List of OptionStrat Daily Tips

This page includes all of the daily tips shown by OptionStrat. Note that tips exclusive to free or paid users are shown here, regardless of your current subscription level. Use the checkbox below to enable tips if you disabled them.

Tip #1

Use OptionStrat on the go with our mobile apps! Sign in to our apps using the same account to view your trades on any device.

Tip #3

Check out our weekly posts and videos about the markets! We include interesting insights and multiple weekly trading videos.

Tip #4

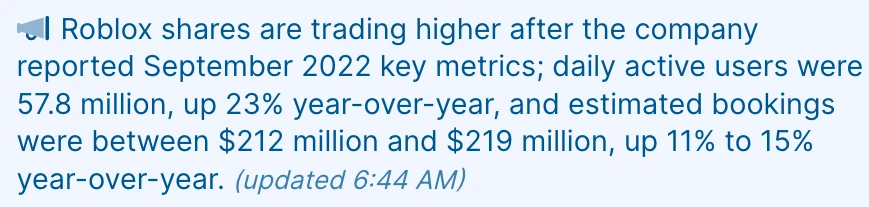

Why is a stock moving today? Find out with our live news headlines that explain why a stock is on the move, available for premium members.

Tip #5

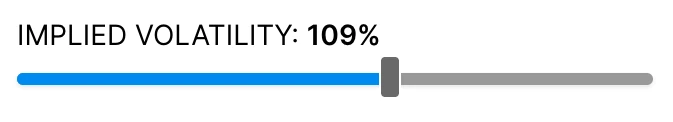

Implied volatility is an important factor for options trading. It generally increases as events with unknown outcomes (such as earnings) approach, and rapidly collapses once the outcome is known. Use the IV slider to simulate how changes in IV will affect your strategy.

Tip #6

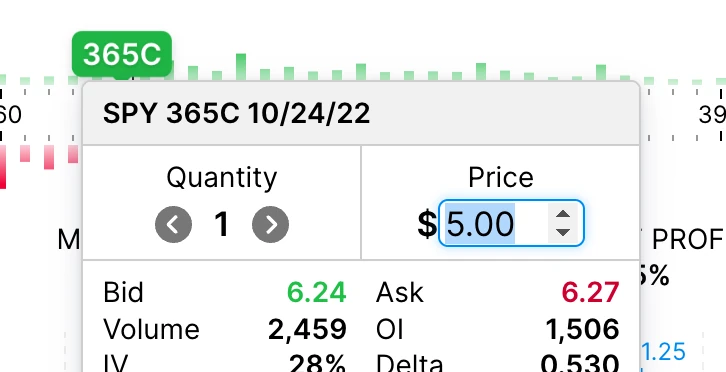

Already made your trade? You can input an existing trade to OptionStrat. To input an existing trade, you simply need to re-create the positions and the set the cost-basis of each option to the actual cost-basis rather than the current market price. (The cost-basis is the price you paid or the credit you received for the option) Click the option and then click the price to edit it with your custom entry price.

Tip #7

To easily see how adding or removing an option affects your strategy, you can temporary exclude items rather than removing them. Simply click on an option and click “Exclude” on the menu.

Tip #8

Watch out for the liquidity warning! This warning icon is displayed for options that have extremely low volume or open interest, or a wide bid/ask spread. These options don’t have much activity and can be hard to buy and sell at reasonable prices.

Tip #9

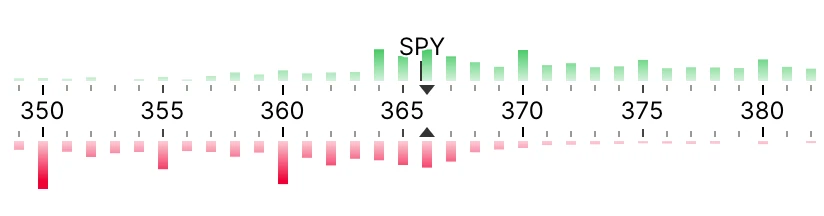

Quickly find the most active options! Our premium volume overlay feature allows you to easily see where liquidity is concentrated. Options with more volume are more active and will likely have better prices and be easier to buy and sell.

