Risk Management for Dummies

- Numerous studies have come to the same conclusion: you can’t time the market. You might be able to every now and then, but it’s extremely rare to beat the market consistently and in the long term.

- Whatever your real or perceived trading talents, applying a systematic trading rule to your portfolio will reduce the effect of market drawdowns.

I’m often confronted by retail and institutional investors that fancy themselves what I call Master Traders. If you take what they say at face value, they always buy the low, they always sell the high, and they have a preternatural, God-given talent to pick the latest hot stock and trend, without fail. I think people talk to me about this because they know I’ve worked for a few hedge funds and therefore believe that I am a member of a super-secret society, one in which we wear funny hats, chant incantations, and chart the course for all future price movements.

Well, I’m sorry to inform you that no such society exists (sadly), and that hedge funds are plagued by the same lack of information and indecision that the smallest retail investors face on a daily basis. Believe me, not much goes on in hedge funds that is all that much more advanced than what you would hear in your uncle’s investment club held every Monday morning in the all-purpose room in Boca Vista Phase IV. At the end of the day, both concentrate on the same, basic investment decisions: what to buy, when to sell, and what do we do if it doesn’t work out. And most important, both groups are making those decisions given very imperfect information and subject to the same flawed psychologies that affect all human beings.

No matter who you are, no matter where you work, and no matter how much information you have, you will still be susceptible to a whole host of human foibles that make timing the market incredibly difficult. Like it or not, the fact is that most investors, retail and institutional, are not very good (read: bad) at market timing. There are numerous academic and not-so-academic studies that strongly support this.

Most investors recognize their limitations but never pursue a simple buy and hold strategy for long. Given the 24-hour news cycle and all the readily available commentary, the temptation to intervene is just too strong. Downturns can be steep, and few have the discipline to ride the market out. On the other hand, few can resist buying into a sharply rising market, even though they suspect it might be a bubble and will end badly.

Of course, it’s easy to say in retrospect what you would have done, but think back to 2008 and ask yourself, honestly, whether you would have been able to tune out all the doom and gloom and all the failed mortgages and all the people out on the street to recognize one of the greatest buying opportunities of all time. Or similarly, in Q2 2020, during the height of Covid and all the predictions of a new black death, would you have gone against the tide and actually bought real estate? Again, I doubt it.

Regardless, admit it: you’re not going to just buy and hold, and you believe that you can time the markets, sort of and maybe not always, but enough of the time to keep trying. If that’s how you want to go, and you have what you consider to be a significant portfolio, then you should think about trying to reduce the effects of serious drawdowns. Just like fire, storms, and earthquakes, disasters happen, and the most serious ones occur without warning. And just like insurance designed to mitigate these risks, insulating your portfolio against drawdowns will incur a cost in upfront payments, reduced return, or both. Nothing is free.

Designing disaster insurance can be as complex or as simple as your imagination and abilities dictate. Many hedge funds apply an out-of-the-money index put strategy in varying degrees of complexity to shield them from serious drawdowns. For the retail investor that doesn’t want to incur the cost or complexity of options strategies, there are several systematic, rules-based approaches that could be applied. All use some indicator to determine when to exit the market or reduce positions and are relatively simple to backtest and implement.

