War, the Dollar, and an Exchange Warning

Ukraine, Again

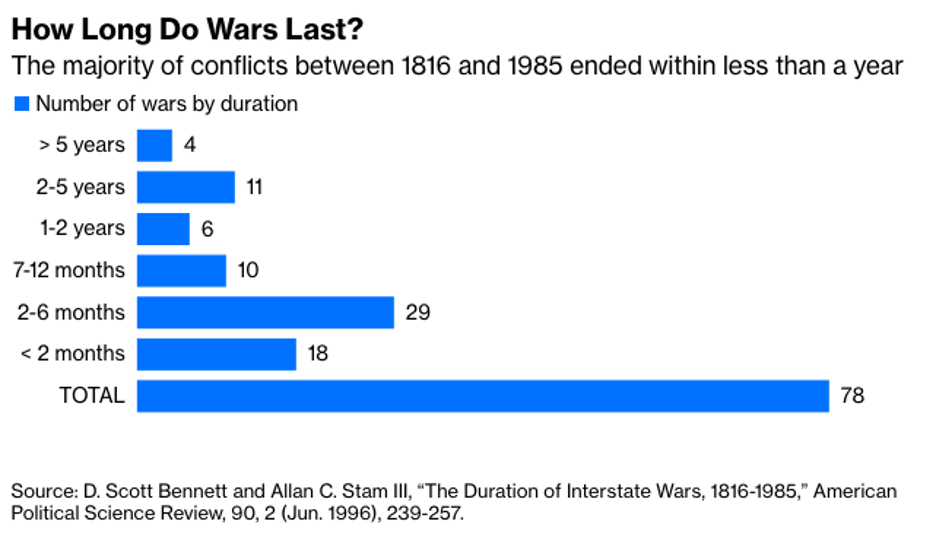

As I write this, the War in Ukraine continues to rage on with no end in sight. Despite early hopes of a Ukrainian “victory” leading to a forced ceasefire, Putin and Russia (are they the same thing?) still think their original objectives are possible and won’t back down. Neither side is winning in the conventional sense, and as long as that’s true, the probability of an extended stalemate increases. The good news (if you can call it that) is that about 40% of all wars since 1816 lasted 2 to 6 months and 73% lasted less than a year. The bad news is that other studies have concluded that the longer a war drags on with both sides roughly equally matched, the longer it’s likely to be.

Interesting, but what does this have to do with trading options? As I’ve written in several previous blogs, geopolitical conflict drives uncertainty and anxiety which in turn drives option prices through implied volatility. Since option prices are essentially a bet on future price levels, the more uncertain those levels, the more expensive options should be. This is especially true during the beginning of conflicts (or any news from left field, for that matter) when they are a shock to the market. However, as the market grows accustomed to the news and participants’ short attention spans start asserting themselves, uncertainty starts decreasing. Only a new fix of unexpected news will remind the market that the situation is unresolved. The latest allegations that war crimes have been committed may fit the bill. The net result is that volatility could shoot up with little notice.

