The VIX: Beware!

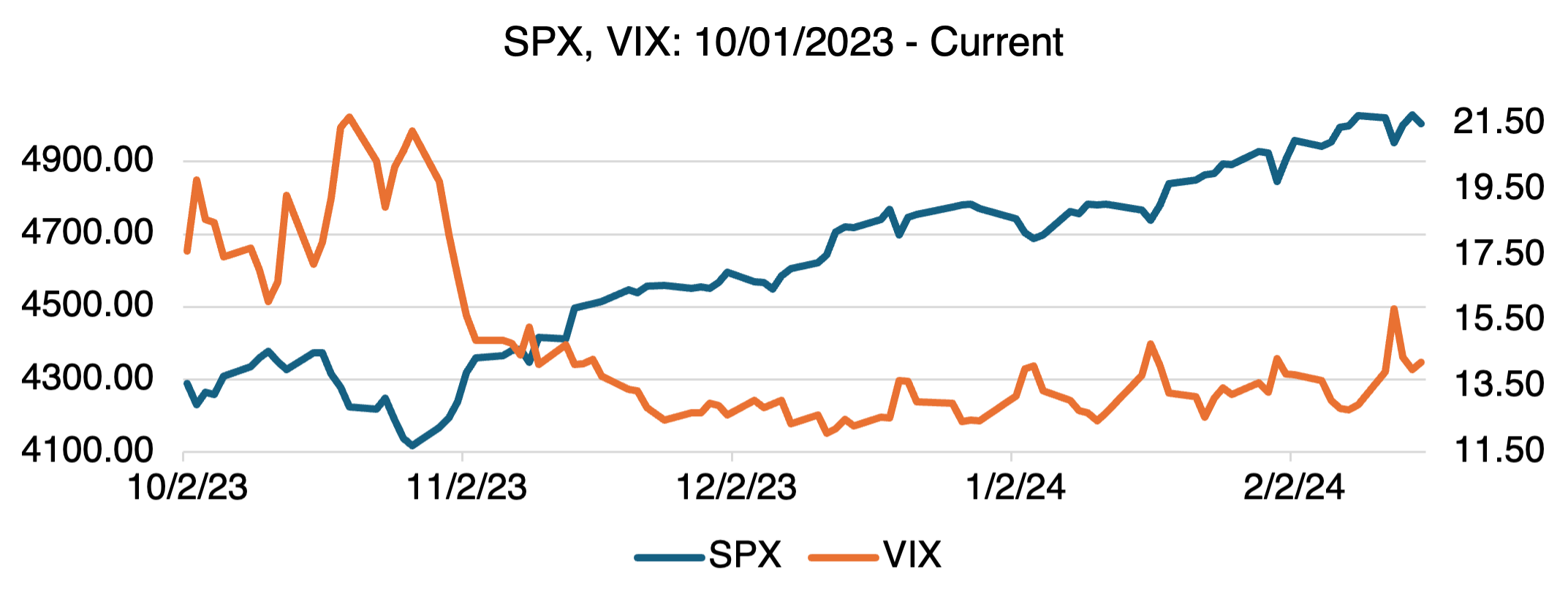

I’m asked frequently why the VIX doesn’t seem to rally all that often or all that much. I tackled this question last October in a blog entitled The VIX: Hope Springs Eternal! but thought it was time for an update since something is going on with the VIX that is abnormal. Since early November of last year, the SPX has been increasing in a fairly orderly and consistent fashion. Given that, one would naturally expect the VIX to be decreasing. Instead, the VIX has been moving roughly sideways and has actually increased year-to-date (albeit slowly and inconsistently). Let’s look into the main drivers behind the VIX to see what’s behind this.

To review, the VIX, or formally the CBOE Volatility Index, measures the market’s expectations of forward-looking volatility. Constructed using 30-day implied volatilities of a range of put and call options on the S&P 500 index, it is often referred to as the “fear index” since it measures market risk and investor sentiment. An elevated VIX indicates that investors anticipate high volatility levels with large price swings; conversely, a low VIX suggests market stability and predictability. Just like the implied volatility of individual stocks, the VIX is affected by investors’ perceptions of future uncertainty, which in turn is affected by the direction of the SPX, the correlation between the individual components of the SPX, the VIX’s risk premium, and ongoing or impending systemic and geopolitical risks.