Tip #11

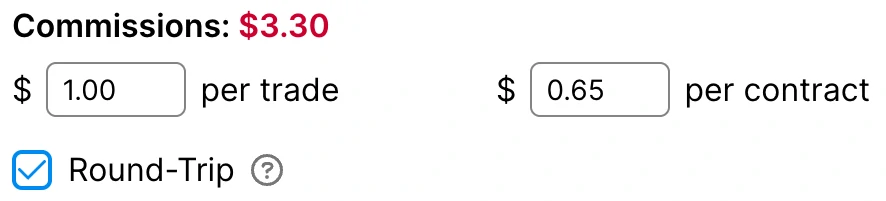

Account for commissions in your trade with a premium subscription. Subscribe to the Live Tools plan to unlock commission fees.

Tip #12

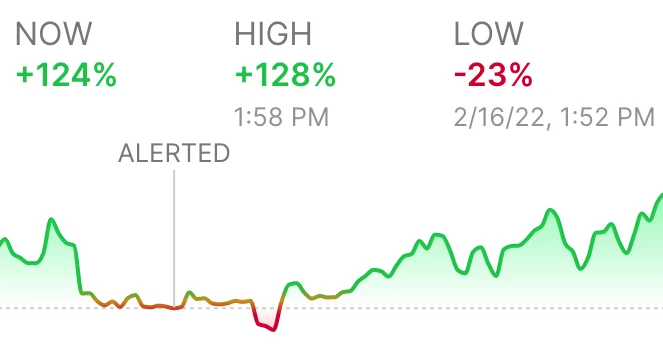

Track your saved strategies with even more detail using a premium subscription. See the high, low, and historical graph of each of your saved strategies. Saved strategies can also be exported.

Tip #13

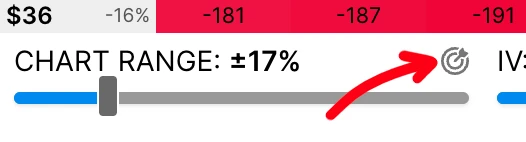

Set a target price to easily see the expected profit/loss your price target. Instead of moving the chart range to show the target price, click the target icon to set a target price which will make it easier to see your target price.

Tip #14

OptionStrat includes useful features for managing multi-option trades:

- Hold shift while dragging the strike slider to move all options at once.

- If the strategy has opposing options on each side, such as an iron condor, hold shift and drag one option to move the opposing option in the opposite direction, widening the spread between them.

Tip #15

Use the budget field to set a maximum spend. The budget also limits your maximum risk (downside) of the trade.

Tip #16

What is the difference between neutral and directional? Neutral trades are used when you think the price of the stock is going to stay about the same. Directional trades are the opposite, when you think that the stock will move up or down significantly, and not stay the same.

Tip #17

The higher the return, the riskier the strategy. Moving the slider to the left will select the strategies with the highest potential return, but they will be very risky and have a low chance of profit. Meanwhile, strategies with a high chance of profit will offer a lower rewards in exchange for much less risk.

Tip #18

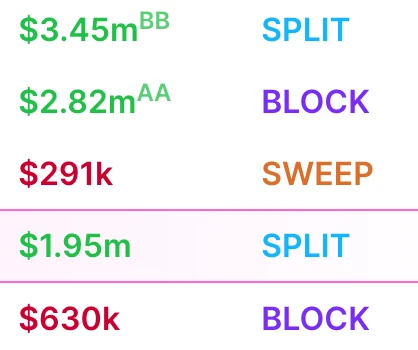

What is a “SPLIT”, “SWEEP”, and “BLOCK” trade?