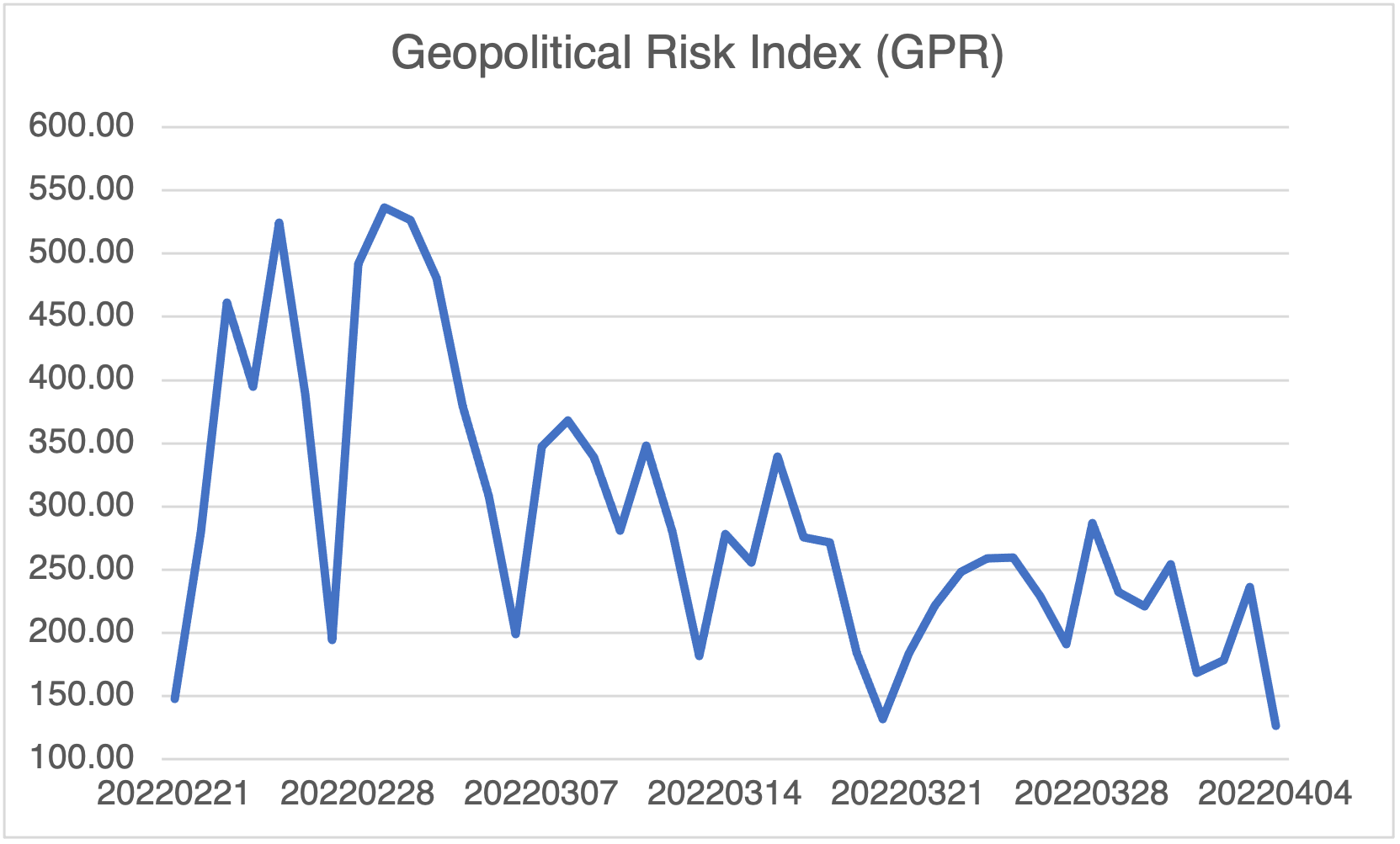

In a previous blog, I mentioned the GPR index, and an index of geopolitical risk developed by Dario Caldara and Matteo Iacoviello of the Federal Reserve Board. The index reflects automated text-search results of the electronic archives of 10 major newspapers (for more information, click here). Below is the daily index since the beginning of the war:

(Source: https://www.matteoiacoviello.com/gpr.htm)

