Truth Social: Who Knows?

Despite the attention on the upcoming presidential election and the new markets and platforms that have sprung up to bet on the result, one of the most direct indicators that can be used to speculate on the outcome often gets lost in the shuffle. Of course, I’m talking about Truth Social, shorthand for Trump Media and Technology Group (DJT). Although political factors mostly drive the stock, it can also be viewed on a longer term basis as a media company whose main (and only) product, Truth Social, is in competition with X, TikTok, FB, Instagram, and all the rest. Given that we are now only about a month and a half away from the election, DJT may therefore present an interesting and very timely options setup—or not. Sometimes, obvious trades aren’t necessarily good trades.

As you may remember, Donald Trump started his own media company shortly after being banned from Twitter in 2021. In the ultimate “I’m taking my ball and going home” move, Trump then formed, via a SPAC, Trump Media and Technology Group. Soon thereafter, he raised $1 billion from private investors, and the company launched its social network, Truth Social. Needless to say, there have been numerous financial and legal issues and allegations since then.

DJT’s financial results have not been good. Starting a new social media company to compete against entrenched and popular incumbents is a very heavy lift. According to SEC filings, Trump Media and Technology Group lost over $58 million in 2023 with only $4 million in advertising revenue from Truth Social; for the first quarter of 2024, the company reported a net loss of $327.6 million with $770,500 in revenue. So far, not too encouraging.

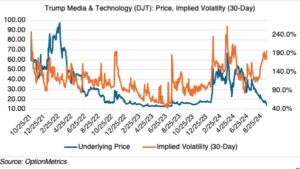

Since DJT is hostage to Trump’s ever-changing electoral and legal challenges, the stock has been on a wild ride since its initial listing. Daily price changes greater than 10%, and even 20% in some cases, are quite common. Given that, it’s not surprising that DJT’s implied volatility averages well into the triple digits. Most recently, the stock has started to display the classic inverse relationship between price and implied volatility, which has soared to almost 200% (see July ’24 forward, below):

Since the stock is joined at the hip to the election results, there are two obvious scenarios for DJT: Trumps wins, or Trump loses.

If Trump wins, it is still not exactly clear what that might mean for DJT in the medium to long term, beyond a likely short-term spike. The company’s financials have not been good (an understatement), and Truth Social is the company’s only product. Conceivably, DJT was just a way for the ex-president to market himself, without interference or negativity, in order to get elected. If that occurs, DJT could be deemed to have served its purpose and now more trouble than it’s worth.

What happens to DJT if Trump loses? Although DJT will no longer be tied to the election, it will still be subject to its challenging fundamentals and poor financials. It’s possible that Trump may decide to abandon the enterprise entirely, which will virtually ensure the company’s demise. Trump may not be as loyal to Truth Social as he was just a few months ago; he has started tweeting on TikTok as well.

My conclusion: if you believe that Donald Trump may win, you can play DJT for a short-term spike, but the risk/reward is problematic, to say the least. On an implied volatility basis, DJT options are wildly expensive, and rightly so. Although DJT is certainly an interesting opportunity, its risk/reward is very difficult to determine. As a colleague once said to me about one of my more “difficult” trades, “Is it really worth the trouble? Aren’t there easier ways to make money?” In this case, and at least on an options basis, I think so.