Swiss Mess

If you follow juicy Wall St. scandals, as I do, Credit Suisse’s latest nosedive shouldn’t have come as a surprise. CS has been at the center of some of the most irresponsible behavior over the last decade (and that’s really saying something for a Swiss bank!), and it’s a wonder that it didn’t come sooner. Look them up — Greensill Capital, TunaGate, Archegos, Money Laundering, and so on and so forth — CS played a starring role in all of them and none of them came cheap.

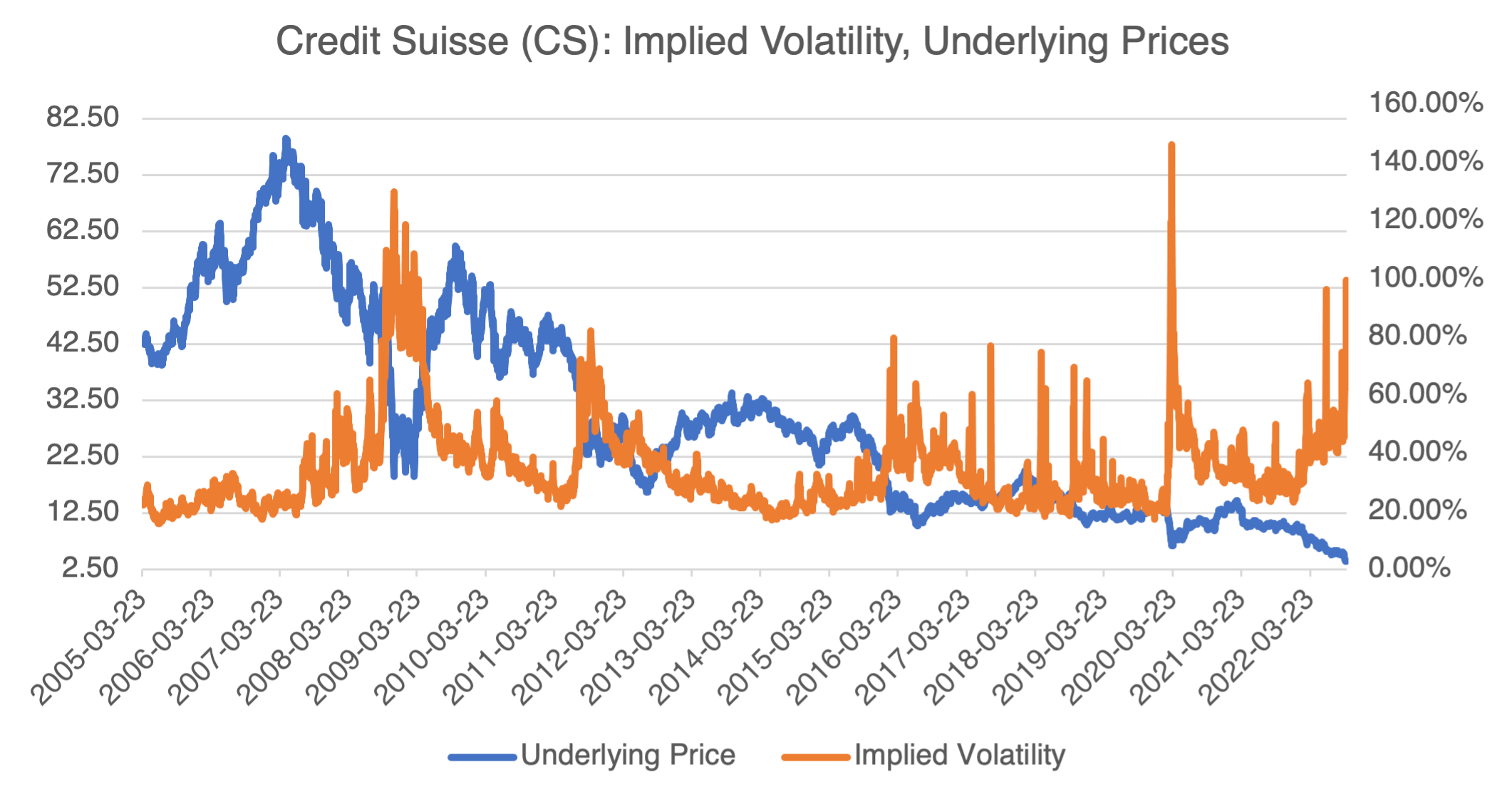

And now, suddenly, the market is talking about the Bank’s possible default. What’s new? The CEO wrote an internal memo to employees late last week, saying that the bank was at a critical moment before it releases its strategy update on October 27. In the old world, this probably wouldn’t have been a big deal. CEOs always write firmwide notes extolling their staff to work hard because the firm is at a turning point. But not now, and not with millions of investors scouring social media for investment scuttlebutt. And, sure enough, there was blood in the water, and Twitter and Reddit retail forums exploded with predictions of default and apocalypse now. As a result, CS stock declined to an all-time low below $4.00, its implied volatility almost doubled to nearly 100%, and its credit default swaps (the cost of insuring against a CS debt default) peaked out at 355 bps from 57 earlier in the year. All of a sudden, a Swiss bank was a meme stock! That was one expensive memo!

(Source: OptionMetrics)

Does CS have troubles other than hysterical social media trolls trying to ignite a bank run? Of course, but they also have, according to most analysts that follow bank stocks, more than enough capital to operate and are on solid ground. The trouble is that they need to restructure, and that will cost $4 to $5 billion that they will get by either selling stock, or from investors. This latest fiasco makes that harder, but not impossible. CS also has going for them the fact that the Swiss might not be too crazy about having one of their own go under and might step in if things get truly dire.

All this presents an interesting options trading opportunity if you think that CS is oversold and yet another victim of chat room venom. Keep in mind, however, that implied volatility, despite settling down somewhat to the mid-80s, is still very expensive historically. Outright options positions are not recommended — spread accordingly.