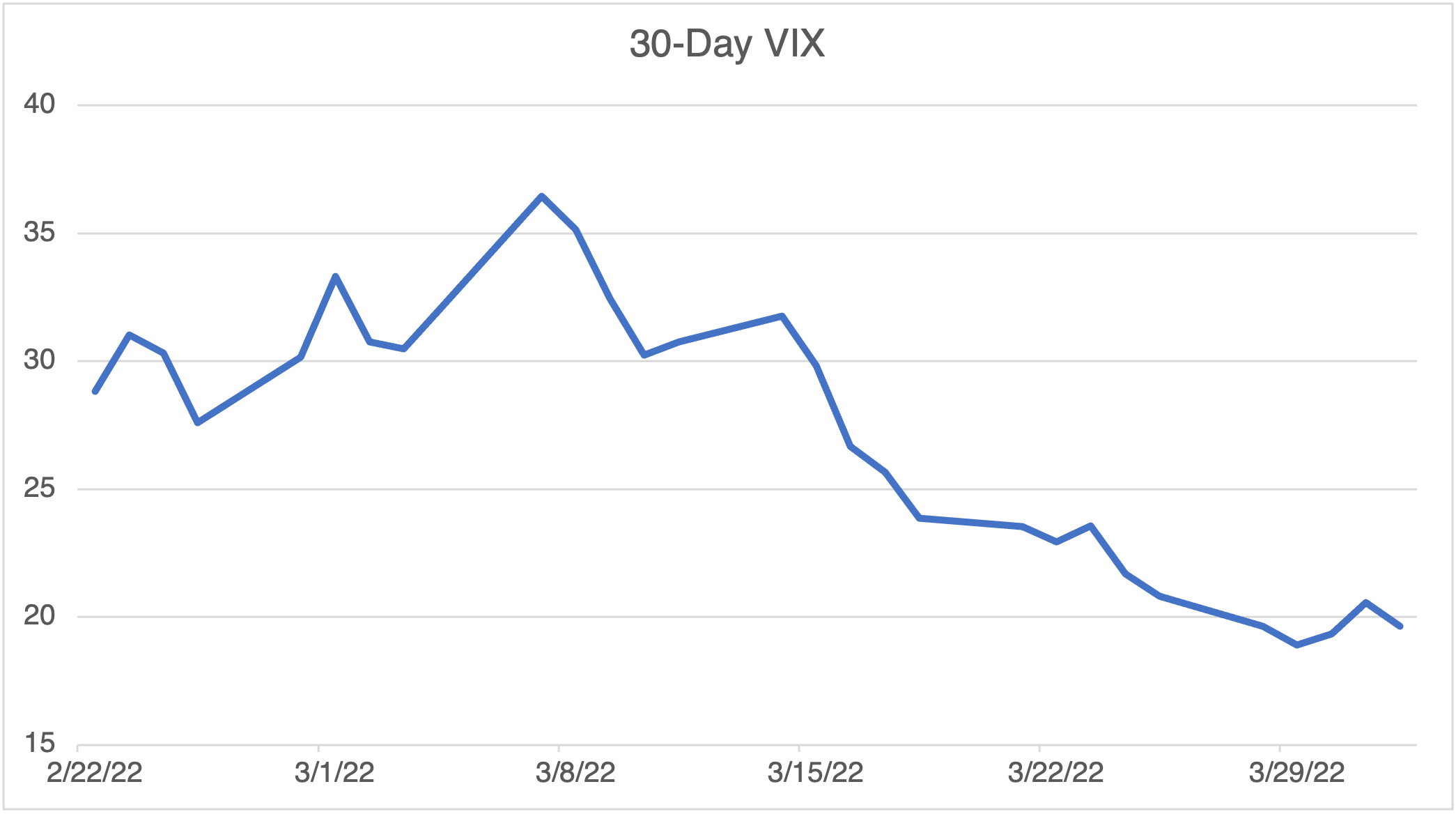

Apparently, the Ukraine War is getting less press attention than it did a few weeks ago. A more general indicator of uncertainty, VIX futures and options, leads to the same conclusion:

(Source: OptionMetrics)

Rightly or wrongly, it only took a few weeks for Ukraine to become old news to the market. There may be a potential opportunity here for options investors.