Like many stocks we have reviewed, the VIX is negatively correlated to the SPX, i.e., the two usually move in opposite directions from one another over short time periods. Since the beginning of the year, this has not been the case. Unusually, both the SPX and VIX are both positive YTD, with the SPX up 4.9% and the VIX 16.8% (or 2.2 vol points).

Source: OptionMetrics

The relationship between the implied correlation of the SPX and that of its individual components, as measured by the CBOE COR3M index, also influences the VIX. In most cases, decreasing correlation reduces overall portfolio volatility due to increased diversification. Increasing correlation, such as occurred during the 2008 financial crisis, can lead to extreme tail events as all the individual components move in the same direction. As you can see below, COR3M has been decreasing sharply since last November:

CBOE 3-Month Implied Correlation Index (05/28/2021 – Current)

Source: Google Finance

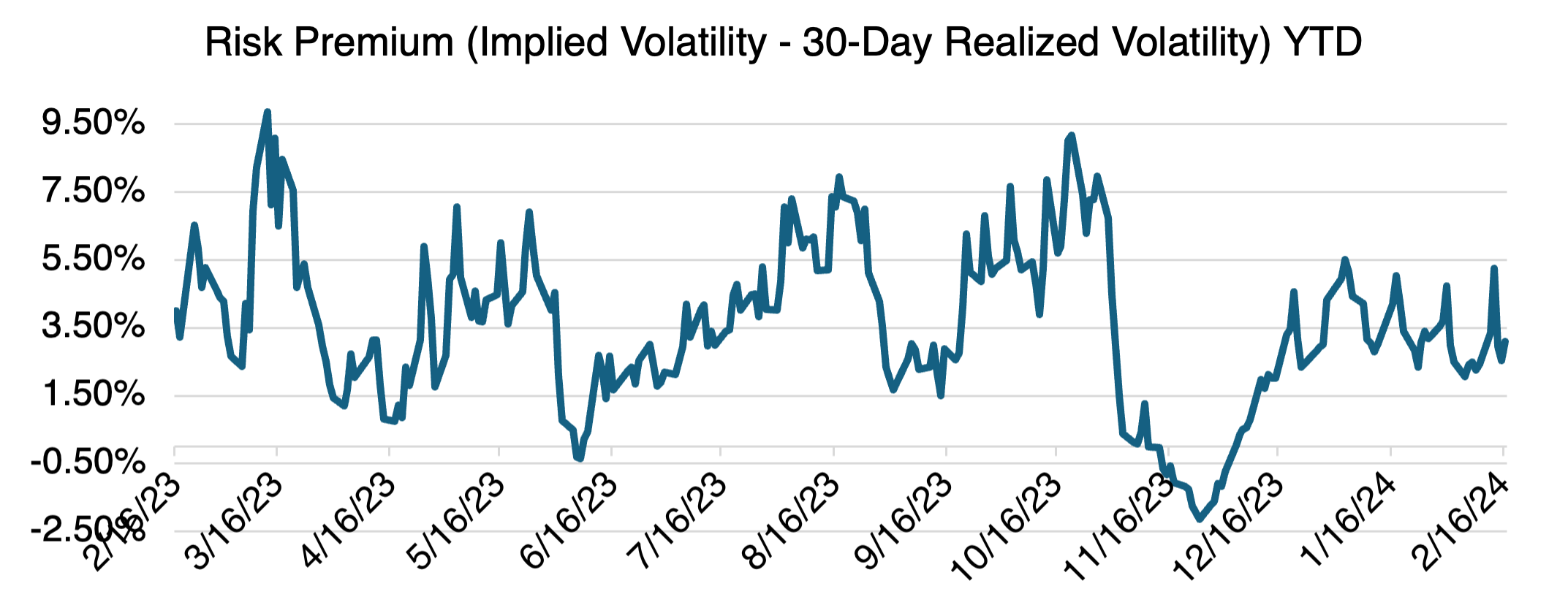

The VIX risk premium, or the difference between the level of the VIX and 30-day historical volatility, is also a factor. Since historical volatility is backwards looking, and the VIX (implied volatility) is forward looking, the difference may be interpreted as the uncertainty factor. As uncertainty increases, the VIX will increase, and vice versa. As you can see below, the VIX risk premium has remained more or less stable this year.

