Visiting Some Old Friends

Some of my previous blogs focused on the so-called Covid Darlings, the stocks that benefited from Covid, but are now subject to extreme selling pressure. I have also featured several stocks that benefited from the Ukrainian war. This week, I will check in with all of them and see how they’ve been doing since serious selling pressure developed in the market.

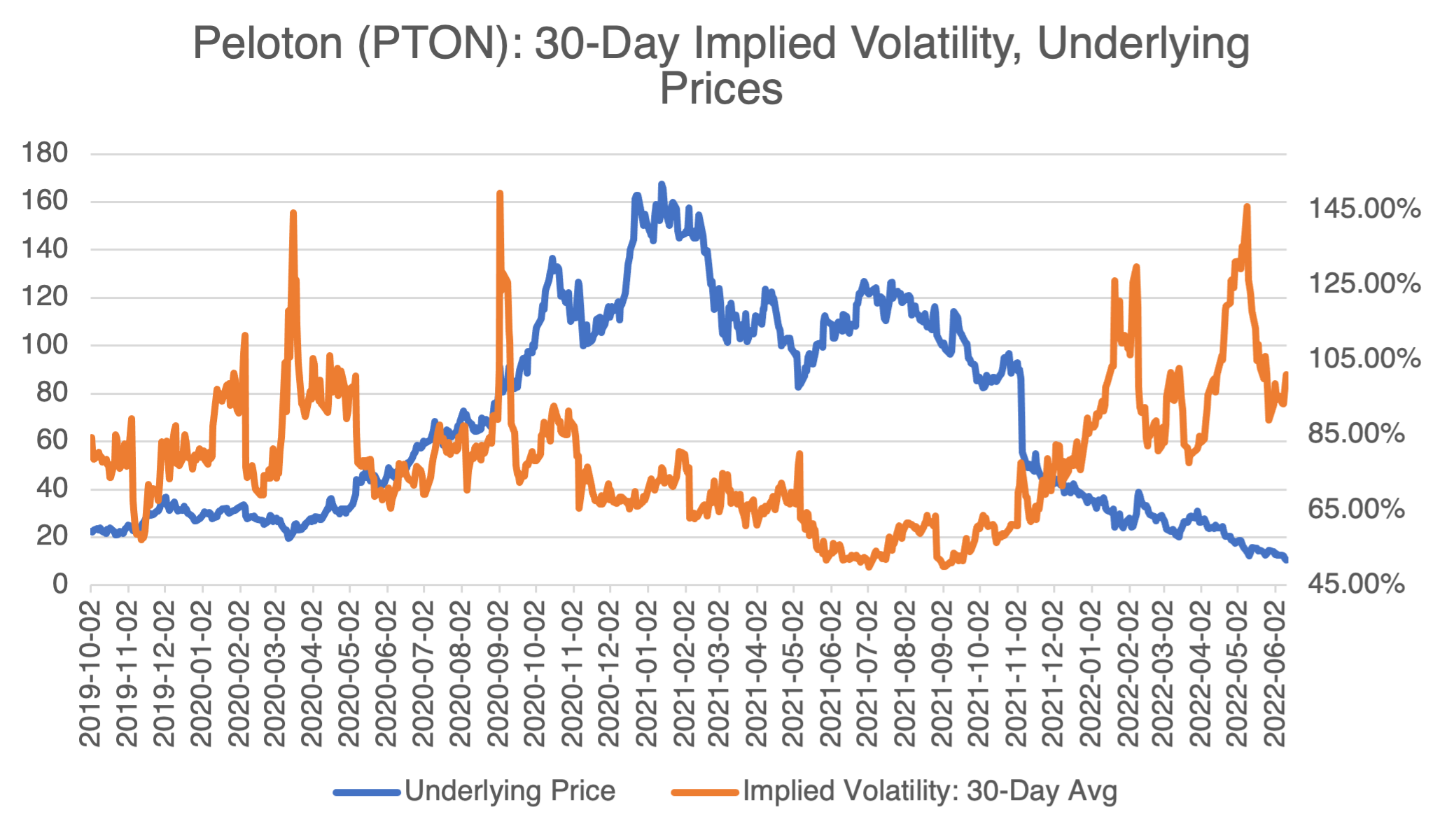

First up is one of the stocks most representative of the Covid fever that temporarily infected the market, Peloton (PTON). Remember? No need to go the gym and get infected, you can work out right in your own living room on a $1500 spin bike with attractive people that look just like you! Like many highflyers (and people, for that matter), Peloton management made the mistake of believing their own schtick (to put it nicely). When Covid broke, finally, they were left with too much capacity and dwindling cash reserves. A new CEO hasn’t helped — the stock made a new low of $9.61 last Friday, below its $29 IPO price and way below its high of almost $163 reached in 2020. The current CEO is doing what all new CEOs do, making changes and hiring new people, but he still talks about a growth strategy like the company’s basic survival isn’t even an issue. Add to this negative consumer sentiment and declines in the broad indices, and things aren’t looking too bright and shiny right now for PTON investors.