- Sweep: Orders that execute across multiple trades and exchanges at once. Many individual orders may actually be an urgent larger order that was trying to go unnoticed.

- Split: Similar to a sweep, but only on a single exchange. A large order that was executed as multiple smaller trades.

- Block: Privately negotiated orders that are traded off-exchange. Like splits and sweeps, they are often broken up into smaller orders that can add up once consolidated. Blocks also often span multiple strikes and expirations as a large investor is buying a huge "block" of options.

Tip #19

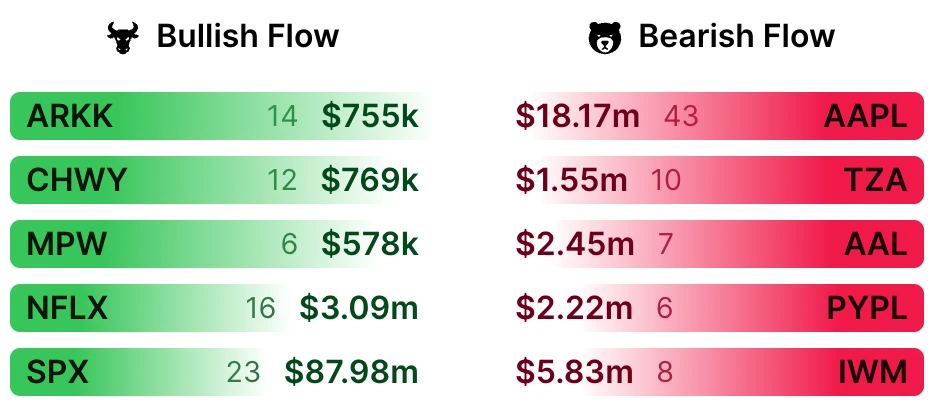

The flow summary shows the stocks with the most unusual trades for the day. The bold dollar amount is the total dollar value of the trades, and the number next to it is the total number of trades. This list is NOT sorted by either dollar value or number of trades, instead it is sorted by most unusual. This allows you to see a variety of interesting stocks, rather than the largest (SPY, QQQ, TSLA, etc) each day.

Tip #20

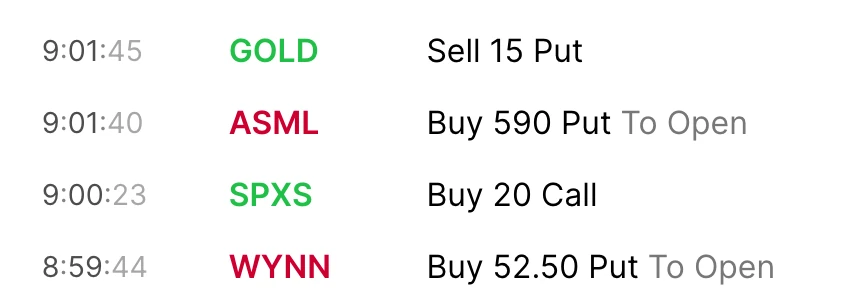

A trade is classified as a “sell” or a “buy” depending on which side of the transaction was most aggressive. Since every trade has a buyer and seller, we indicate which side was most aggressive and urgent in making their trade.

Tip #21

Some trades are marked “To Open” when they are guaranteed to be opening trades. Traders can buy an option to open, or they can buy it to close (if they were previously shorting the option). Unfortunately, this information is not shared with any market participants and is generally unknown. In some cases however, we can use the open interest and volume to determine that it was impossible for a trade to be closing. In this case, we will show the “To Open” text next to the trade.

Tip #22

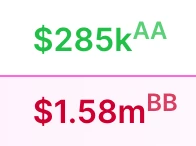

Some trades are marked with “AA” or “BB” to indicate that they were bought above the asking price or sold below the bid price.

A trade being above ask or below bid indicates that it was extra aggressive and the trader was prioritizing speed over price. When clicking on a specific trade, you may see “A” or “B” which also means at ask, or at bid.