Source: OptionMetrics

Since the technical factors I have mentioned so far — price direction, index component correlation, and risk premium — are unsupportive of a higher VIX, two explanations remain for the index’s sideways to higher price action so far this year.

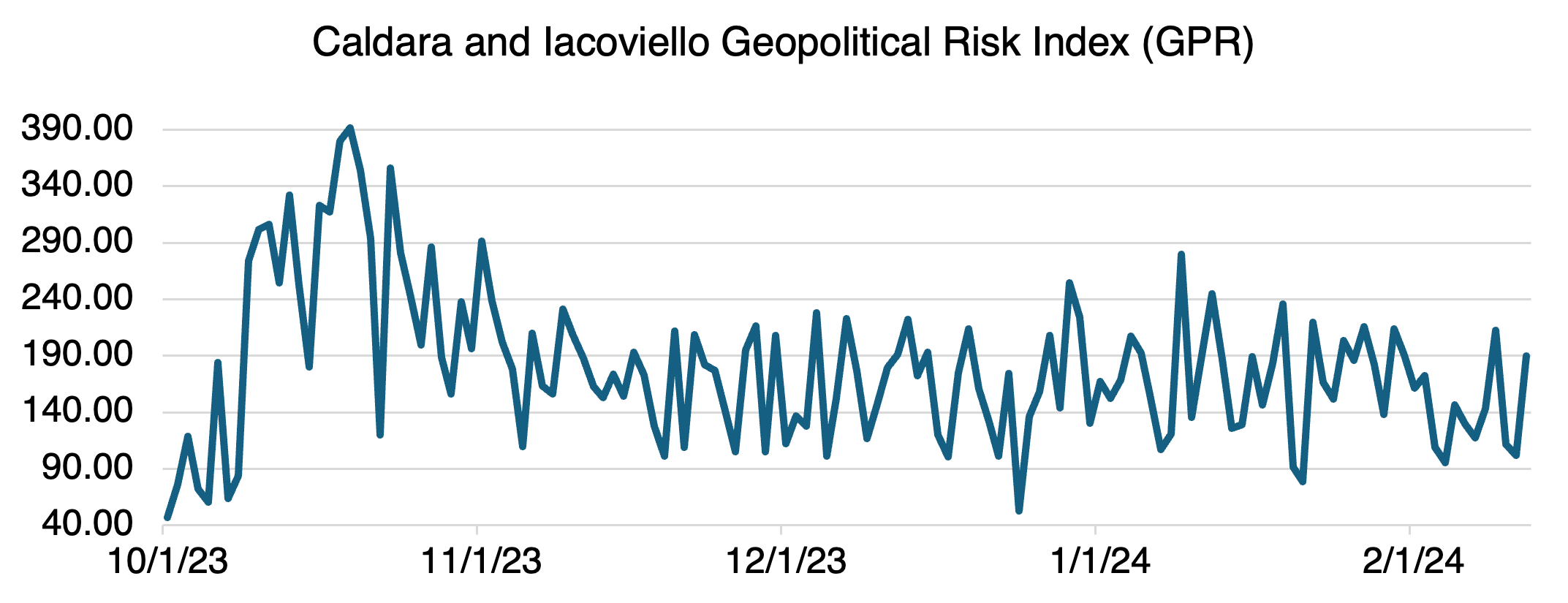

First, geopolitical risks, although not directly tied to the VIX, have an effect on future perceptions of uncertainty and implied volatility due to their possible negative effects on the economy, and by extension, the SPX. The Caldara and Iacoviello GPR index provides an objective daily measure of geopolitical risk by counting the number of newspaper articles related to adverse geopolitical events. After some manipulation, a daily index centered around 100.00 is then calculated.

Source: Dario Caldara and Matteo Iacoviello GPR Index

As you can see above, the index spiked at the beginning of the war in the Mideast last October and then decreased after the initial shock wore off. However, since then it has remained at relatively elevated levels, indicating that real concerns regarding the war in the Mideast, the war in Ukraine, and continued tensions with China and Russia continue to exist. These concerns have helped support the VIX, despite the other factors mentioned above.

The second explanation is that VIX traders may be skeptical of the year-to-date rally in the SPX and are concerned about a sharp sell-off that could propel the VIX higher. One surprise announcement from the Fed, one unpredicted economic indicator, or one political event could spike the VIX. The conclusion from both factors is the same: the upside/downside of being short the VIX at current levels doesn’t add up.