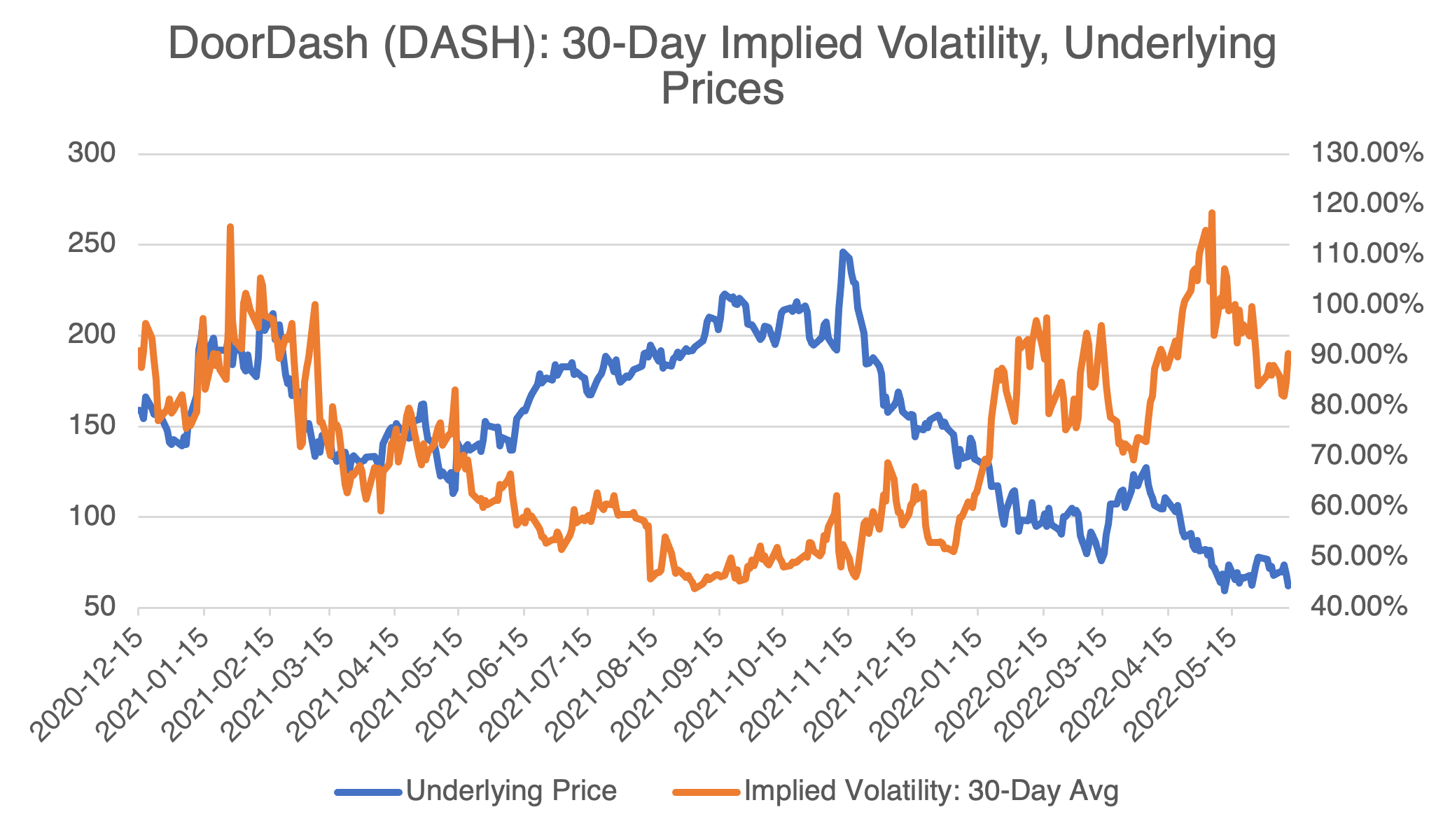

DoorDash was another Covid Darling that has fallen back to Planet Earth. After peaking at $409 in 2021, the stock is currently trading about $43.18 (interestingly, its all-time high was achieved in the halcyon days of 2017, a whopping $1234.47).

Both PTON and DASH share one thing in common; they have been beaten down to levels from which a surprise rally might occur. Peloton still has an almost religiously loyal customer base and a solid core product, despite the company’s mismanagement. Rumors of a buyer stepping in have died down lately, but M & A activity might become more likely since the stock dropped below $10. Similarly, DoorDash is a segment leader and customers are more familiar and comfortable with it than any of its new competitors. In both cases, options strategies that could benefit from price recovery are merited. Price levels are relatively low and the current high implied volatility levels will have only a marginal effect on the strategy (see last week’s discussion on ARKK for the effect of implied volatility).