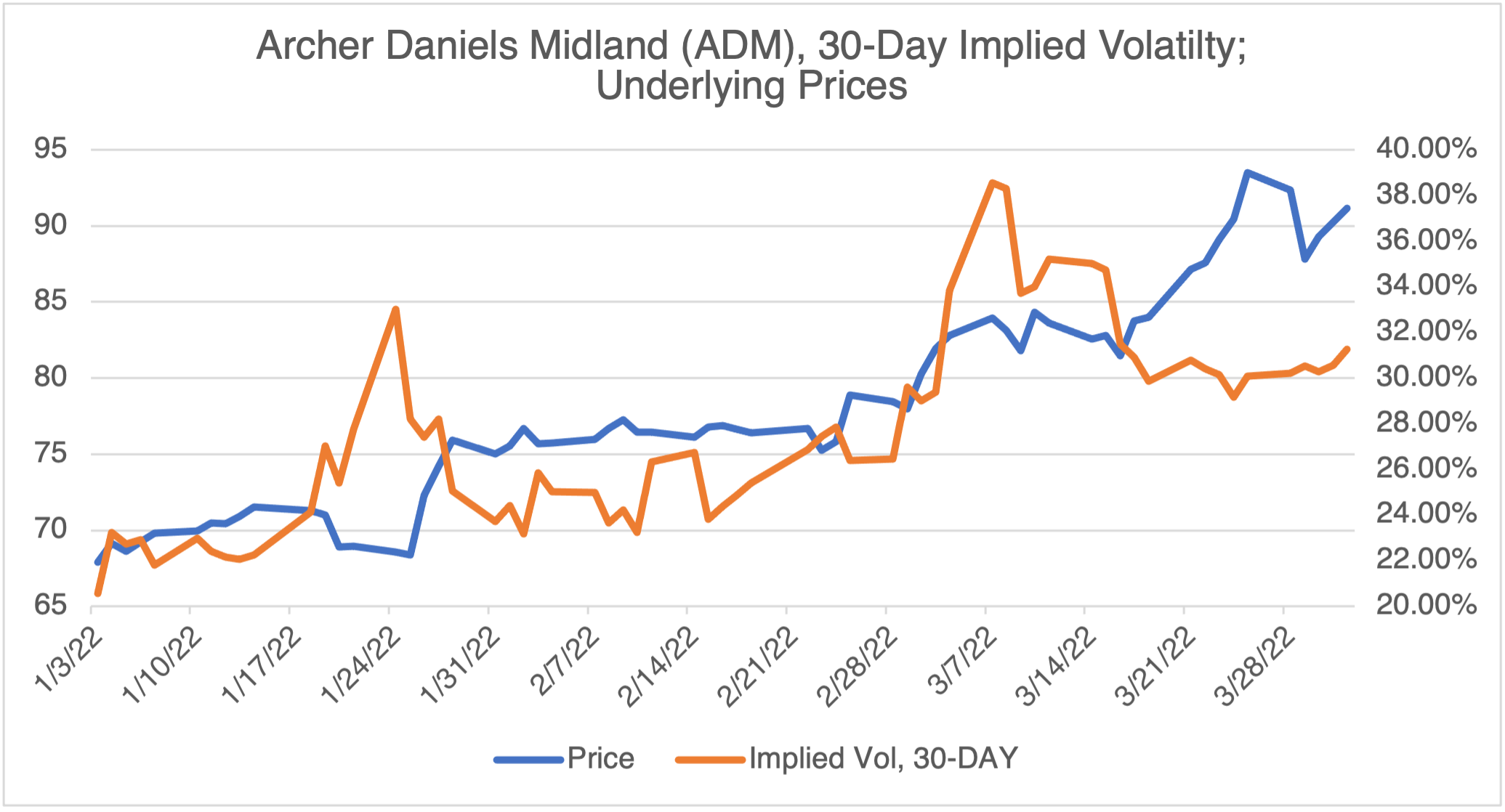

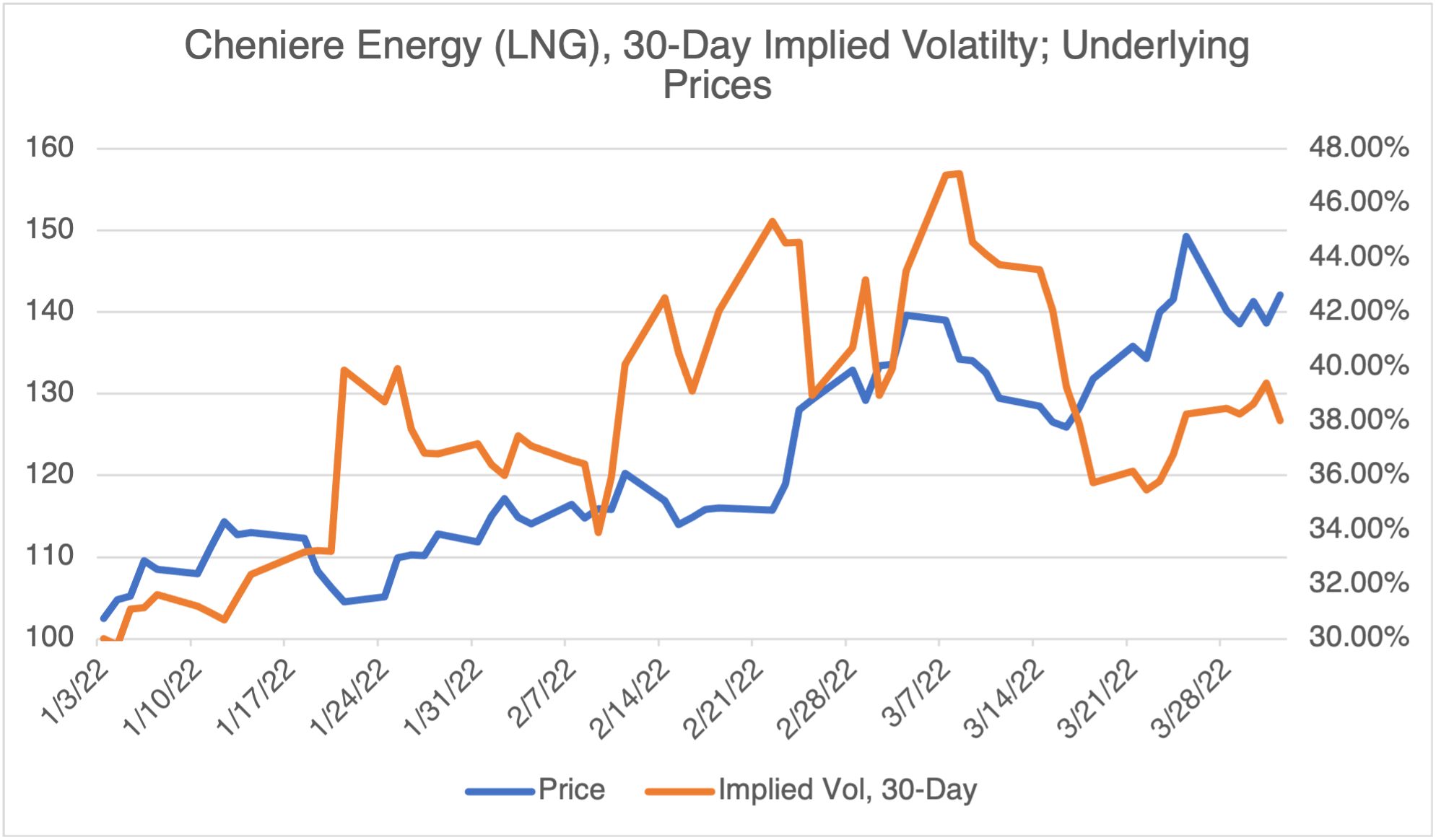

New sanctions (energy in Europe, energy and/or agriculture in the US) as a result of alleged war crimes and civilian atrocities could produce a renewed volatility shock in those sectors. If you believe that such sanctions are imminent or inevitable, then it follows that implied volatility, and option prices in those sectors, are relatively inexpensive and could spike to the implied volatility highs from the beginning of the war. Energy (e.g., Cheniere Energy (LNG)) and agriculture related stocks, specifically wheat-based (e.g., Archer Daniels Midland (ADM)), could benefit.

(Source: OptionMetrics)

(Source: OptionMetrics)

Nickel: As Expected

A few blogs ago, I discussed the crazy goings-on in the nickel market and the London Metals Exchange (LME). As you may remember, I reminded all traders that exchanges could, and would, do anything if they felt that the financial survival of the exchange was at risk, including suspending trading, instituting price limits, or even (as the LME did) cancelling the trades from a particular session. All these will indeed allow the exchange to fight another day, but as the LME is finding out, they come at an extreme cost. Namely, traders start questioning the viability and management of the exchange itself and going elsewhere to trade. In the case of the LME, volume on February 28th was 91,322 contracts; as of April 1st, it was 46,967, or almost a 50% drop! Interesting how just one short-sighted action by frightened management can destroy a 145-year-old exchange (to put that into perspective, Queen Victoria was on the throne when the LME was founded). A warning to the management of all exchanges: when you try to impose what you consider to be “correct” prices through heavy-handed rules favoring one group over another, you undermine the main function of an exchange and drive volume elsewhere. Traders are an exchange’s customers, and when they don’t like the way they’re being treated, they head for the exits.

“The Dollar is Finished”

We’ve been hearing a lot about the demise of the US dollar since the imposition of sanctions against Russia. Since the evil West can push around other nations that have fallen afoul of their wishes, so the argument goes, then maybe it’s time for a new reserve currency. I’ve been hearing this since the start of my career when dinosaurs roamed the planet. Chinese renminbi, various non-dollar baskets, and cryptocurrencies have all been touted. I’m not a FX guy, but why anyone would trust those as opposed to the dollar is anyone’s guess. For a cogent analysis as to why the almighty dollar isn’t going away any time soon, I urge you to read the cogent analysis by Richard Gluck, a former colleague of mine.