Wednesday: Nvidia’s Big Day

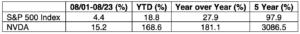

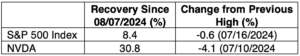

This coming Wednesday, Nvidia (NVDA) is scheduled to release their Q2 financial results. Obviously, it’s a big day for the company and an even bigger day for the market. NVDA has been at the center of the rally since late 2022 and has accounted for about a third of the gains in the S&P just this year. By any measure, Nvidia’s performance to date has been remarkable:

Of note is its performance since NVDA briefly fell out of favor in early July — apparently reports of its imminent death were premature:

Given its performance and the market’s current obsession with all things AI, NVDA is the most closely watched stock around. However, it is under increasing pressure to justify its $3 trillion valuation and lofty 47X forward earnings valuation (compared to the S&P 500 at 23X and Nasdaq 100 at 30X).

For Q2, the consensus is expecting Nvidia’s earnings and revenue to more than double, with earnings of 65 cents a share on sales of $28.7 billion. Due to the global AI spending spree, NVDA has set a pattern of surpassing the most bullish expectations. Outsized results and forecasts have come to be expected.

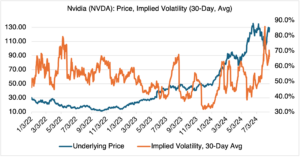

This has ramifications for NVDA’s implied volatility. As I described in detail in a previous note from July 16th (It’s Over?), Nvidia displays “vol crush” before and after each earnings announcement: “the implied volatility of NVDA tends to increase sharply before earnings announcements and then decline sharply afterwards. Beforehand, uncertainty and implied volatility mounts as to whether NVDA will meet expectations. If it does, NVDA’s price is perceived to be justified and its business as usual; uncertainty is then reduced and implied volatility drops.” Other stocks display a similar pattern, but NVDA’s is particularly pronounced and has been relatively predictable since mid-2023 (see below):

Source: OptionMetrics

Despite its recent recovery, there seems to be more doubt going into this earnings announcement than previous ones. If the company disappoints, or fails to meet perhaps unreasonable expectations, then the market will perceive that NVDA’s price isn’t justified and sell it off. The broad market may also follow, and it might not be pretty. Since uncertainty will then increase, implied volatility will also increase, making the vol crush trade particularly hazardous. Trades like NVDA’s vol crush, that work time after time like clockwork, are great – until they are not, and everybody is trying to get through the same door at exactly the same time.

Before the announcement on Wednesday, Steve Ganz, a fellow contributor to OptionStrat, will be producing some YouTube content – NVDA Possible Earnings Butterflies — and how to potentially trade them from both sides. I suggest you take a look!