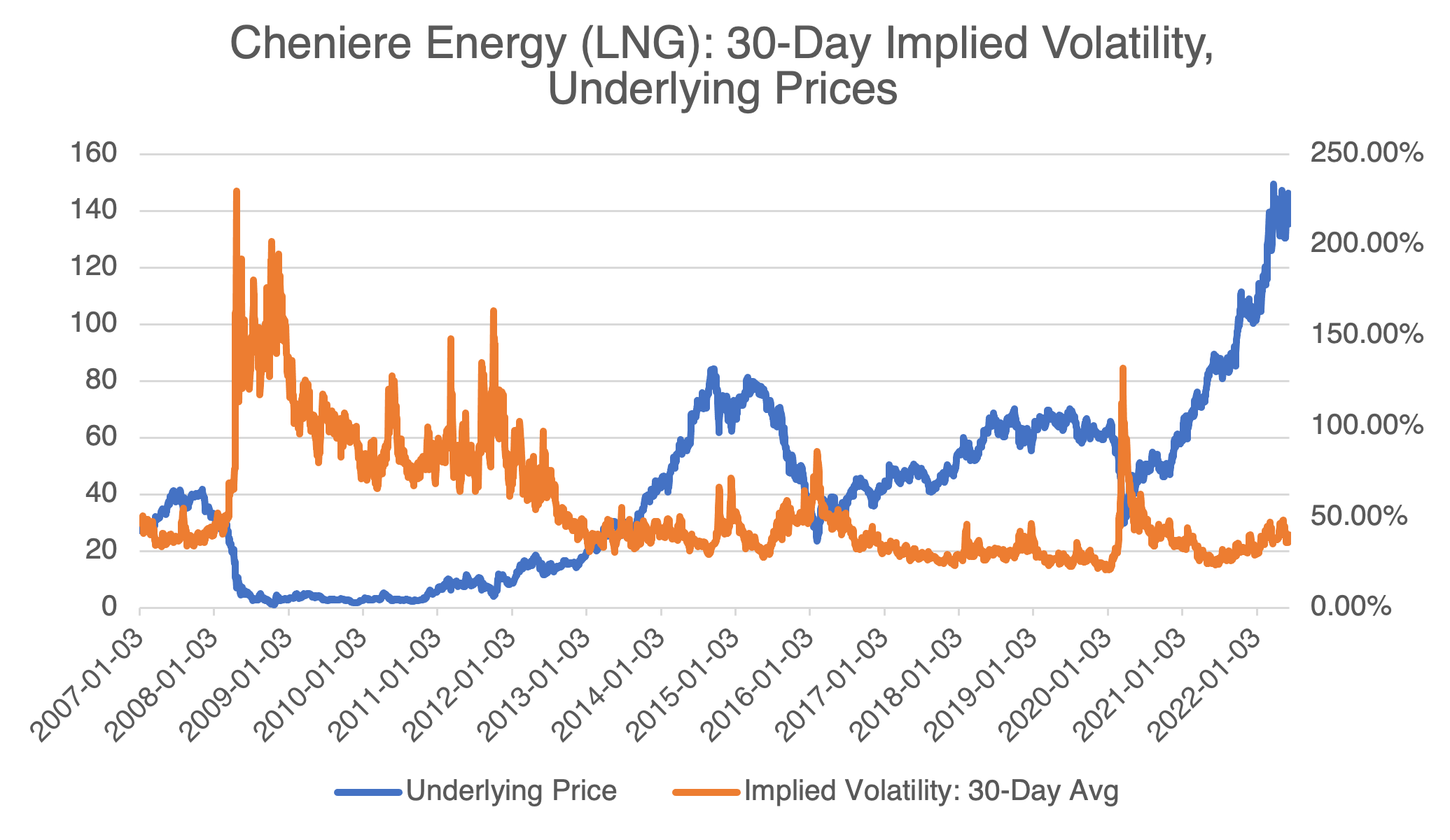

On the bullish side, we have Cheniere Energy (LNG). Just as PTON and DASH were tied to Covid, LNG has the Ukrainian war to thank for its price action. Cheniere is the largest US producer of LNG and second in the world. The stock is up almost 33% since YTD, but seems to be stuck in a $130 – $150 trading range. The situation seems tailor made for an options strategy that would benefit from a breakout from this range, e.g., a $130/$150 strangle (long $130 put, long $150 call). Implied volatility levels have retreated to average levels for LNG, so they should not be a factor in the strategy.

