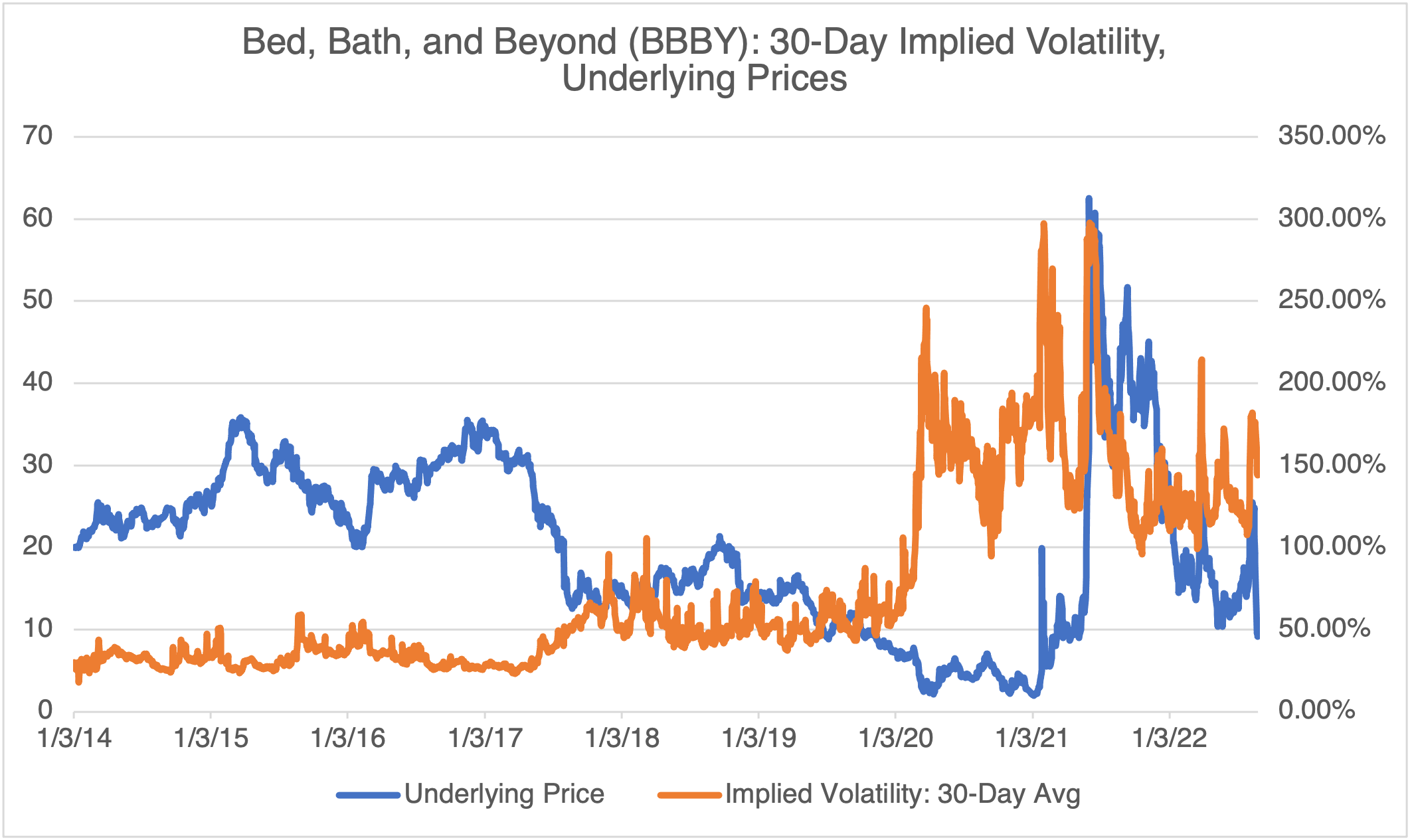

I can comment on AMC and BBBY’s options pricing, however. As you would suspect given what’s been going on in these two, it’s not pretty. See below:

As you can see, both AMC and BBBY are currently trading well over 100% implied volatility. Yes, historically speaking, it has the potential to go higher. However, if the attention fades and the market moves on, their implied volatilities will fall precipitously, along with their options. You can only reach one conclusion: by any standard, AMC and BBBY options are crazy expensive! By way of comparison, natural gas, one of the most volatile commodities out there, maxed out at just over 120% implied volatility in October 2021, but quickly fell back to its normal trading range.

Keep that in mind if you’re thinking of playing the meme stock Russian Roulette because the options are “cheap.” High volatility levels don’t come out of nowhere but are a good reflection of the amount of risk and uncertainty that the market perceives. In this case, there is a 50-foot sign on the wall flashing “PROCEED WITH CAUTION!”

Inflation, Again

My natural inclination is to be a contrarian when it comes to well-established narratives. Simply, when everyone agrees on something with almost perfect consensus, it’s usually time to go the other way (and yes, I agree that certain things are exempt — gravity, the Four Laws of Thermodynamics, etc. — but I think you know what I mean).

A few months ago, everyone was in agreement that the markets were overvalued, inflation was roaring, interest rates were going to spike, and the great bull market was officially and finally over. It was hard to find anyone that would have disagreed with that prognosis. Right on time, the SPX rallied over 17% to its highs of mid-August and remains up about 9% from its lows of mid-June. Inflation and interest rate worries suddenly faded.

Last July 19th, I suggested (Inflation: Not So Fast!) that inflation might be peaking, at least for the time being. I based this on price developments from various energy, agricultural, and industrial commodities. And, sure enough, a few weeks later, the Commerce Department’s personal-consumption expenditures price index registered a 0.5% decrease in July.With gasoline prices falling at the pump, it was easy for the market to believe that inflation had crested.

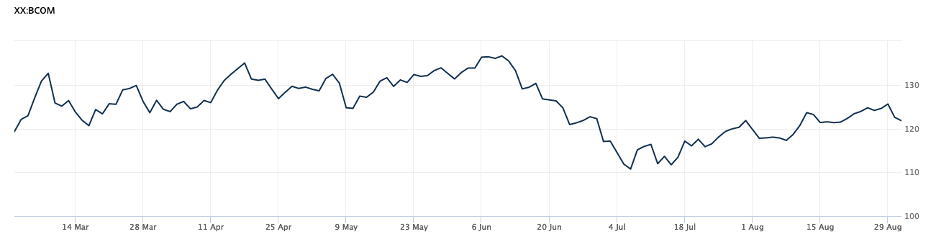

That belief was quickly quashed by statements from the Fed that they remained committed to possible rate increases. Although they may be using different indicators to gauge inflationary pressures, the Fed’s stance is still not supported by commodity price trends. As you can see below, the Bloomberg Commodity Index (BCOM), has rallied somewhat since early July but remains on the defensive, especially from its energy components (crude and gasoline).

(Source: WSJ

Keep one thing in mind when trying to figure out what the Fed will do on interest rates. Chairman Powell witnessed the inflation of the 70s and realizes how difficult it is to reduce inflationary expectations once they become established. He, and the other Fed governors who lived through that period, have no desire to relive the bad old days. Hence, their inclination is to clamp down hard, and stay clamped down probably longer than necessary, at the first sign of real inflation. Bad memories die hard.