The Crypt Keeper Emerges

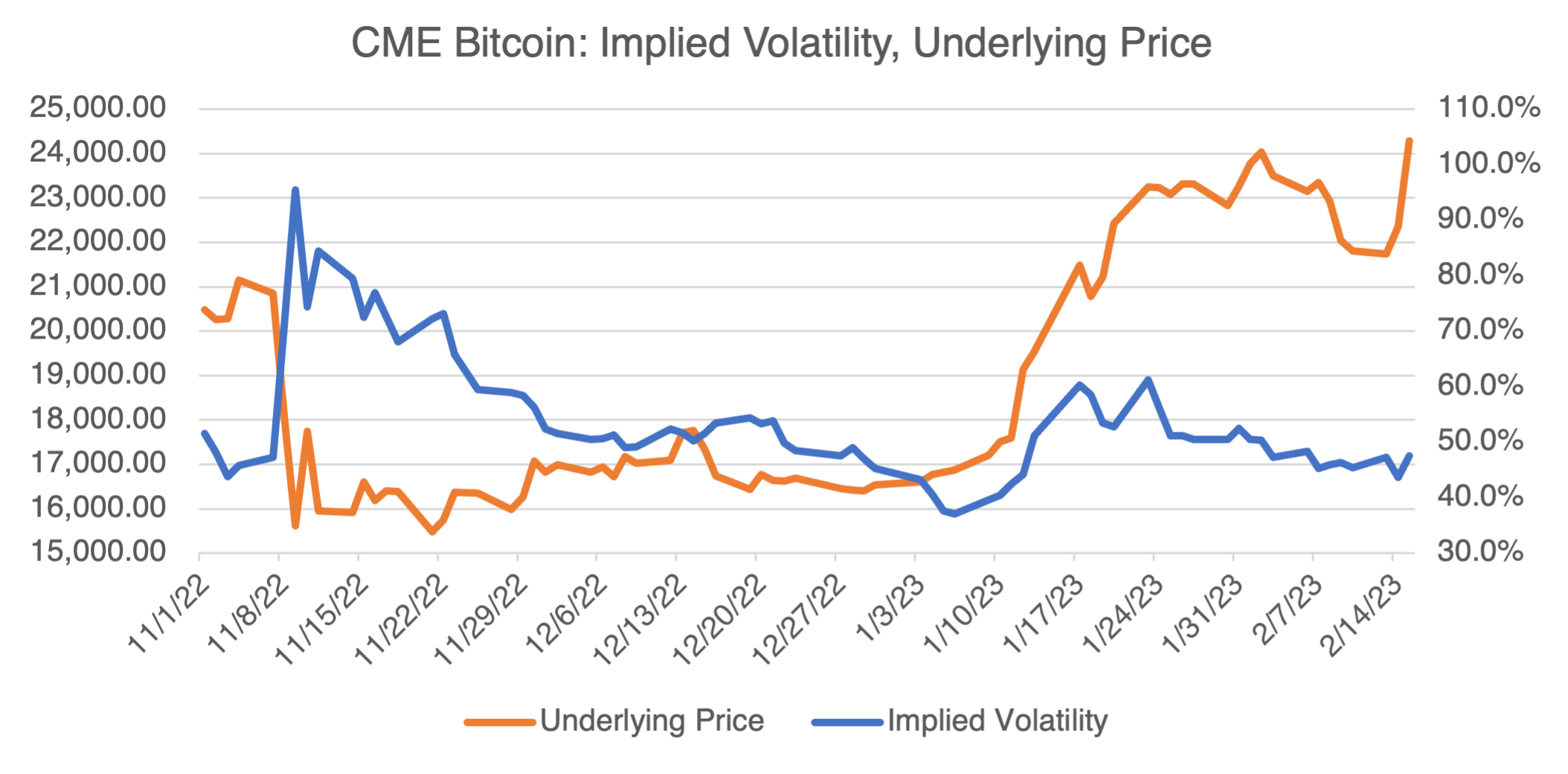

I mentioned a few weeks ago that Bitcoin was starting to show some life after its near-death experience during the crypto meltdown (Surprise! Crypto Might be Back!). At the time, I hesitantly wrote that bitcoin options looked cheap based on their implied volatility.

Bitcoin seemed to have been losing steam until yesterday, when it rallied almost 9% to make new yearly highs of $24,293 on the CME. Its implied volatility has not changed much and is still hovering in the high 40% region, although it seems to want to trend higher.

Given all the negative press, Bitcoin’s latest move is surprising. Over the last month or so, the SEC and other regulators woke up, finally, and have been aggressively doing what they should have been doing all along, i.e., regulating markets and protecting retail investors. Better late than never! Voyager Digital, Celsius Network, Gemini Trust, Kraken, Paxos, and the granddaddy of them all, FTX, have all run afoul (to say the least) of regulators or have been accused of outright fraud. The regulatory actions mostly boil down to whether the particular crypto product is a security or not and whether they are therefore subject to security registration and auditing requirements. In other words, if you’re an entity selling something that fits the legal definition of a security (“the investment of money in a common enterprise with a reasonable expectation of profits to be derived from the efforts of others”), you can’t do whatever you want, no matter how innovative or clever it is.

Whatever the details, all this points out that the crypto market is subject to significant risks apart from its sheer price risk, which is considerable all by itself. This isn’t a recipe to attract investors who can’t afford to lose all their money due to fraud or gross mismanagement. With that in mind, one possible scenario is that the crypto market is eventually cut off from banking services (or at least from the largest banks), and morphs into its own little offshore island servicing true believers and those up to no good. Who knows, maybe a new, regulated, and squeaky-clean version will emerge eventually, but right now the future looks bleak for crypto.

So why is Bitcoin rallying? In short, if you want to trade crypto, and are worried about any of the above or getting regulated out of existence, it’s the only game in town and available on a legitimate, established exchange, the CME. I still believe that Bitcoin options are relatively cheap in implied volatility terms, especially so if you believe that the current rally will cause a severe case of FOMO that will propel the market even higher. That being said, if you are going to trade Bitcoin, I urge you to do so ONLY on an organized, fully regulated, and onshore exchange, such as the CME.

One crypto story has come to light over the last few days that is very interesting if you’re into shameless, WE LIVE IN A SOCIETY!, behavior:

Three Arrows Capital, or 3AC to the cool kids. In a nutshell, investors would lend 3AC real money, 3AC would then buy new tokens (or something), and then pay investors a return when the tokens went up (so-called “crypto arbitrage”). There’s only one problem: the tokens turned out to be worthless and all the lenders’ money went up in a puff of smoke, who knows where.

But that would have been a pretty standard story. The twist here is that the two 3AC founders, one Kyle Davies and Su Zhu, haven’t disappeared into the night, but have secured $25 million to launch a brand-new crypto exchange, Open Exchange, or OPNX. And what does OPNX do? It allows crypto creditors (in other words, the ones who were burned the first time around) to trade their claims or even use them as collateral to trade cryptocurrencies, including new tokens that can be lent out (sound familiar?). Of course, included in those claims are claims on Three Arrows! You can’t make this up!

While your here, check out our options profit calculator tool which lets you experiment with various option strategies to show their predicted profit and loss. Never trade in the dark again with easy to use stats such as max loss, chance of profit, and more – all calculated instantly for you.