I Was Right and They Were Wrong

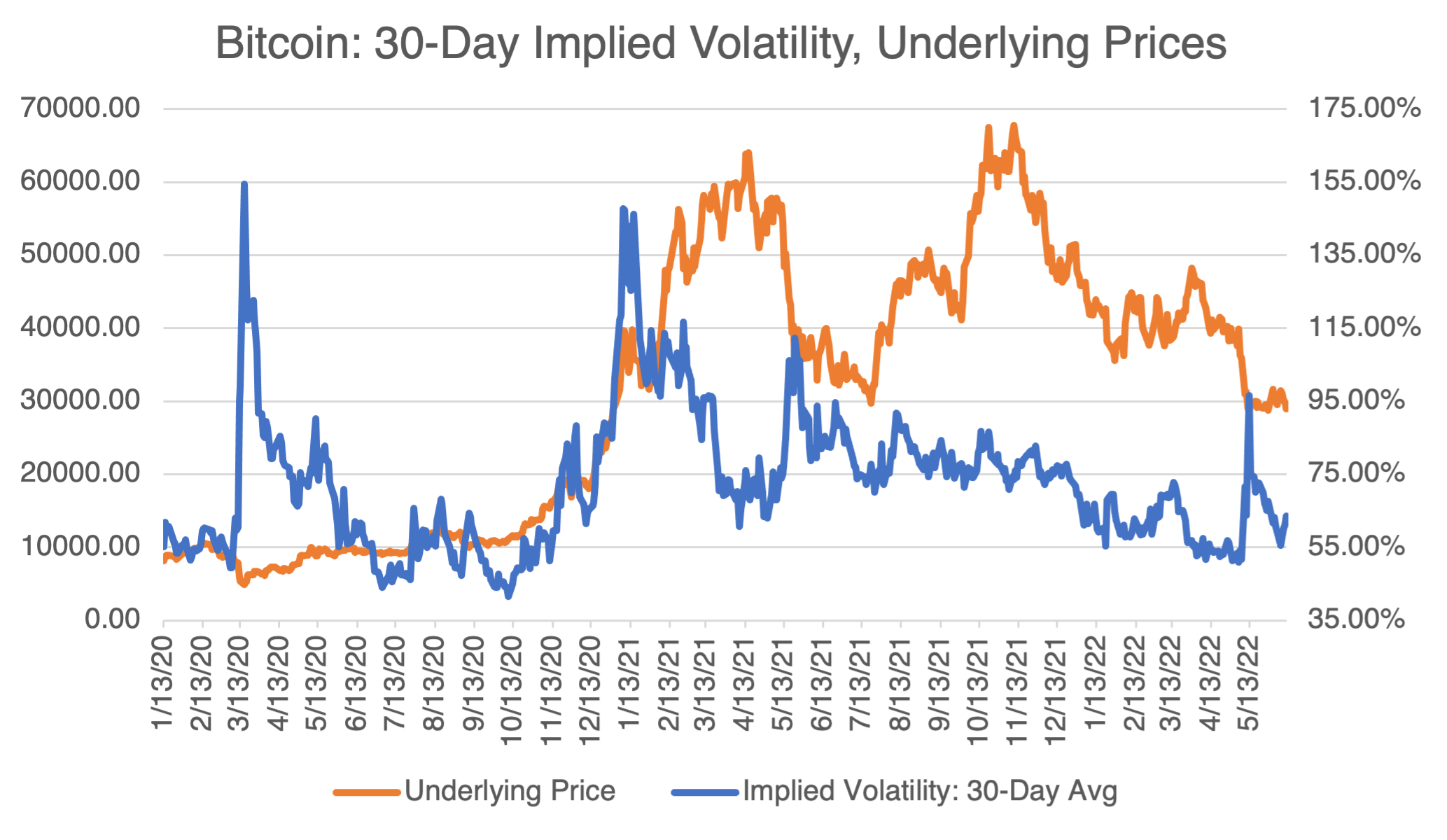

I know. I’m old and out of it and think that crypto was a crazy fad and a solution in search of a problem. Well, in this case, it seems that I was right, and Kim and Matt and Gwyneth and the kid across the street who lives in the attic who made a “fortune” selling an app were all wrong (at least for the time being). Again, and just like the case with Peloton, many in the industry believed their own [insert expletive of your choice] and got caught on the wrong side of things.

As I mentioned in previous blogs, I’m not a fan of 100% agreement on anything, and right now we’re getting a giant rush to the crypto exits by formerly diehard fans. In addition, press coverage has gone from “the birth of the coolest asset class, ever” to “round up the usual suspects” in the space of a few weeks. Arrogance without performance has a cost, and one need look no further than the sad tale of crypto pseudo bank Celsius Networks (“Banks are not your friends”) for confirmation.

Regardless, and similar to the stocks I mentioned earlier, it might be time to start looking at bullish bitcoin strategies. As in the case of Peloton and DoorDash, implied volatility levels have come off from their recent spike, making options more affordable.