Finally, and despite what the scaremongers are ranting about this week, CS is not the next Lehman Brothers. I’m not going to look it up, but I’m willing to bet that there have been at least 10 “Lehman Brothers events” since 2008. Honestly, everything can’t be a crisis, and everything can’t be the catalyst for the next Great Depression. It’s natural for people to fight the last war, but as a risk manager, I can tell you that the greatest risks are those that aren’t discussed ad infinitum, but those that come out of left field that no one (sane) predicted. Sudden shock causes markets to move violently and unpredictability, the two factors that cause risk managers to lose sleep.

Pay Up, Kim!

During the crypto meltdown a few months ago, I noted that certain celebs — Kim and Matt and Tom and Larry and Gwyneth and Reese, and I’m sure others — had breathlessly pushed crypto on social media and in TV ads and, despite their deeply felt concern for humanity, didn’t seem to be donating their promotional fees to those who subsequently lost their life savings. But don’t fret — the SEC has come to the rescue! In what may be the start of something beautiful, the agency has fined Kim Kardashian $1 million for promoting crypto securities on her Instagram account (330 million followers — who are these people?) without disclosing that she was compensated for doing so. In addition, she will be required to return her promotional fee of $250K, plus interest. As is the norm in SEC proceedings, Kardashian settled without admitting or denying the agency’s findings (when the SEC comes after you, you settle).

Why was Kim fined and none of the others? Because she promoted a product offered by EthereumMax called EMAX tokens, and that’s technically a security, or at least it is according to the SEC. Specifically, she “…violated Section 17(b) of the Securities Act, which makes it unlawful for any person to promote a security without fully disclosing the receipt and amount of such consideration from an issuer.” If the others were promoting crypto in general, and not a specific product (i.e., a security), then they may only have the FTC to contend with. Still, I would be lawyering up.

It’s a shame that all the others weren’t similarly fined, but here’s hoping that the SEC and FTC are only starting.