Timing Does Matter

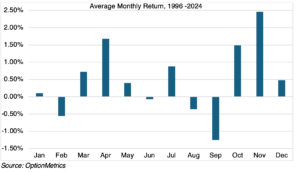

I’m often asked about when is the best time of the year to invest in stocks, specifically the SPY ETF. To answer the question, I looked into monthly SPY returns from 1996 to 2024 to see if any months had demonstrably higher or lower returns than others. Since nominal returns do not take into account the corresponding risk, I also calculated a risk adjusted metric (the Sharpe ratio) for each month over the period. The results were surprising, and clear.

In short, whether measured on a nominal or risk-adjusted basis, certain months – April, October, and November — stand out as those with the best performance.

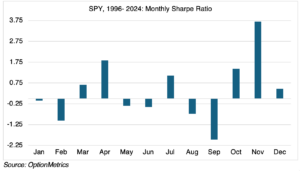

To check whether this was the case on a risk-adjusted basis, we calculated Sharpe ratios for each month (see chart below). Sharpes are the most popular and widely used of many different metrics that attempt to measure performance in terms of risk. Each divides nominal return by some measure of risk, whether standard deviation (Sharpe Ratio), beta (Treynor Ratio), or downside-only standard deviation (Sortino Ratio). Each version has its pros and cons, and one can debate endlessly about the true nature of risk, but the Sharpe ratio is the most common. Regardless, the higher the ratio, the better the risk-adjusted return.

As you can see, the Sharpe Ratios closely mimic the nominal returns. Usually, higher returns indicate higher risk, but in this case, risk doesn’t keep up with returns — hence, a higher Sharpe ratio.

The conclusion: April, October, and November are great times to buy SPY. At the same time, stay away in February and September.

Context Required

It’s tempting to focus only one the troubles that currently face the US economy. Sure, there are some difficult problems, but context is required. From the WSJ, 01/13/2024: “U.S. and European stock-market capitalizations were comparable at the end of 2009. Now estimates show that the U.S. market is more than three times the size of Europe’s. The dollar and euro are close to parity. A Canadian dollar will buy you only 69 Lincoln pennies. Chinese consumers have lost $18 trillion in real estate since 2021, more than U.S. households lost in the 2007-09 financial mess.”