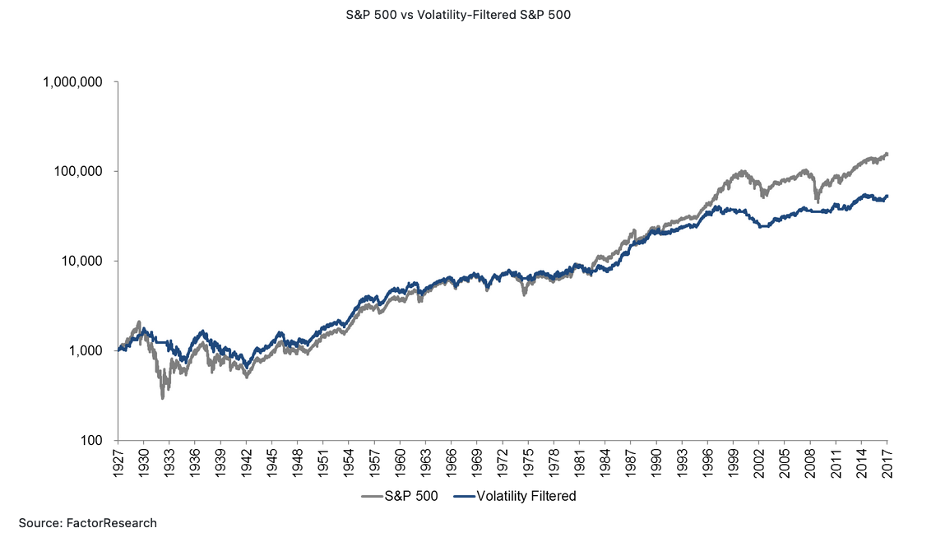

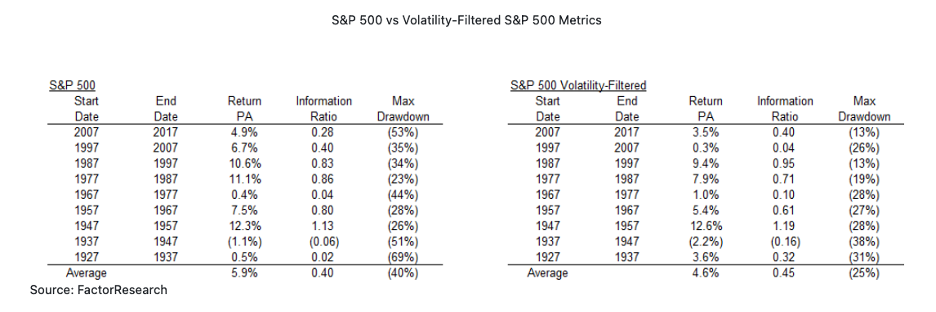

Nicolas Rabener, a friend of mine from Factor Research, has suggested one systematic approach that should appeal to options traders, a simple volatility-based indicator that is triggered when the volatility of the most applicable index to your portfolio reaches the highest quartile. At that point, the portfolio would be liquidated. Alternatively, you could use the VIX or even the historical or implied volatility of your largest holding. Using the S&P 500, and the simple rule described above, the results are the following:

As you can see, the strategy is particularly effective in reducing the effects of drawdowns but does come at a cost — on average, about 1.3%. At the same time, the strategy did reduce the effects of drawdowns. This is evident from the table below, which contains all the major drawdown periods since 1927. Paying particular attention to before and after a drawdown event that most of us can personally relate to, the financial crisis period (2007-2017), you can see that the return was decreased by 1.4%, but the max drawdown was decreased from a disastrous, never-ever-again 53% to a we-can-live-through-this 13%. Personally, that’s a trade-off I would be willing to make to get some sleep.

Again, there are other systematic indicators that could be developed and applied. This is just one simple example. Indicators tied to price momentum, other volatility measures, overbought/oversold indexes, rate of return, partial liquidation, or some combination, could be considered. Easy to construct, understand, and implement usually works best.

A word of warning. Given human nature, it’s always difficult to cut positions when things look great. And yet, at the same time, the key to systematic strategies is to follow them consistently and robotically, not to pick and choose. Most traders I know think they have the discipline to do so, but few do in reality. Instead, they follow a middle of the road strategy and wind up still hostage to their delusions that they can time the market. In almost all cases, it’s just not true.

To check the risk and reward for your own strategies, consider trying our options profit calculator tool. Use the build menu at the top of the site to choose from over 50 pre-made strategies. Our calculator will then show the expected profit/loss over time as well as other stats so that you can compare strategies and find what works for you!